Fastener Distributor Index – Report #167 November 2025

Written by R.W. Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 12/5/25

Key Takeaway:

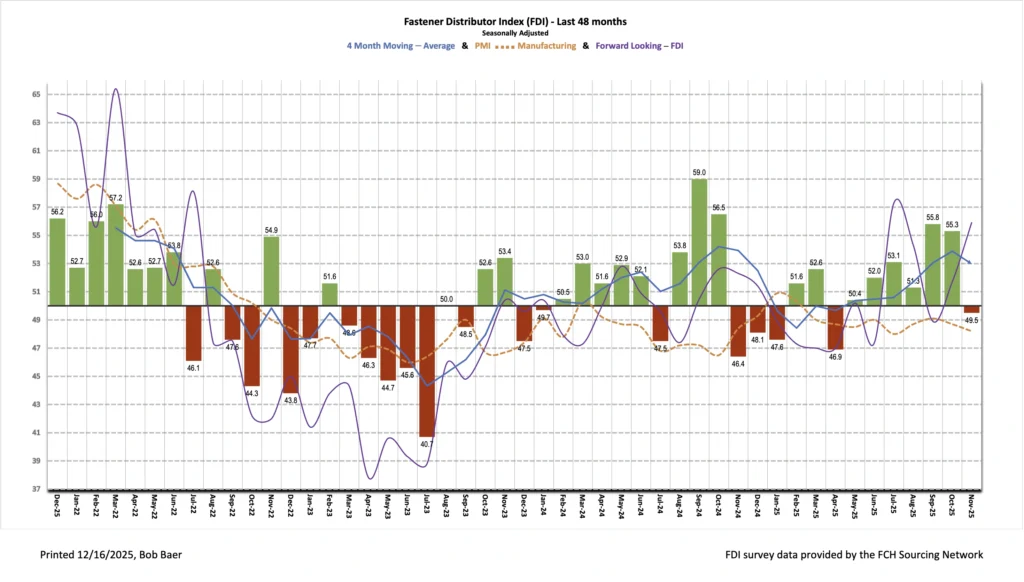

This month, the seasonally adjusted Fastener Distributor Index (FDI) retreated to just below 50, coming in at 49.5. The m/m pullback (October 55.3) mainly reflected a retrenchment in the seasonally adjusted sales index. However, a near-50 reading suggests mostly stable trends, overall. Conversely, the Forward-Looking Indicator (FLI) was more positive m/m at 55.9, expanding further above 50 due to stronger six-month outlooks. Respondent commentary was mixed as tariff uncertainty continues to weigh on sentiment, though some participants see a healthy setup into 2026.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and R. W. Baird. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward- looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM). Additional background information is available at:FastenersClearingHouse.com.

Key Points:

FDI pulls back below 50. This month, the index slipped just below 50 to 49.5 after two very strong months (October 55.3, September 55.8). This reflected weaker selling conditions; the seasonally adjusted sales index came in at just 49.1 vs. 62.4 last month. A mere 23% of respondents said sales were above seasonal norms, which was well below October (50%) and the average levels over the past year (37%). Anecdotal commentary suggested either a slow start to the month or a soft finish around the Thanksgiving holiday. Pricing continues to play a large role in the monthly sales performance, as pricing increased for 42% of participants m/m and 77% y/y. The percentage of respondents seeing higher pricing m/m continued to stabilize overall relative to 61% in August, 65% in July, and 66% in June –signaling tariff-related increases are starting to moderate. Employment levels were stable and remained a slight tailwind to the overall FDI, as the share of participants saying employment was “lower than seasonal norms” remained at a very low 3%, though the overwhelming majority (84%) say employment levels are in line. Supplier lead times were relatively unchanged m/m, while customer inventories were slightly more in balance (just 3% said too high vs. 16% last month).

FLI continues to track higher, while PMI remains muted. The Forward-Looking Indicator (FLI) improved to 55.9 from 51.7 in October. The m/m increase was driven by a more optimistic six-month outlook for respondents. Specifically, 52% now forecast better trends six months from now compared to today, increasing from 44% in October and above the 43% average throughout 2024. Conversely, just 16% forecast lower activity levels in six months, which decreased from 22% last month. The remaining 32% anticipate stable momentum (vs. 34% last month). The ISM PMI, meanwhile, suggested slightly worsening momentum in the industrial economy, with November coming in at 48.2 vs. October 48.7.

Commentary suggests a weak start or end to the month; outlook uncertain but some lean positive. Depending on the participant, the weaker sales index in November reflected the start of the month “Nov incoming order rate was strong after slow start. Record year with one month to go. Expectations are high for 2026.” or the end of the month “Even though activity was up with our customers, the second half of the month slowed down more than usual due to the holiday. Expect the unworked demand to climb sharply at the beginning of December.” That said, clearly both participants see pent-up demand being released either very near term (i.e. in December) or in 2026. Looking forward, several are hesitant to project out given tariff uncertainty: “Really no solid trends to project that far out. Just not enough stability in the marketplace with foreign policy/tariffs plus erratic consumption from our customers.” Similarly, another comment said, “Again, predicting what havoc the tariffs will impose is a challenge. Hurry up and wait.” Others have found ways to grow significantly this year in the face of tariffs “We’re currently tracking year over year sales up at 51%.” and/or see the tariffs as having created opportunity for deeper partnerships across the supply chain “While tariffs have stolen much time from our business, they have allowed for deeper partner relationships both with customers and suppliers.” Lastly, others are optimistic about new business wins powering a strong 2026: “[We are] rolling out a lot of new business in Q1-Q2 of 2026.”

Fastenal reported November daily sales +11.8% y/y, which exceeded our +10.6% estimate and came in above what normal seasonality would have implied (+10.5%). Fastener sales were also stronger m/m, accelerating to 14.6% growth (from +12.8% in October). Elsewhere, safety sales were +8.1% and other non-fasteners grew +11.9% y/y. For December, we are anticipating a slight moderation to +11.3% y/y daily sales growth, which reflects slightly below normal seasonality due to the possibility of extended customer plant shutdowns from mid-week holidays and/or possible weather headwinds.

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Grainger: Risks include ability to maintain margins, internet-only industrial supply sources, ability to sustain secular growth, cyclicality, and international operations.MSC Industrial: Risks include cyclicality, maintaining and managing growth, success of Mission Critical initiative, and poor investor sentiment.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for November 2025, with graphs and disclosures, Click-here.