Written by R.W.Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 9/7/21

Key Takeaway:

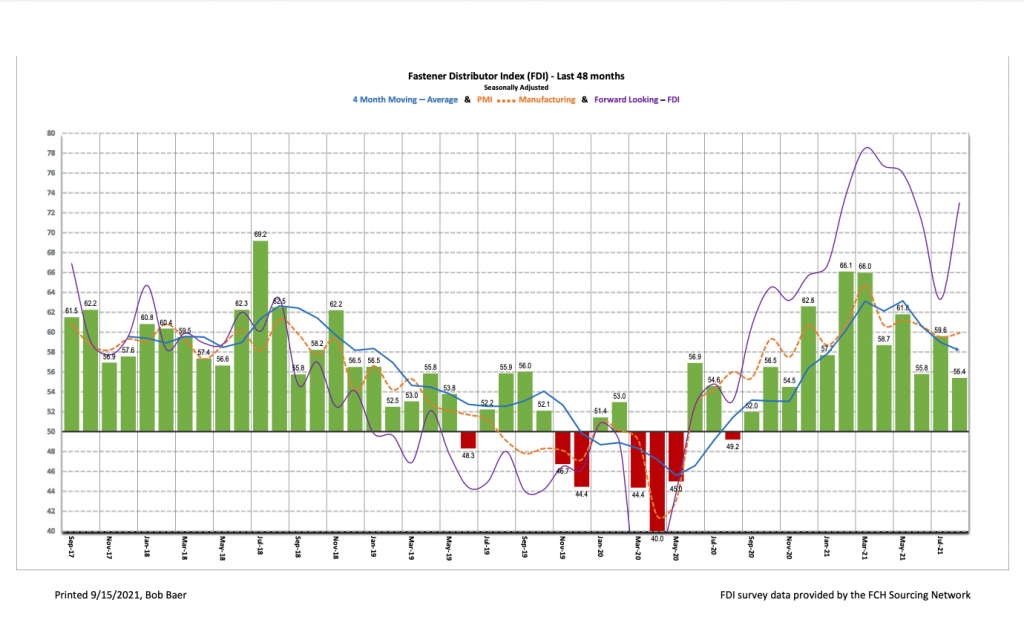

The August seasonally adjusted Fastener Distributor Index (FDI) cooled m/m as raw material, freight, and labor constraints partially hindered growth, although the index remained firmly in expansionary/growth territory at 55.4. Commentary pointed to a strong supply-demand imbalance, labor shortages, accelerating pricing, and overseas supply chain difficulties. The Forward-Looking Indicator (FLI) improved nicely climbing to 73.0 on both a better six-month outlook and very low inventory levels for respondents and customers (which is read as a positive if supply can ramp to meet the restocking demand); the overall FLI continues to signal growth is expected in the months ahead. Net, the FDI suggests August market conditions moderated some from July, although once again due more to labor/supply chain challenges than demand.

About the Fastener Distributor Index (FDI).

The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and Baird with support from the National Fastener Distributors Association. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward-looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM).

Key Points:

FDI decelerates on continued supply chain and labor market difficulties. The seasonally adjusted August FDI (55.4) moderated from last month’s 59.6, reflecting lower employment levels and a softer seasonally adjusted sales index (-7.7 m/m). Pricing, however, continued to accelerate amid raw material inflation, inventory/labor shortages at the supplier level, and robust demand. This resulted in further improvement in the FDI Pricing month to month index. In addition to extended lead times, labor shortages, and freight delays impacting respondents’ ability to meet orders, the ongoing semiconductor chip shortage continues to have negative impacts on demand (most likely in auto) for some respondents.

FLI sees nice m/m improvement. The seasonally adjusted FLI came in at 73.0, breaking the previous four month stretch of declining FLI readings. This improvement was due to extremely low (and weakening) customer inventory levels, which could be a positive for future demand, as well as a better six-month outlook. Net, the FLI remains on very solid footing and continues to suggest growth ahead. With the exception of the employment index, which continues to be impacted by labor shortages, all other FLI components (respondent inventory levels, customer inventory levels, and six-month outlook) improved m/m.

Employment levels soften in August. The FDI employment index came in at 53.8 vs. 61.3 last month. Just 19% of respondents saw employment levels as above seasonal expectations vs. July’s 26% as the job market remains extremely tight, although the recent expiration of enhanced federal unemployment benefits could spur additional return to the labor force. Looking at the broader economy, the August jobs report was much weaker than expected with a disappointing gain of 235,000 jobs coming off July’s better-than-expected report. This widely trailed economist expectations for +725,000 as concerns over the Delta variant impacted hiring in customer-facing areas (restaurants, leisure, hospitality, etc.). Unemployment stands at 5.2% compared to the pre-pandemic level of 3.5%.

Respondent commentary continues to focus on key themes of supply chain havoc and labor shortages. Labor and logistics constraints continue to be respondents’ top concerns. Said one respondent, “Continued supply chain challenges due to port/rail congestion, raw material availability. Labor remains scarce.” Echoing this, another participant said, “Overseas supply chain delays continue to be a big problem.” One respondent went so far as to say, “In my 30+ years in the business I don’t think I have ever had such a difficult time meeting demand.” Lastly, semiconductor chip shortages also remain a headwind for some respondents: “With delay in imported material and computer chips our sales are down by as much as 15% and doesn’t look like it is going to improve anytime soon.”

Fastenal’s +9.0% overall August daily sales growth matched our +9.0% estimate. Safety sales declined 3.8% as demand for masks and other COVID-related products further moderated amid easing restrictions. Excluding safety products, underlying sales were +12.7% y/y, essentially in line with our +12.6% estimate and normal seasonality. Turning to fasteners specifically, FAST’s fastener sales were +18.9% y/y, marking the sixth straight month of double-digit fastener sales growth and generally consistent with recent strong FDI/FLI readings. Looking forward, we model September overall daily sales +7.7% y/y, reflecting safety -1.6% and non-safety (including fasteners) +10.2%.

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for August 2021, with graphs and disclosures, Click-here.