Written by R.W.Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 4/6/22

Key Takeaway:

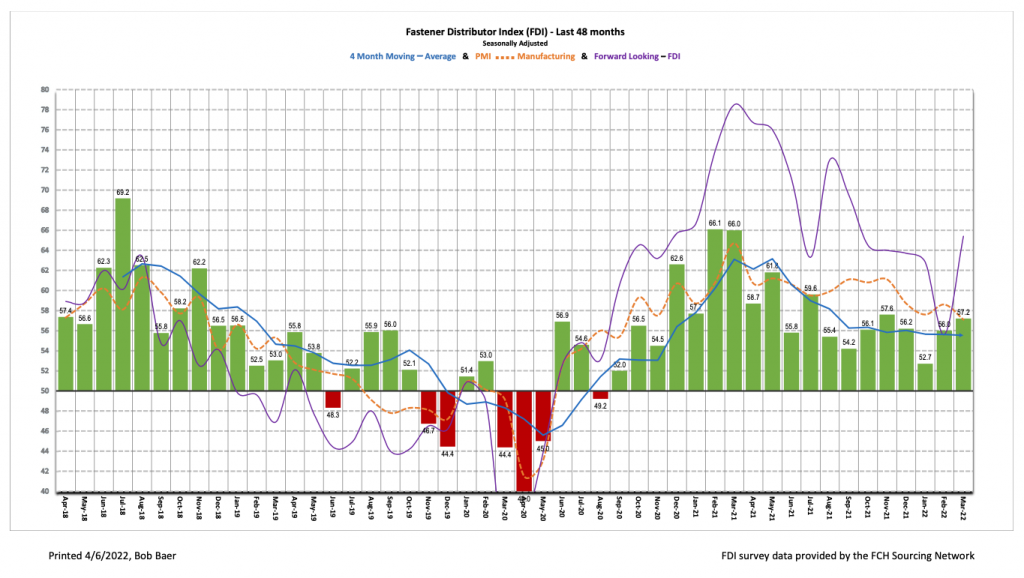

The March seasonally adjusted Fastener Distributor Index (FDI) saw a modest m/m improvement at 57.2 on better sales and employment levels. Despite a slightly weaker reading in the supplier deliveries index amid some manufacturing plant shutdowns in Asia and continued port congestion, the FDI improved for the second consecutive month and remained firmly in expansionary territory. Respondent commentary suggested additional acute inflationary pressures are emerging, particularly in stainless steel, but inbound order activity remains consistently strong. The Forward-Looking Indicator (FLI) also improved m/m at 65.4 amid more optimistic six-month sales expectations and an increased hiring pace. Overall, we believe fastener market conditions remained strong in March, with growth increasing at a slightly faster rate than February.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and Baird. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward-looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM).

Key Points:

FDI sees slight m/m improvement. The seasonally adjusted March FDI (57.2) saw growth at an increasing rate (February 56.0). This was primarily driven by an improvement in the sales index, as order activity continued at a strong rate while some supply chain relief was also a positive contributor. Pricing also continues to contribute nicely to top-line growth – boosted recently by significant stainless steel inflation, as evidenced by further improvement in the month-to-month and year-to-year pricing indexes. Demand feedback remained very positive, and demand broadly continues to outpace supply by a significant margin.

FLI also improves nicely. The seasonally adjusted FLI came in at 65.4, improving substantially from last month’s 55.6 and signaling growth ahead. Relative to February, a higher employment reading, lower respondent/customer inventories and a more positive six-month outlook were all contributors to the expansion. Regarding the outlook, respondents this month were evenly divided between those expecting higher activity levels (45%) and those expecting lower (45%) over the next six months vs. today. This still represents a fairly sizable down-tick, however, vs. the ~72% on average that expected higher activity levels back in 1H21 as inflation, labor and supply chain concerns have mounted. However, with continued strong demand/backlog and lengthy lead times, we believe this means the FDI could remain in solid growth mode for quite some time.

FDI employment index also improves. The FDI employment index came in at 62.1 vs. 48.3 last month. This marks the best reading since November – perhaps an encouraging indicator that the “Great Resignation” trend is moderating and/or more labor is coming back from the sidelines. The broader economy also saw an encouraging level of hiring in March as 431,000 jobs were added, which was a touch below economists’ consensus expectation of +478,000 but still encouraging in absolute terms. The labor force participation rate also improved 0.1% to 62.4% m/m and is now up considerably from a pandemic level trough of 60.2% in April 2020. A continued return to the workforce from some sidelined labor would be a significant positive in resolving current labor shortages.

Some supply chain improvement seen; additional raw material inflation surfacing. Feedback suggested some modest improvement was seen for respondents in the supply chain this month. Per one respondent, “Import logistics slightly better, but still hit or miss with regard to movement through the ports and to the rail. Overall sales and future projections are encouraging, but much dependent on chip availability.” Another respondent said, “Inventory is starting to arrive that has been floating in the Pacific for months, allowing shipments to keep pace with new orders.” However, new raw material inflation emerging around stainless steel is driving additional inflationary pressures: “ Material cost and availability continue to be a problem, especially stainless steel where pricing has gone up about 75% since Dec IF you can even get a quote. Material availability very spotty at best. Despite all that, incoming orders continue to be very strong and the quantity per order is close to double this time last year. Many companies that are strong importers are coming to us to cover deliveries while waiting for extraordinarily long lead times from overseas.” Another participant echoed the pressure being seen from stainless steel prices saying, “Terrible things [are] happening with stainless steel at the moment, never know when this will end.”

Fastenal’s +21.3% overall February daily sales growth easily beat our +14.4% estimate. Amid lingering Omicron cases, safety sales were +18.8% y/y. Excluding safety products, fastener sales were +28.0% y/y (accelerating nicely vs. +20.9% last month, consistent with FDI improvement) and other non-fasteners were +17.3%. Looking ahead to March daily sales, we model overall daily sales +18.9% y/y. FAST will report March daily sales in conjunction with 1Q22 earnings on April 13.

Risk Synopsis:

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for March 2022, with graphs and disclosures, Click-here.