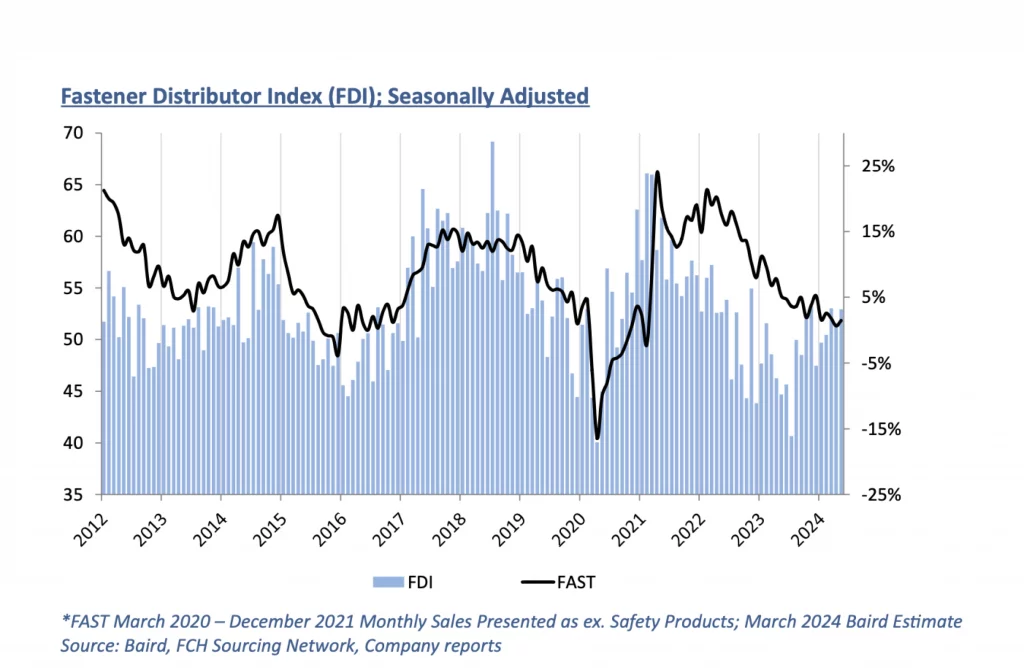

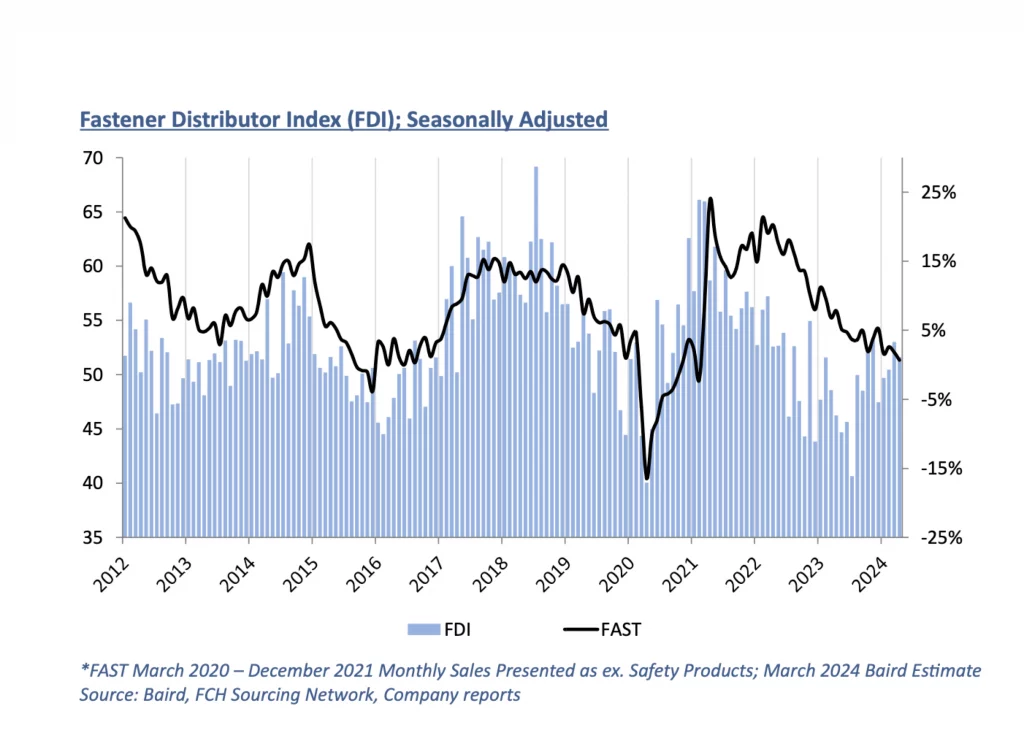

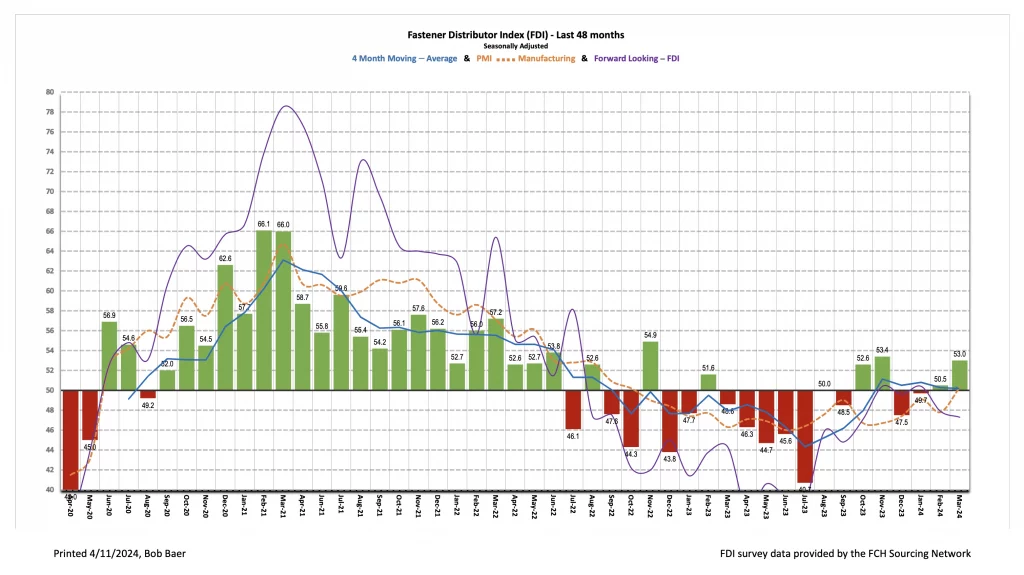

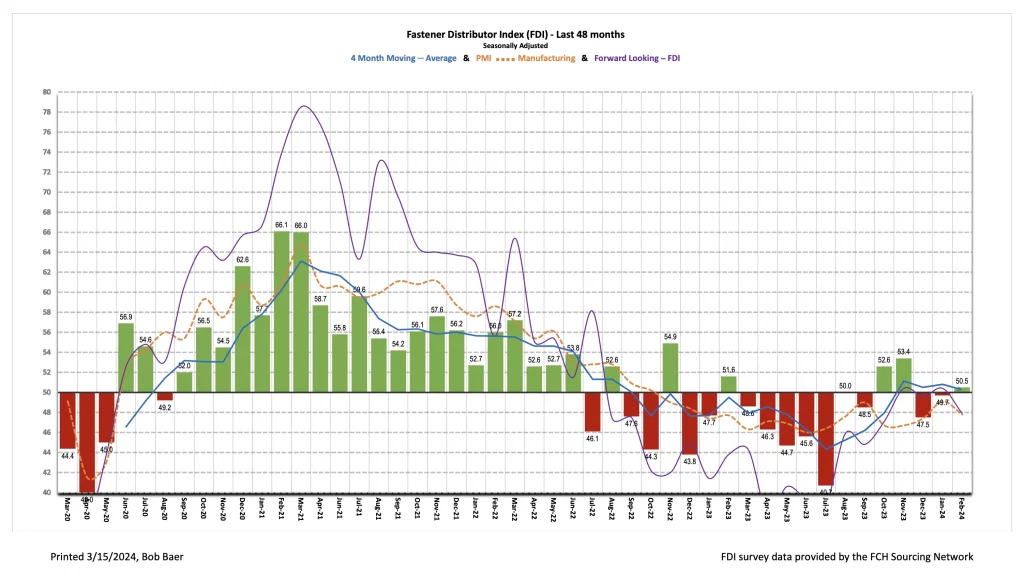

