Written by R.W. Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 9/9/22

Key Takeaway:

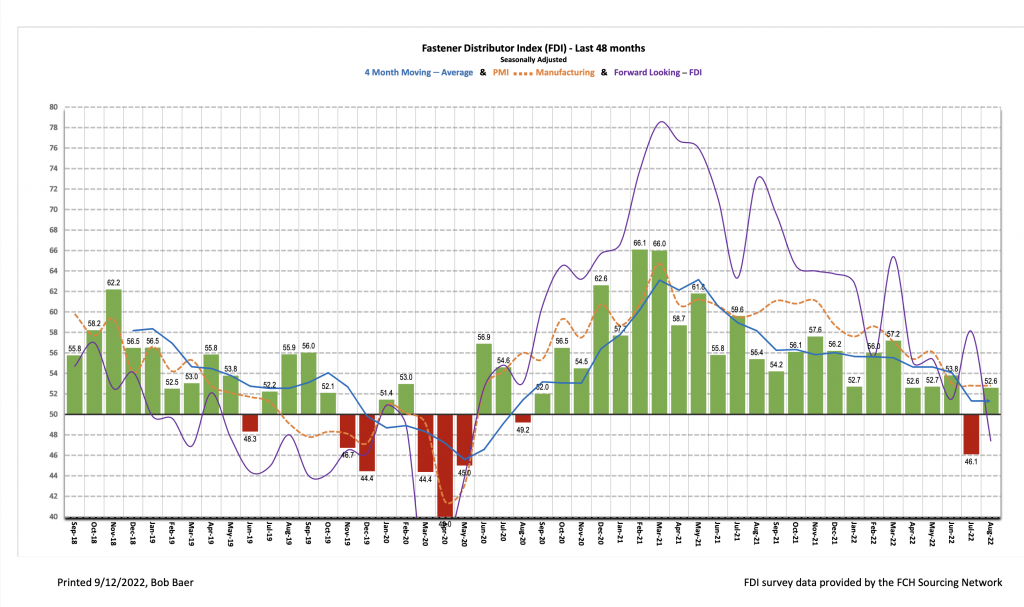

The August seasonally adjusted Fastener Distributor Index (FDI) bounced back nicely from last month’s sub-50 reading, increasing back into expansionary territory at 52.6. This was consistent with a still very positive FLI reading last month. Demand commentary seemed to suggest further slowing ahead is likely, however, with commentary noting customers are pushing out deliveries and trying to preserve cash in some cases. Pricing remained fairly stable with last month and still at elevated levels. Looking forward, the Forward-Looking Indicator (FLI) retracted to just 47.4, however, as respondents remain overall cautious. Net, August marked a nice bounce back from a soft July but forward-looking commentary and the FLI indicates more choppy conditions ahead are likely.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and R.W. Baird. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward- looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM).

Key Points:

FDI rebounds back to growth. The seasonally adjusted August FDI (52.6) returned to growth territory after briefly dipping <50 last month (46.1). The sales index was the main driver of the improvement, as only 28% of respondents indicated sales were below seasonal expectations compared to 46% last month. Pricing was consistent with last month’s readings and remains at elevated levels, but recently moderating commodity prices (steel) and container/freight costs could suggest some normalizing ahead, in our view, which could lead the index to decline. At least one respondent noted they were already seeing raw material prices normalize. Overall, we believe August’s FDI reading was indicative of a growing but slowing market.

FLI suggests another dip expected next month. Despite the solid August FDI, the seasonally adjusted FLI suggests the recovery may be short lived, with the index coming in at just 47.4. Relative to last month, employment levels softened, customer inventories crept up into “too-high” territory, and the six-month outlook was less positive. Regarding the outlook, the percentage of respondents expecting higher activity levels six months from now compared to today was just 28% — down significantly from last month’s 50%. Another 28% expect lower activity levels vs. an average of just ~13% over the past two years. Lastly, 45% expect similar trends. Commentary from participants that focused on the outlook indicated customers are pushing out deliveries, while certain sectors (industrial) are seeing significant slowing.

FDI employment index ticks down. The FDI employment index came in at 53.4 for August, decreasing from 62.5 in July. The vast majority of participants indicated they were at levels of employment that is seasonally normal/appropriate (72%), with just 10% saying employment levels were too low (compared to a post-COVID high of 26% in September 2021). The broader economy saw a similar deceleration in August, adding +315,000 jobs vs. the consensus expectation for +318,000 and compared to the +526,000 added in July. Average hourly earnings rose +0.3% m/m and +5.2% y/y in August as firms continue to compete for workers in the current inflationary backdrop.

Outlook deteriorated vs. last month. Forward-looking commentary this month skewed more bearish than recent months amid continued macro uncertainty and recession fears. Participants pointed to customers requesting to delay deliveries and preserving cash: “Continued slowdown and customers asking to delay shipments. In addition, A/R now starting to age further out as customers attempt to preserve their cash.” The industrial sector was also called out by one participant as seeing significant slowing in demand: “Our automotive tier sector remains busy, but inconsistent in terms of scheduling due to supply chain issues. Industrial sector has slowed because of consumers tightening their spending habits. This has affected inventories across the board–everybody has too much. Supplier deliveries and lead times remain long but at least they seem to have peaked.” Lastly, raw material pricing moderating could be another signal of demand waning: “Raw material pricing is beginning to soften, however; it is still much higher than a year ago.” Even for those participants not yet seeing slowing, to some it feels inevitable: “Many of the industry economic sources predict slower growth so figuring a slowdown is in the near future though have not seen it yet. Numbers still at elevated levels.”

Fastenal’s +16.1% overall July daily sales growth came in materially in line with our +16.5% estimate and days- adjusted normal seasonality. Fastener sales grew by +19.8% y/y (consistent with July growth). Additionally for FAST, safety was +11.7% and other non-fasteners were +14.5%. Looking ahead to September daily sales, we model overall daily sales +13.7% y/y, which is in line with normal seasonality. Over the remainder of the year, we model in-line to slightly weaker-than-seasonally-normal sales as we assume underlying demand conditions continue to soften exiting 2022 with outright recession in 2023. FAST will report September daily sales with 3Q22 results on October 13th.

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for August 2022, with graphs and disclosures, Click-here.