Written by R.W. Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 12/7/23

Key Takeaway:

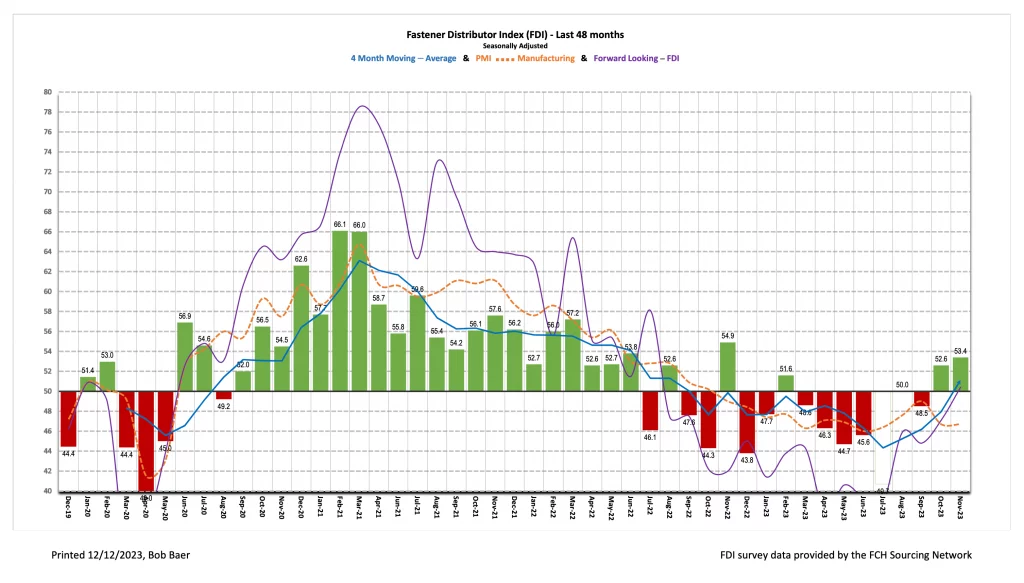

The seasonally adjusted Fastener Distributor Index (FDI) improved m/m and remained above a neutral 50 reading for the second consecutive month, reading 53.4. Comments skewed noticeably more positive this month with many expressing that they are seeing good bookings momentum and feeling growing optimism. The Forward-Looking Indicator (FLI) also improved m/m and finally reached above 50 for the first time since July 2022, reading 50.4. Overall, we view the November FDI/FLI as perhaps indicative of a true stabilization and recovery in fastener markets for the first time in quite a while.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and R. W. Baird. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward- looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM). Additional background is available at:FastenersClearingHouse.com.

Key Points:

FDI above 50 for two consecutive months. The seasonally adjusted November FDI (53.4) improved from last month (52.6) and marked the second consecutive month of growth (>50). While the FDI has registered a handful of growth readings throughout 2023, the last time the index posted two consecutive >50 readings was June 2022 – perhaps suggesting a real change in underlying demand trends rather than another head fake or anomaly. M/m growth was driven by an improved seasonally adjusted sales index (63.0 vs. 52.6 last month), the employment index (improved to 55.9 from 51.6), and customer inventories (54.4 from 51.6 in October). Respondents indicated they saw growth in bookings and strong daily sales numbers: “I was very surprised this month as daily sales numbers added up more quickly than usual. Nice result.” 35% of respondents indicated sales came in above seasonal expectations (October 44%). Another 38% said sales were in line (22% last month), while just 26% saw weaker sales than expected (October 34% and 2023 YTD average 39%).

FLI breaks through to growth. The FLI also saw sequential improvement, coming in at 50.4 vs. 47.1 last month. The FLI had gradually climbed towards 50 from a low of 37.8 in April, but this month marked the first growth reading for the index since July 2022. Higher employment levels and a significantly more positive six-month outlook drove the improvement. On the outlook specifically, 47% of respondents predicted higher activity six months from now vs. today compared to just 25% last month. The percentage anticipating similar activity was 29% compared to 47% in October, while the percentage expecting softer activity was 24% (last month 28%). This drove the six-month outlook index to register 61.8 vs. 48.4 last month.

Noticeably more optimistic tone struck this month. For the second consecutive month, we noticed commentary leaned more optimistic on balance than pessimistic. Stabilization and/or growth in bookings for both October and November have many feeling more positive: “Even though we continue to get mixed signals from customers overall, the past two months have produced positive gain in bookings, and invoiced sales should continue to increase over the next six months. Positivity is starting to grow concerning the short-term outlook for our organization.” Another respondent also saw good momentum: “Business is brisk! This will be our BEST November in company history with record shipping and booking. No sign of slowdown.” Others are seeing more of a stabilization than acceleration but even this is viewed as encouraging: “The slowdown finally steadied. Incoming orders starting to pick up a bit. Inventory is arriving at the fastest pace in the past three years. Factories overseas are slow, and pricing is coming down, even stainless.” Looking forward, the full-year 2024 outlook is murky but “slow growth” could be achievable: “There is still some uncertainty what market conditions will be like but leaning to slow growth for the year with first half slower and picks up [in] second half.” Outside of the market/economy, some feel company-specific performance could drive solid results in 2024: “We see higher sales in the next six months more due to new business than due to increases from current business.” On the negative side, the upcoming election is seen as posing some risk to sentiment/business conditions: “ I wish 2024 wasn’t an election year!”

Fastenal reported November daily sales growth of +3.8% y/y which was above our +2.5% estimate and what normal seasonality would imply (+2.8%). This included fastener sales -3.0% y/y, which was fairly stable vs. last month (-2.6%) but marked the seventh consecutive month of either flat or declining y/y sales. Safety sales were +10.8% and other non-fasteners grew +5.8% y/y. Looking forward, we model December daily sales +4.0% y/y for Fastenal which would be in line with normal seasonality given the optimistic commentary from the FDI this month and the FLI breaking into growth. Looking out to 2024,

Fastenal reported November daily sales growth of +3.8% y/y which was above our +2.5% estimate and what normal seasonality would imply (+2.8%). This included fastener sales -3.0% y/y, which was fairly stable vs. last month (-2.6%) but marked the seventh consecutive month of either flat or declining y/y sales. Safety sales were +10.8% and other non-fasteners grew +5.8% y/y. Looking forward, we model December daily sales +4.0% y/y for Fastenal which would be in line with normal seasonality given the optimistic commentary from the FDI this month and the FLI breaking into growth.

Looking out to 2024, we assume FAST’s growth will return to just modestly above normal seasonality in year one of an industrial recovery beginning in 2H24; in contrast, most of 2023 was below seasonally normal sales. In contrast, most of 2023 was below seasonally normal sales.

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for November 2023, with graphs and disclosures, Click-here.