Written by R.W. Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 10/4/20

Key Takeaway:

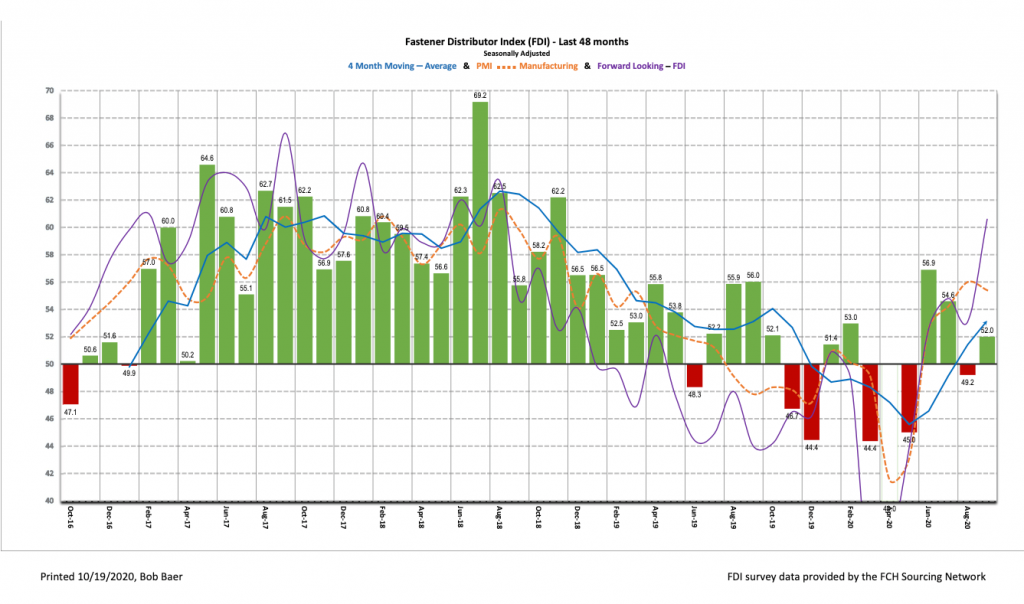

The seasonally adjusted Fastener Distributor Index (FDI) for September was 52.0, returning to growth after last month’s slight contractionary reading (49.2). An improvement in the sales and employment indexes drove the m/m improvement. Looking forward, the Forward-Looking Indicator (FLI) also improved nicely to 60.6, breaking out of the narrow ~53-54 range seen consistently over the past several months. Taking the FDI and FLI together, in our view, we believe this indicates September fastener market conditions showed improvement over a relatively steady August.

About the Fastener Distributor Index (FDI).

The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and Baird with support from the National Fastener Distributors Association. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward-looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM).

Key Points:

The September FDI shows improving momentum after a steady August. The seasonally adjusted September FDI (52.0) returned to expansionary levels after a brief and moderate dip below 50 last month (49.2). The seasonally adjusted sales index, specifically, was the main driver of this improvement, coming in at 60.8 vs. 47.6 last month. Pricing also moved slightly higher when compared with last month.

FLI surges to highest levels in over two years. The seasonally adjusted FLI was 60.6, the highest reading since June 2018. This also broke a recent string of FLI readings in the 53-54 range. We view this breakout as a positive sign looking forward, as low customer inventories, coupled with a slightly more optimistic tone around hiring, could bode well for near-term prospects. Net, we believe the FDI should see continued modest expansionary readings in the near term.

Improved hiring sentiment. The FDI employment index registered a 53.7 reading, improving from last month’s 46.1. Looking at the broader economy, despite a continued recovery in the labor market, the unemployment rate remains elevated (7.9% as of September), and after four consecutive months of better-than-expected job gains, the September jobs report slightly missed expectations (+661,000 vs. +800,000 consensus expectations). Many analysts believe the September jobs report could be an indication that the labor market recovery seen over the prior four months has begun to stall out.

Respondent commentary slightly more positive on balance. We noticed more respondent commentary indicating higher levels of activity and an improved outlook than those expressing dissatisfaction with current activity levels. One respondent summarized it by saying, “Markets increasing!,” while another commented, “Some markets rebounding much faster/heavily than others. But overall customer demands have been increasing monthly.” More cautious commentary included: “COVID has caused a substantial decrease in sales.” Another commonly mentioned topic was strained supply chains, with one respondent indicating, “end user inventories are too low forcing stress on dist./mfg’s to produce parts sooner than typically offered” and another saying, “Many distributors are ordering ‘hand to mouth’, there is a concern that when the business returns, there will be a mad rush to refill inventory levels which will drive up lead times. Distributors need to plan now.”

Attitudes about expected activity levels over the next six months compared to today are more positive than negative on balance, however, with 61% of participants expecting higher activity levels and only 15% expecting lower.

Fastenal reported 2.5% overall August daily sales growth vs. our +0.0% estimate, again boosted by significant demand for safety/PPE (+35% y/y). Excluding safety products, underlying sales were -4.2% y/y, showing modest m/m improvement vs. July’s -4.6% y/y but coming in slightly below our -3.1% estimate. Similar to an FDI reading that indicated relatively stable fastener markets, FAST’s fastener sales were stable m/m at -7.3% (July -7.5%). Looking forward, September safety product sales will likely continue to benefit from surge orders, although we are conservatively assuming m/m moderation (our September estimate is +10% y/y vs. August +35%). We expect underlying momentum in fastener products and other non-fastener products to continue to moderately improve, albeit offset by two additional selling days m/ m relative to normal seasonality, which optically places downward pressure on daily sales growth rates. As such, we are modeling overall daily sales -3.7% in September, which will be reported with FAST’s 2Q20 report (10/13).

Risk Synopsis:

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for September 2020, with graphs and disclosures, Click-here.