The fastener industry reacts to the new tariffs as the impacts begin to take shape. Field Fastener president Adam Derry joins Fastener Technology International editor Mike McNulty to sort out the tanking FDI numbers on the Fastener News Report (21:16). Returning from Stuttgart, Goebel Fasteners CEO Christian Reich checks in with his read (12:55). Plus, John “Cool Hand” Butler of Martin Supply shares news of the largest charity bed build yet (1:54). On the Fastener Training Minute, Carmen Vertullo talks electro-plating alloy socket set screws (59:50). BONUS: Marco Rodriguez presents the quarterly commercial real estate report (52:23). Eric is back from the pit, on the way to Nashville. Close theme: Robert Earl Keen, “Barbeque”, 1996. Run time: 01:07:38

—

Listen to the podcast here

Important Links

- Brian Musker on LinkedIn

- Sleep in Heavenly Peace

- Jake “Valdez” Davis on LinkedIn

- John “Cool Hand” Butler on LinkedIn

- Matt Boyd on LinkedIn

- Mike McNulty on LinkedIn

- Adam Derry on LinkedIn

- Marco Rodriguez on LinkedIn

- Carmen Vertullo on LinkedIn

- Christian Reich on LinkedIn

- Goebel Fasteners

- Fastener Fair Global

- Tough Mudder

- Fasterner Distributor Index Survey

- Fastener Tech

- Fastener Poland

- FRT@FullyThreaded.com

- National Association of Wholesaler-Distributors

Tariffs & BBQ

The Fastener Industry’s Biggest Bed Build For Sleep In Heavenly Peace

A lot of the other metrics that you mentioned are worsening. It’s not going in the direction that we want. It’s really clear in there that pricing month over month, pricing year over year, those things are consistently growing. It just highlights the fear and the reality of costs are going up in the supply chain, and those are starting to get passed through the supply chain.

This episode, when we get to the news report, it’s going to hit a square in the face. How are you doing, everybody? We’re getting this one kicked off a little, unconventionally, I’ll say, because instead of Brian Musker, our usual co-host with us, we’ve got John “Cool Hand” Butler with us. John, we’re settling for second best, you know? I’m not going to be able to take Brian’s place here, E-Rock. Nobody’s asking you to do that, brother. Thanks for being here. You’re in a very cool place right now. We’ll touch on that in a second, and Brian will hopefully close it out with us, but we’re smashing in so much these days that this is going to be an unusual and short episode for you folks. It’s episode 214. John, you shot me an email. You’re doing an amazing thing. What is it?

It’s a partnership with Lowe’s and sleep in heavenly peace here in Charlotte, North Carolina, overnight. We produced 5,000 beds for children who need beds in their homes.

This is incredible. This has got to be the biggest bed build I’ve ever heard of.

We had over 5,000 Lowe’s employees, 300 Sleep in Heavenly Peace chapters. People from chapters that were around the United States. Some of them flew in, some of them brought in trucks. A lot of them. We’re taking the beds right out after we built them, loading them onto their trucks and driving them back to their locations. In some larger locations, it was first-come, first-served as they signed up for it, but got 400 beds, 300 beds, 200 beds.

Our chapter is only two months old. We got a little starter pack of bits. This is all about helping kids. What we did, the Sleep in Heavenly Peace members, was we were basically supervising the Lowe’s employees who were doing all the work making these beds. Anybody who’s been a part of a bed build, no, you can make 40, 50 of them. When you make over 5,000 beds, it is a yeoman’s work, but work that is done from the heart and done with love.

I saw some of the pictures. I can only imagine. Let me tell you something. I’m squarely behind this. I’m impressed. I cannot even tell you. We’ll talk about this a little bit more as time goes on, but I just wanted to get the news out there to everybody because this is huge. Of course, you’re with Martin Supply these days, and Martin has a big heart. I’m sure they’re supporting this really nicely. I reached out immediately to Jake “Valdez” Davis. Of course, he and Matt Boyd with Parker Fasteners. Jake with BTM and Matt with Parker were the first to kick the ball off for the fastener industry that I’m aware of. It’s really blossomed, and things like this are just great to hear.

We have an incredible association. All the different members were all faster nerds, all brothers and sisters in arms. Jake just had a bed built on this past Saturday, this past weekend, I believe. I know that he raised well over $40,000 for the beds, and they had their bed built right there in Kansas.