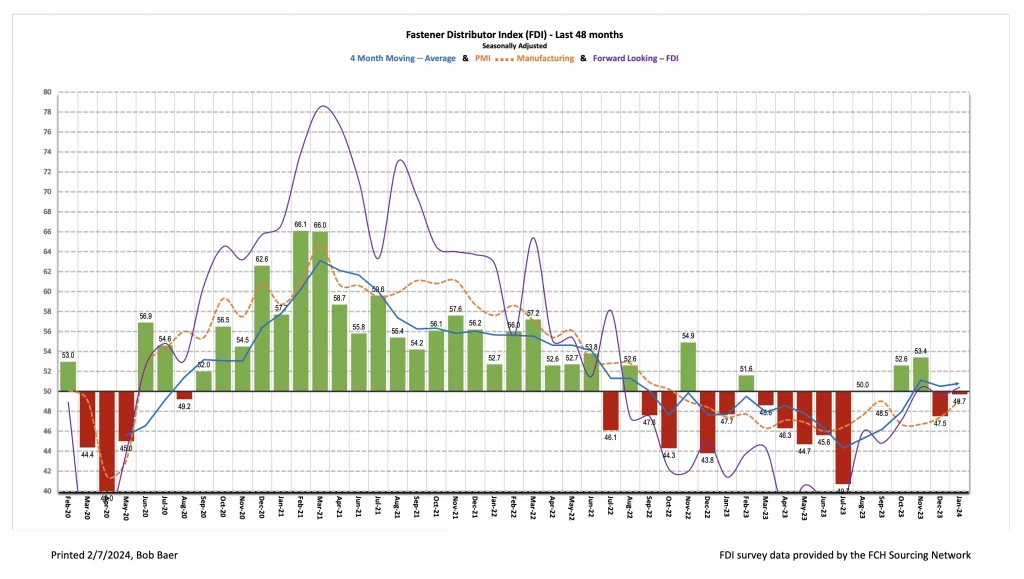

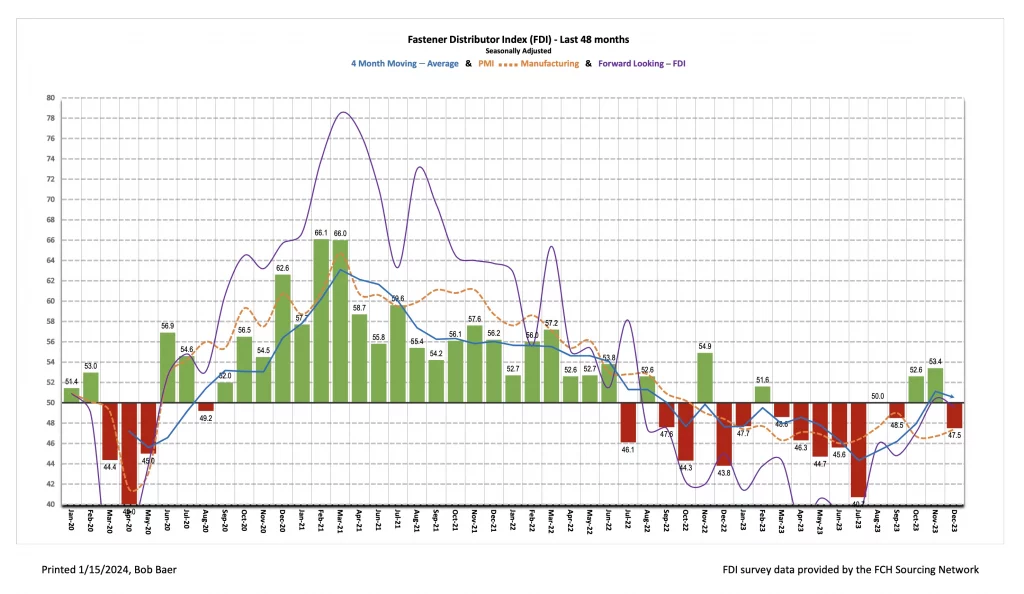

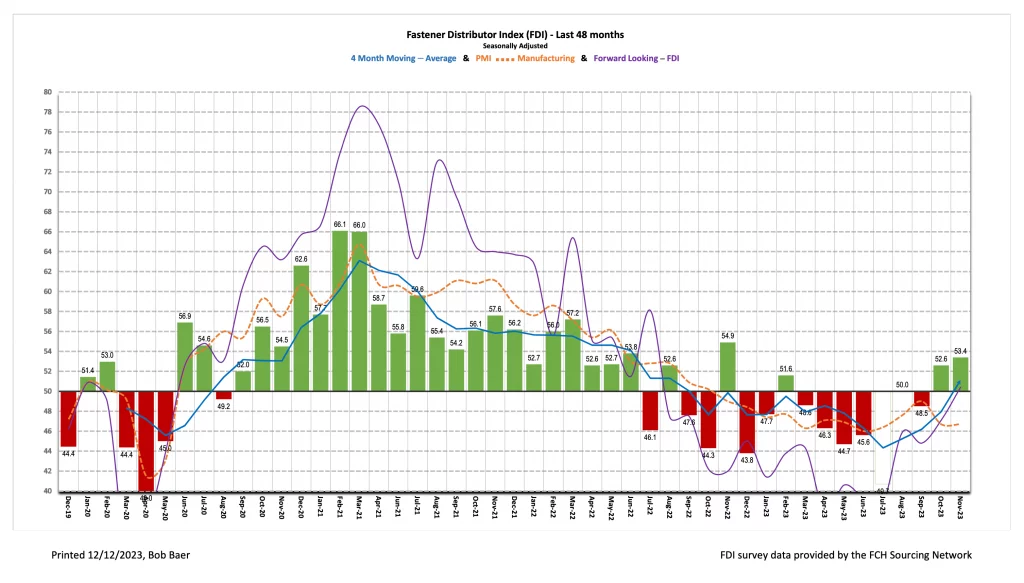

