Written by R.W.Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 8/4/21

Key Takeaway:

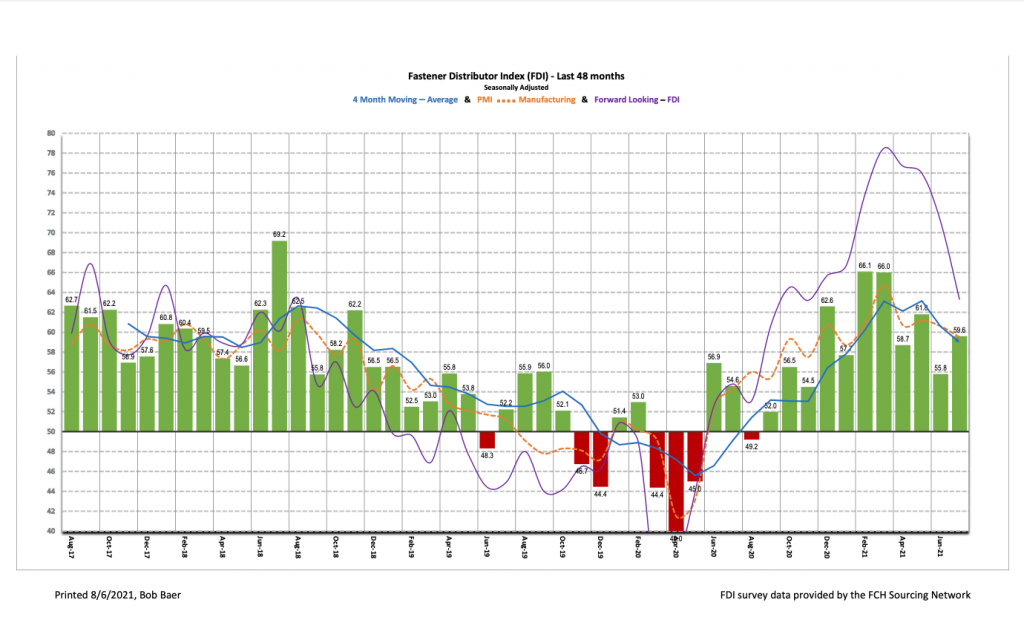

The July seasonally adjusted Fastener Distributor Index (FDI) of 59.6 improved vs. June, driven by slightly better selling conditions. Commentary continued to point to a supply-demand imbalance, along with labor shortages, accelerating pricing, and logistics backlogs. The Forward-Looking Indicator (FLI) of 65.3 speaks of continued cooling while the indicator still remains firmly on the positive side, as higher respondent inventory levels (which could actually be a positive for future growth given inventory shortages) and a slightly weaker six-month outlook continues to signal growth, expected in the months ahead, albeit constrained by the aforementioned factors. Net, strong inbound orders and accelerating pricing continue to power strength in the FDI, while meeting the very elevated demand remains extremely challenging.

About the Fastener Distributor Index (FDI).

The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and Baird with support from the National Fastener Distributors Association. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward-looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM).

Key Points:

FDI accelerates on slightly better sales trends. The seasonally adjusted July FDI (59.6) expanded from last month’s 55.8, reflecting an improvement in the sales index (+3 points m/m). Pricing is accelerating with seemingly no end in sight (at the moment) amid rapid steel/raw material inflation. This drove the FDI pricing index to an all-time high this month. In addition to extended lead times, labor shortages, and freight delays impacting respondents’ ability to meet orders, several respondents also commented on the ongoing semiconductor chip shortage for the first time this month, as this seems to now be filtering down to impact fastener market demand.

FLI moderates further. The seasonally adjusted FLI was 65.3, retrenching for the fourth consecutive month as sentiment among respondents is being negatively impacted by the aforementioned challenges. However, putting the FLI in context vs. the longer-term survey average (55.3), the FLI remains on very solid footing and continues to suggest growth ahead. All four FLI components (employment index, respondent inventory levels, customer inventory levels, and six-month outlook) softened m/m.

Employment levels very modestly weaker. The FDI employment index came in at 61.3 vs. 62.9 last month. Twenty-six percent of respondents saw employment levels as above seasonal expectations vs. June’s 35%. We believe this reflects continued challenges in finding/retaining qualified labor amid a strong job market and enhanced federal/state unemployment benefits, although the latter factor could disappear in September as enhanced federal unemployment benefits expire. Looking at the broader economy, the June jobs report showed a better-than-expected gain of 850,000 jobs coming off two straight soft reports. This solidly surpassed economist expectations for +706,000. Unemployment is still elevated, however, at 5.9% compared to the pre-pandemic level of 3.5%. July’s job report is expected to show +788,000 jobs added, according to consensus economist expectations.

Robust demand continues but growth is held back by constraints. Labor and logistics constraints are most respondents’ top concerns at the moment. Said one respondent, “Biggest obstacle right now is the worldwide logistics backlog. Booked sales and additional sales opportunities are growing, they’re just difficult to fulfill.” Echoing this, another participant said, “Pricing is out of control. Supply is short. Lead times unbearable. Customers not all [understanding].” A new growing concern evident this month was the ongoing semiconductor chip shortage: “The computer chip impact is a serious problem as is finding labor.” Another respondent said, “Customer demands are [down] due to chip shortages, import delivery delays and lack of labor force.” Even against all these headwinds, however, some respondents continue to fare quite well in this environment: “We’ve experienced four straight months of records sales for our company.” Said another, “Even though July was below June it still was at a high level as this year continues to be on track for record growth.” Finally, sounding weary from the constant quest to locate short inventory, one distributor quipped, “It’s times like this I’m glad we have FCH Sourcing Network! It’s helped us out of jams several times.”

Fastenal’s +1.7% overall June daily sales growth exceeded our -0.6% estimate. Safety sales declined 30.3% against a COVID-fueled +95% June 2020 comparison and as demand for masks moderated with easing of mask mandates. Excluding safety products, underlying sales were +15.6% y/y, which was just above our +14.9% estimate and normal seasonality. Turning to fasteners specifically, FAST’s fastener sales were +24.4% y/y, consistent with the strong readings seen in the FDI/FLI over the last several months. Looking forward, we model July overall daily sales +9.9% y/y, reflecting safety -3.7% and non-safety (including fasteners) +13.9%. FAST will report July daily sales on August 5.

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for July 2021, with graphs and disclosures, Click-here.