Written by R.W. Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 1/8/21

Key Takeaway:

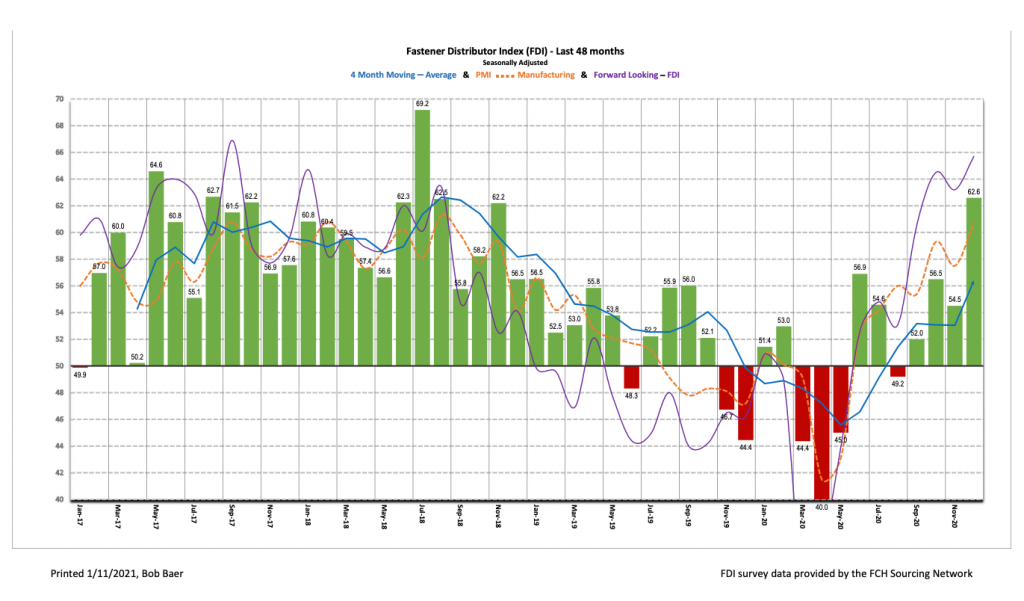

The seasonally adjusted Fastener Distributor Index (FDI) for December came in at 62.6, showing nice m/m improvement and signaling a strong end to the year. The sales index saw similar strength with about two thirds of respondents seeing better-than-seasonally expected sales. Looking forward, the Forward-Looking Indicator (FLI) also saw slight improvement vs. November, seemingly boding well for future demand conditions. Taking the FDI and FLI together, we believe December was a strong month for most fastener distributors relative to expectations.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and Baird with support from the National Fastener Distributors Association. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward-looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM).

Key Points:

FDI sees strong finish to the year. The seasonally adjusted December FDI (62.6) saw nice m/m improvement (November 54.5), primarily driven by a strong expansion in the sales index. 68% of respondents saw better-than-seasonally expected sales in December, boosting the sales index to an unusually strong 90.0 during what is typically a seasonally soft period around the holidays. The employment index and supplier deliveries were also positive contributors to the FDI’s expansion. Pricing continued to move slightly higher amid raw material inflationary pressures and freight increases.

FLI also moves slightly higher. The seasonally adjusted FLI was 65.7, remaining well above the neutral reading of 50 and improving moderately from 63.2 last month. All four components of the FLI (employment, respondent inventories, customer inventories, and six-month outlook) improved vs. November. With the FLI well above 50, customer inventories getting increasingly low, and continued improvement registered in respondents’ six-month outlooks, we believe the FDI should see additional expansionary readings ahead, implying continued m/m improvement even though sales trends may remain lower y/y for many respondents until comparisons ease significantly in March/April.

Employment levels slightly higher. The FDI employment index registered a 58.8 reading this month vs. 52.7 last month. Looking at the broader economy, despite a continued recovery in the labor market, the unemployment rate remains elevated (6.7% as of November). The November jobs report also showed fewer jobs added than expected (+245,000 vs. economists’ consensus of ~475,000), and the economy remains down about 10 million jobs from pre-pandemic levels. At November’s rate of additions, the US economy would not be back to pre-pandemic employment levels for another four years. The December jobs report (slated to be released 1/8) is expected to see further deceleration in gains (economists expect +50,000), as the economy weakened amid claims of surging COVID cases, new lockdowns, and waning stimulus.

Respondent commentary skews positive. Given the strong sales trends in December, commentary not surprisingly remained positive this month. This included one respondent who characterized the 2021 outlook as “surprisingly good.” Additionally, another respondent commented, “December is typically a slow month but this year it was up significantly compared to what we normally expect. Material pricing is increasing in Q1.” Attitudes about expected activity levels over the next six months compared to today also got slightly more positive this month, with 79% expecting higher activity levels vs. today (compared to 78% last month), while 6% expect lower (vs. 8% in November).

Fastenal’s 6.8% overall November daily sales growth compared very favorably to our -0.2% estimate, primarily driven by significant demand for safety/PPE (+36% y/y). Excluding safety products, underlying sales were still slightly positive at +0.8% y/y, showing continued sequential improvement relative to October’s -1.6% y/y. Turning to fasteners specifically, FAST’s fastener sales were also better m/m at -1.7% (October -4.7%). December daily sales will be reported with 4Q20 results on 1/20, but we model some headline deceleration (+3.5%) primarily due to our assumption that safety/PPE demand will moderate. We expect underlying momentum in fastener products and other non-fastener products to be mostly steady with November.

Risk Synopsis:

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for December 2020, with graphs and disclosures, Click-here.