Written by R.W. Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 12/3/20

Key Takeaway:

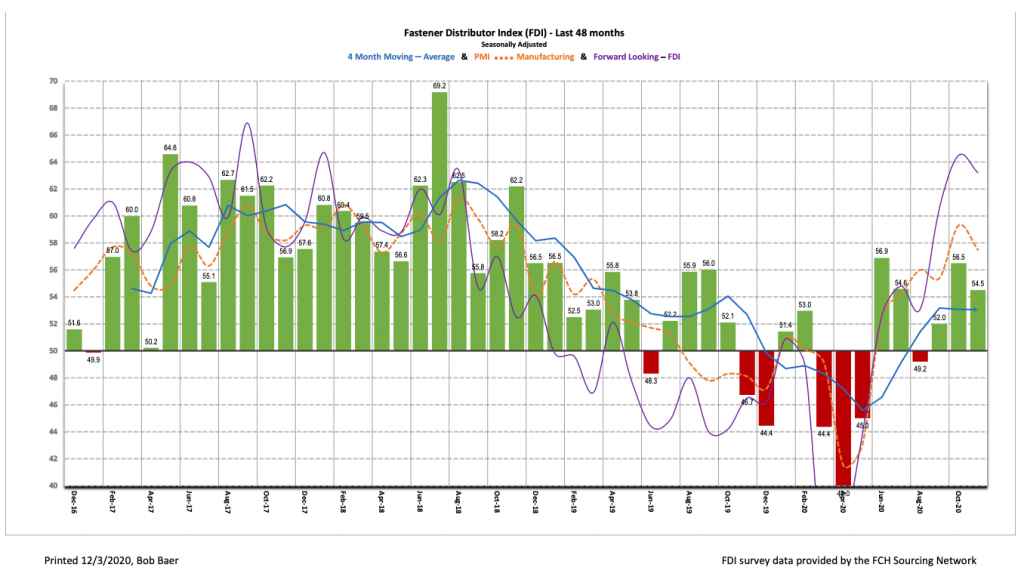

The seasonally adjusted Fastener Distributor Index (FDI) for November was 54.5, moderating slightly from last month but remaining in growth range. The sales index, however, showed some modest improvement m/m as sales were slightly above normal expectations for the seasonally slower month of November. Looking forward, the Forward-Looking Indicator (FLI) retreated moderately but still remains well above 50, seemingly boding well for future demand conditions. Taking the FDI and FLI together, we believe November fastener market conditions showed continued m/m improvement but at a slightly lower rate than October.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and Baird with support from the National Fastener Distributors Association. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward-looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM).

Key Points:

November FDI shows momentum improved m/m but at a slower rate than in October. The seasonally adjusted November FDI (54.5) remained well into expansionary territory but dipped slightly from October (56.5), implying continued m/m improvement but at a slower rate. The seasonally adjusted sales index, however, did show slight improvement vs. October, as sales outpaced expectations in what is normally a softer month of November. Slightly weaker employment and customer inventory levels drove the modest m/m contraction in the FDI. Pricing, however, took a slight step up m/m, perhaps in part reflecting passing on recent freight increases (more on this later).

FLI normalizes some from elevated October reading. The seasonally adjusted FLI was 63.2, well above a neutral-reading of 50 but retreating slightly from last month’s very strong 64.5 reading. As last month’s FLI was the highest recorded since January 2018, we were not surprised to see the FLI settle down some in November. That said, with the FLI well above 50, customer inventories getting increasingly low, and continued improvement registered in respondents’ six-month outlooks, we believe the FDI should see additional expansionary readings ahead, implying continued m/m improvement even though sales trends may remain down on a y/y basis for many respondents.

Hiring sentiment takes a slight step back. The FDI employment index registered a 52.7 reading vs. October 58.3. However, based on past historical responses, it is not unusual for employment levels to take a modest step back in the seasonally slow month of November. As such, we would not read too much into this contraction. Looking at the broader economy, despite a continued recovery in the labor market, the unemployment rate remains elevated (6.9% as of October). The October jobs report showed slightly better than expected jobs added (+630,000 vs. economists’ consensus of ~600,000), but the economy remains down about 10 million jobs from pre-pandemic levels. This was the seventh straight month of net gains but also the fifth consecutive month of decelerating additions. The November jobs report (slated to be released 12/4) is expected to see the smallest gains in seven months (economists expect +475,000).

Overseas shipping concerns evident. In response to a special question this month on overseas shipping, 69% of respondents indicated they are seeing price increases on shipping. Additionally, 67% of respondents indicated they are seeing increased lead times as a result of shipping disruptions. Commentary attributed the source of these issues to multiple causes, including the pandemic event, shortages of shipping containers, labor shortages, and holiday shipments, among others. Shipments coming from Asian suppliers seem to be most impacted. Per one respondent, “Ocean carriers restricted capacity at the height of COVID-19 disruptions… now hesitant to bring on new capacity too quickly.” Another said, “Backlog at ports, shortage of containers overseas, shortage of labor due to Covid-19, trucking industry backed up due to holiday freight.” On price increases, one respondent said, “Inbound from Asia is ridiculous. Ocean carriers are taking advantage of us! Hopefully things get better after Lunar New Year.”

Respondent commentary skews positive. Commentary was mostly positive this month. This included one respondent who summarized the current environment as, “Business [is] picking up.” Attitudes about expected activity levels over the next six months compared to today got even more positive this month, with 78% expecting higher activity levels vs. today (compared to 72% last month), while 8% expect lower (vs. 6% in October).

Fastenal’s 4.1% overall October daily sales growth compared favorably to our +0.7% estimate, again boosted by significant demand for safety/PPE (+32% y/y). Excluding safety products, underlying sales were -1.6% y/y, showing continued sequential improvement relative to September’s -3.5% y/y. Similar to an FDI reading that indicated improving fastener markets sequentially, FAST’s fastener sales were better m/m at -4.7% (September -6.1%). November daily sales will be reported on 12/4, but we model some headline deceleration (-0.2%) primarily due to our assumption that safety/PPE demand will moderate. We expect underlying momentum in fastener products and other non-fastener products to be mostly steady with October.

For the full FDI report for November 2020, with graphs and disclosures, Click-here.

![[GC2610] Solution_FCH Banner_[220x100] copy](https://news.fastenersclearinghouse.com/wp-content/uploads/2025/09/banner_solutionind.jpg)