Written by R.W. Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 3/7/23

Key Takeaway:

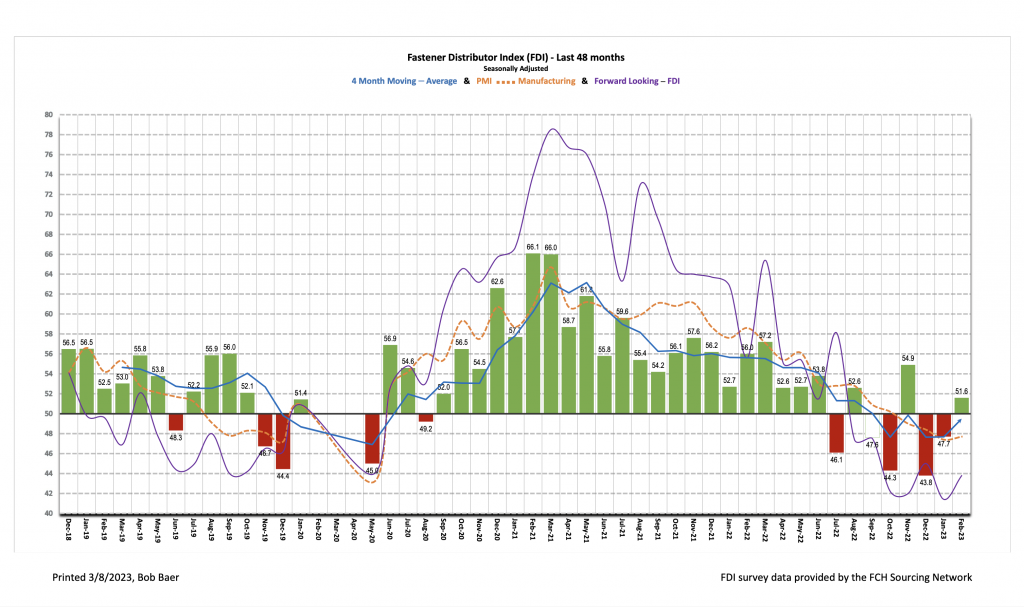

The seasonally adjusted Fastener Distributor Index (FDI) registered its first expansionary (>50) reading since November, improving to 51.6 from 47.7 last month. Consistent with this, commentary from participants was also a bit more positive this month, with some respondents seeing “some positive signs” for the first time in a while. Looking forward, the Forward-Looking Indicator (FLI) also improved, albeit remaining in contractionary territory, with a 43.8 reading. Overall, the FDI/FLI results suggest February saw improvement in fastener market conditions relative to January.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and R.W. Baird. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward- looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM). Additional background is available at:FastenersClearingHouse.com.

Key Points:

FDI improves to register a growth reading. The seasonally adjusted February FDI (51.6) improved for the second consecutive month and registered an expansionary reading for the first time since November. A higher employment and supplier deliveries index drove the improvement. The sales index was also nicely better m/m at 51.4 vs. 44.7 in January. Participants indicated pockets of strength among certain customers was a partial offset to general weakness elsewhere, while others characterized sales as “solid” or “steady, but not quite enough to drive measurable growth just yet.”

FLI also improved. The FLI registered a 43.8 reading, improving vs. last month (41.4) but remaining at <50 and thus signaling weakening is still expected ahead. A stronger employment reading and lower customer inventory levels drove the improvement seen this month. The six-month outlook softened slightly, however, with just 27% of respondents anticipating higher activity levels six months from now vs. today compared to 37% in January. This remains well below the 44% average seen over the past two years. Conversely, 37% expect lower activity levels (January was 33%) vs. an average of just ~19% over the past two years. Finally, 37% expect a continuation of February trends over the next six months. Uncertainty/lack of clarity on the direction of future trends were commonly expressed themes.

FDI employment also higher m/m. The FDI employment index came in at 55.0 for February vs. 48.1 last month. Employment levels continue to be seen as generally at appropriate levels (70% of responses), although there was an uptick in the percentage indicating employment was “too high” in February (20% vs. just 7% last month). Only 10% of respondents say employment is “too low”, which was essentially unchanged (January 11%). Turning to the overall economy, the January jobs report came in well above expectations. 517,000 jobs were added vs. economist expectations for +187,000. A cooling labor market remains key toward the Federal Reserve eventually pausing rate hikes, but to this point the labor market has remained persistently strong. The February jobs report is expected to be released on March 10; economists are predicting 200,000 jobs will be added.

Outlook retrenches after streak of three consecutive months of improvement. Forward-looking commentary generally focused on uncertainty in the direction of future trends: “Seeing mixed winds in our sails, uneventful periods with sudden bursts. [It’s] steady, but not quite enough to drive measurable growth just yet… unsure of future trend.” Others indicated they’re starting to see early encouraging signs of improvement: “A little more activity – starting to get some positive signs.” Lastly, some respondents continue to see pockets of strength: “Our business is down, however, not all of our customers are feeling the slow down. Doing our best to pivot and regain lost revenue.” The overall six-month outlook was less positive, however, at 45.0 vs. 51.9 in January.

Fastenal reported February daily sales growth of +9.6%, just above our +9.3% estimate and in line with normal seasonality. This included +8.0% y/y growth in fasteners, +3.2% growth in safety, and +13.8% other non-fastener growth. Looking forward, we model overall March daily sales growth also at +9.6% y/y, which would be just slightly below normal seasonality which we view as appropriate given the still sub-50 FLI. Looking at 2023 overall, we generally model slightly weaker-than-seasonally-normal sales given the string of sub-50 FDI/FLI readings, a sub-50 ISM PMI, and an over-arching assumption that recession hits in 2H23.

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for January 2023, with graphs and disclosures, Click-here.