Written by R.W. Baird analyst David J. Manthey, CFA 7/6/20

Key Takeaway:

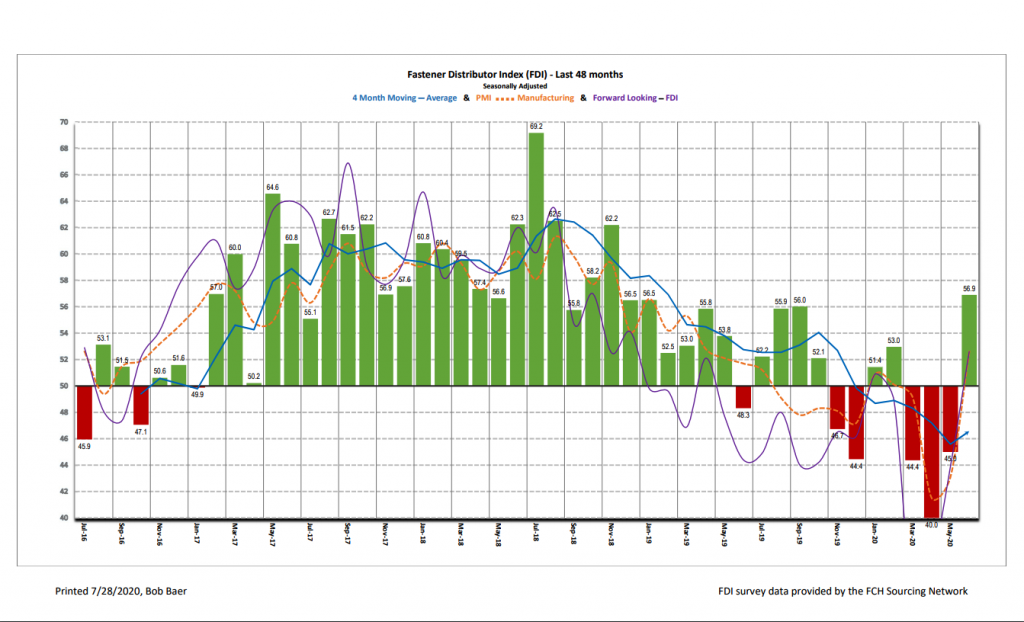

The seasonally adjusted Fastener Distributor Index (FDI) for June was 56.9, surging m/m as the economic re-opening continued. Sales trends were better than seasonally expected for a majority of respondents, the first time that has occurred since January. The six-month outlook further improved and was the strongest since early 2018, as participants gain confidence a recovery is taking shape, albeit one that is perhaps slow and uneven and conditional on the reaction to COVID-19. Net, June showed further recovery from the bottom, with the FDI once again returning to growth, and momentum continued to improve.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and Baird. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward-looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM).

Key Points:

FDI returns to growth in June. The seasonally adjusted June FDI (56.9) improved vs. May (45.0), consistent with an improvement in last month’s forward-looking indicator and an expansionary reading in the June ISM PMI. The month marked a return to expansionary readings for the FDI for the first time since February. Additionally, the seasonally adjusted sales index showed very strong improvement, surging from a still very weak 28.9 last month to an impressive 69.9 in June. Pricing remained stable for most respondents.

FLI also continues to improve. The seasonally adjusted FLI increased to 52.6, an impressive gain from last month’s 43.9. Respondents are on balance once again feeling more optimistic than pessimistic about the six-month outlook, while employment has also started to return to more normal levels. These two factors primarily accounted for the m/m improvement in the FLI. Net, with the FLI improving for three straight months and the US economy continuing to reopen, we believe the FDI could see steady improvement in the immediate term, albeit conditional on widespread government-mandated shutdowns not re-occurring.

Hiring sentiment is improving. The FDI employment index registered a 56.6 reading, also a significant improvement from last month (40.0). The percentage of respondents noting lower employment levels than seasonally normally decreased to just 11% vs. an average of 40% seen over the last three months. Looking at the broader economy, while the unemployment rate remains elevated (11.1%), both May and June saw much better-than-expected job gains as businesses re-opened. Should additional business closures and/or any government mandate shutdowns occur, we could see the employment situation again quickly deteriorate. But recent gains have been undoubtedly positive news for the US economy.

Respondent commentary remains uneven. Although June seems to have been better than expected for most respondents, and momentum is clearly improving, many participants still characterize the recovery as slow and somewhat uneven to this point. One respondent commented, “Slow recovery but at least positive trend after the shutdowns in April and early May.” Another commented, “Have experienced more customer demand [increases] but [some] don’t believe our industry will see normal levels for some time. Too many variables especially related to the pandemic that can impact the economy.” Attitudes about activity over the next six months compared to today are much more positive than negative on balance, however, with 61% of participants expecting higher activity levels and just 11% expecting lower.

Fastenal reported a very impressive +14.8% overall May daily sales growth vs. our -6.2% estimate, again boosted by a huge surge in demand for safety products (+136% y/y). Excluding safety products, underlying sales were -10.0% y/y, showing improvement vs. April’s -16.4% y/y (similar to the FDI). Fastener sales, while lagging growth in other non-safety products, also showed m/m improvement at – 15.3% y/y compared to -22.5% in April. Looking forward, June safety product sales will likely continue to benefit from surge orders, although we assume not to the same degree as April/May, while we expect momentum in fastener products and other non-fastener products to continue to improve as the economy further reopens. As such, we model overall +0.7% daily sales in June. June daily sales will be reported with FAST’s 2Q20 earnings report on 7/14.

For the full FDI report for June 2020, with graphs and disclosures, Click-here.