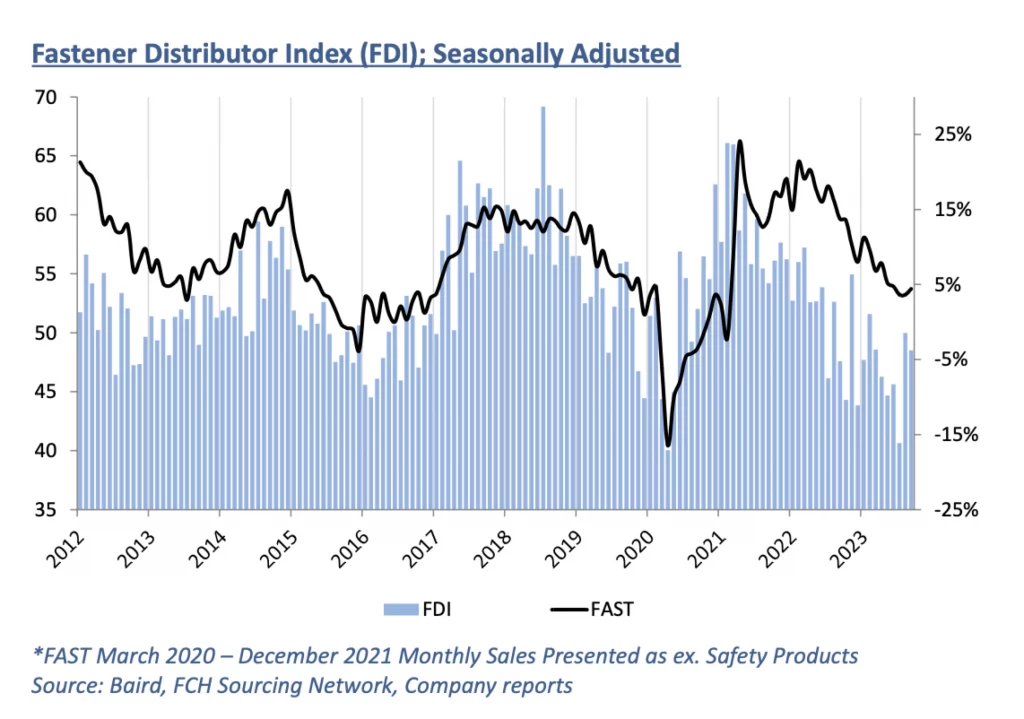

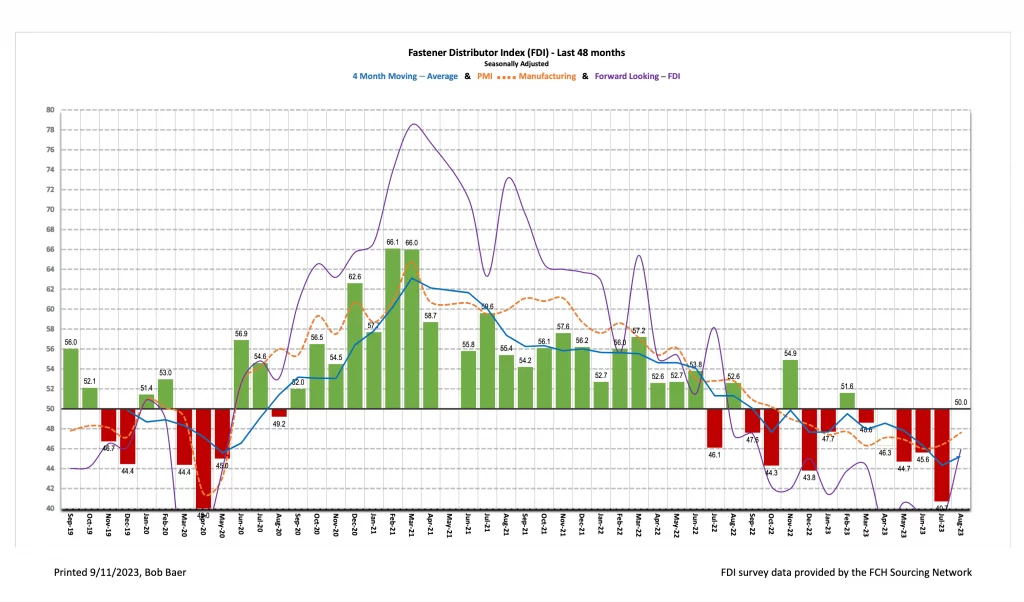

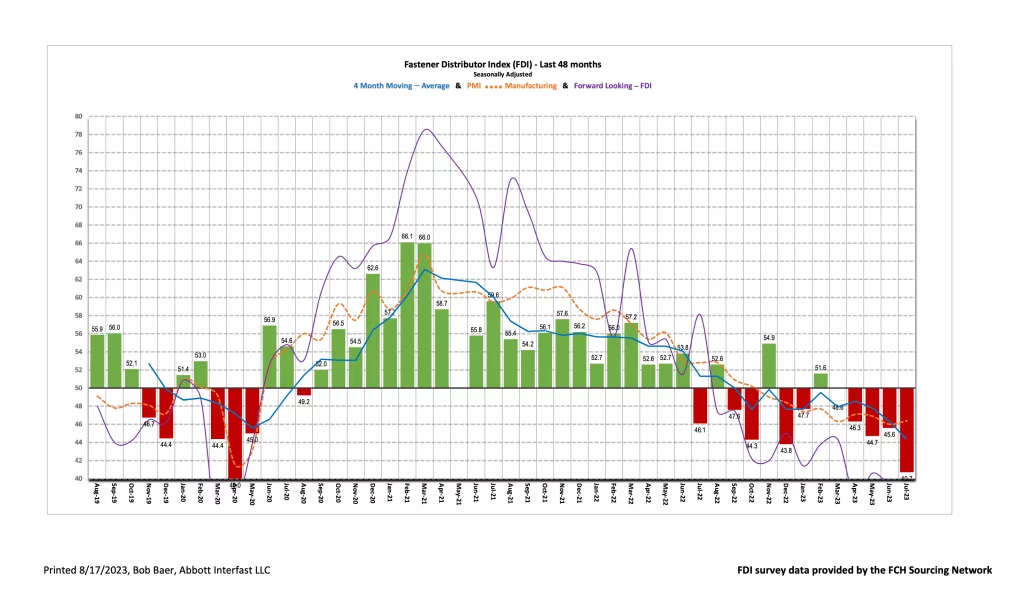

Written by R.W. Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 6/6/24 Key Takeaway: The seasonally adjusted Fastener Distributor Index (FDI) saw modest m/m improvement, reading 52.9 in May vs. 51.6 in April, and continued to expand (above neutral reading of 50), albeit driven by just one component, supplier deliveries. Commentary was again […]

FDI May 2024