Written by R.W. Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 6/4/21

Key Takeaway:

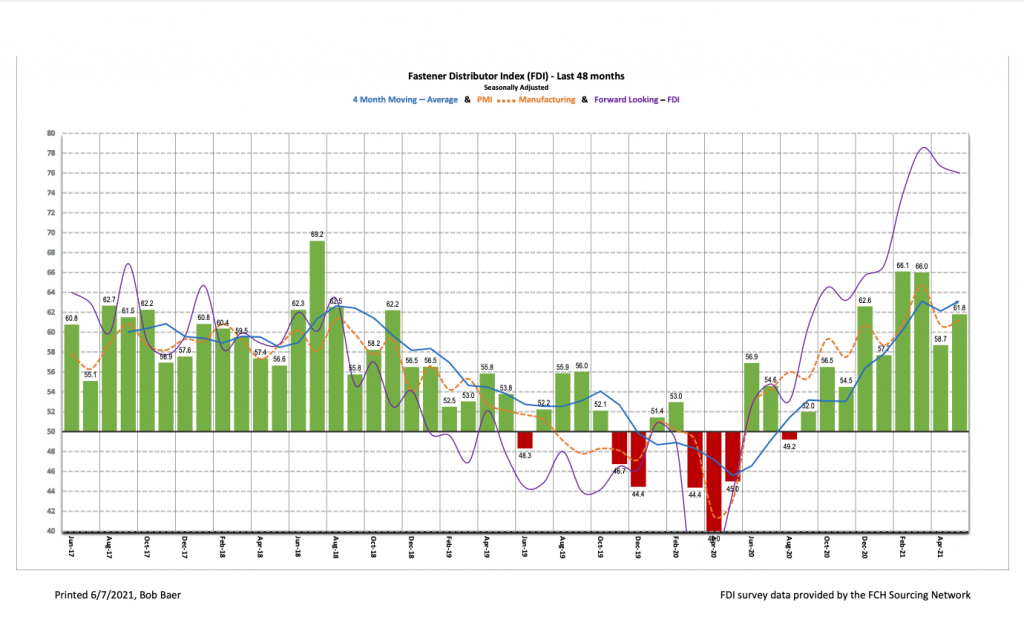

The seasonally adjusted Fastener Distributor Index (FDI) showed market conditions improved at an accelerating rate in May with a reading of 61.8, remaining above 50 and with strong m/m improvement. Respondent commentary focused on continued robust sales/order activity, however, extended lead times, challenges finding labor, and inflationary cost pressures were partial offsets. The sales index also saw m/m improvement. The Forward-Looking Indicator (FLI) was essentially unchanged vs. last month at a very robust 76.0, signaling expected expansionary demand conditions in the months ahead. Net, respondents continue to see more demand than they can service given extended lead times, freight challenges, and material/staffing shortages.

About the Fastener Distributor Index (FDI).

The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and Baird with support from the National Fastener Distributors Association. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward-looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM).

Key Points:

FDI sees m/m improvement despite continued supply chain disruption. The seasonally adjusted May FDI (61.8) expanded from last month’s 58.7, which had retreated amid intense supply chain/freight disruptions. Although these disruptions continued in May, improving demand conditions drove overall expansion. Nearly two-thirds of respondents saw better than seasonally expected sales, which was an improvement from the ~half of respondents last month. Higher pricing has also contributed, as 86% of respondents saw higher point-of-sale pricing y/y and 76% m/m.

FLI stabilizes. The seasonally adjusted FLI was 76.0, about flat with last month’s 76.7. The FLI remains near all-time highs (March 2021 78.5) as low customer inventory levels and continued bullish six-month outlooks signal strong market conditions ahead. Compared to last month, the FLI employment component improved but customer inventory levels and the six-month outlook moderated slightly, leaving the FLI mostly unchanged.

Employment levels tick up slightly. The FDI employment index came in at 70.3, breaking out from the recent 66-67 range seen over the past four months. Forty-nine percent of respondents saw employment levels as above seasonal expectations in May – slightly higher vs. April’s 42%. Of note, some respondents this month noted employment levels would be higher at the respondent/customer level, although finding qualified labor is challenging given enhanced unemployment benefits. Looking at the broader economy, the May jobs report showed a solid but slightly disappointing gain of 559,000 jobs coming off April’s soft +266,000 adds. This trailed economist expectations for +675,000, as labor force participation rates ticked down. Unemployment now stands at 5.8% compared to pre-pandemic levels of 3.5%.

Supply chain issues continue. Supply chain disruptions showed no signs of abating in May, and based on respondent commentary, may have deteriorated further. However, demand remains robust, in some cases overwhelmingly so. Said one respondent, “Distributors starting to run out of critical stock, pricing continues to rise, domestic lead times continue to rise. New orders continue to be amazingly higher than last year with no sign of slowing.” Another commented, “Continued strain in supply chain and raw materials are driving cost pressures. Transit market remains turbulent. Demand remains high .” Amid port backup and other freight challenges, lead times continue to extend: “Deliveries are delayed from Taiwan and from the US ports and intermodals. Shortages everywhere followed by inflation across the board.” Echoing this feedback, another participant said, “Master Distributors – Suppliers are REALLY slow in shipments and inventory to distributors. And when they do have inventory, it could be coming from anywhere in the country. Lead times are out of this world…. might as well just go fishing!”

FCH Sourcing Network traffic and inquiry volume spiked during the month. Especially strong was the number and dollar value of FCH SourceFinder inquiries, which are broadcast RFQs shared among network members. The higher than usual number of distributors searching to fill inventory gaps seems consistent with faltering supply concerns.

Fastenal’s -3.2% overall May daily sales growth exceeded our -5.5% estimate. Safety sales declined 44.1% against a COVID-fueled +136% May 2020 comparison. Excluding safety products, underlying sales were +18.7% y/y (April was +23.8% against an easier comparison), which was above our +16.7% estimate and normal seasonality. Turning to fasteners specifically, FAST’s fastener sales were +28.2% y/y, consistent with the strong readings seen in the FDI/FLI over the last several months. Looking forward, we model June overall daily sales -0.6% y/y, reflecting safety -36% and non-safety (including fasteners) +14.9%.

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for May 2021, with graphs and disclosures, Click-here.