A fully threaded audience who are regulars will know about Sleep in Heavenly Peace. This is a really a focus charity that we as an industry have been looking at for a couple of years here. This is really great news. John, let’s introduce the show quickly. You’ve got another thing that you were involved in. I’m going to wish you congratulations in a second in this episode. The headline is the Fastener News Report with Mike McNulty.

He’ll be joined by Field Fastener president, Adam Derry, this time. The FDI took a hit. We all knew it was coming, and you’ll hear it. Marco Rodriguez with Cresa also got a spot on this news report. He’ll be bringing us his commercial leasing report. Carmen Vertullo is keeping with the brevity theme on this one. He’s got a short fastener training minute for us also.

To get that started, Christian Reich with Goebel will let us know what he’s up to, give us his impressions on Stuttgart. Seems like ancient history, but always good to hear from him. We’ll jam that all in. John, back to you. You are always out and about with Martin, and otherwise your cool hand. I’m sure you’re training for the mud race is coming along really well. Before that, you hit the Southeastern Fastener Association Spring Conference and heard you made a splash on the green.

Southeastern Fastener Association Spring Conference: Golf Highlights

You could say something like that, Eric. There’s this little gift that you get for being a great golfer, or maybe not so much. This year, I landed on the latter part of that. We were the fortunate winners of a 30-pack of Busch Light from a fully threaded radio.

It’s quite a feeling, isn’t it?

It is fun. We had a blast. We had some really great people out there. We filled up nine holes, and they had two sets of nines that were closed because they’re remodeling, but we had a good time. First place winner was Eric and Big Country from INxSQL, and also T.J. McFarland, who is now on the board of the SEFA, Southeastern Fastener Association, and also Brian Wheeler. They took first place with twelve under. They used only six of their eight eligible mulligans to make that score of twelve under. That’s incredible. These guys are big sticks.

They’ve been dominating lately, and it’s always good to see them out there. I’m taking it, American Ring wasn’t on the slate.

No, they did not show up. No, sir.

They always make it a challenge. Thanks for the report, and we’ll get more on the SEFA conference a little bit later. I wanted to jam all that in, and of course, this really great headline with the bed build going on. Of course, the MWFA fastener week bed build is the one I’ve got my eye on because that’s the one that Brian and I, also the lovely and talented Lynn Dempsey, will get our hands a little dirty. She is such a good stainer. I don’t know if you’ve ever seen her at work on that part of it, John.

I have. Let’s say she gets her hands dirty. Shall we say that? That’s a nice way to put it.

She looks like a giant raisin when that thing’s all done.

I was in charge of that station here in Charlotte. Let’s just say a lot of my clothes and body are going to take a while to get the vinegar smell out.

Good work, John. It’s really something the fastener industry can feel good about. That’s for sure. Keep it up. I guess we’ll talk about it at greater length down the road. We want to smash this episode together. I appreciate you jumping on at the last minute. We’re again, shooting from the hip on this one. Before we cut to the new segment, let’s say that the title sponsors of Fully Threaded Radio are Brighton-Best International, tested, tried, true, great, and best. Goebel Fasteners, “Quality the First Time, Go Goebel,” and Star Stainless.

Fully Threaded is also sponsored by Buckeye Fasteners, Eurolink Fastener Supply Service, Fastener Technology International, INxSQL Software, Fastener Fair USA, J. Lanfranco, MW Components, Volt Industrial Plastics, and Würth Industry USA. We couldn’t do it without them. The fastener industry really couldn’t do it without you, Cool Hand. Thanks for coming on here, and I look forward to seeing you at the race in August, as well as the bed build.

It’s going to be a lot of fun. I’ve been hitting the gym. I just need to put down a couple of beers first.

I’m sure you guys will be doing that. We’re cruising into the weekend pretty soon, and I appreciate you reaching out to me and keeping me up to date on it. Such a great thing to hear.

Thank you. I appreciate you, buddy. You take care.

Take us into the break, John. How about in the voice of Solution Man?

Fastener Fair Global In Stuttgart: A US Vs. Europe Perspective

It’s the news segment. I’ve got Christian Reich with Goebel here with me. Brother, how are you doing?

Doing well. How are you?

I cannot complain on this end. You just returned from Stuttgart. We talked with Craig Penlon last week about it. How’d you enjoy yourself?

It was a good time. It was my first time going to the Fastener for Global event. I believe they hold it every two years in Stuttgart. Just going into it from only knowing the US shows. It was a whole different experience, positively. The show itself, for those who haven’t been, is about 4 to 5 times the size of the US show. They had like four individual convention halls, just full, but with fastener suppliers, distributors, pretty much the global industry outside of the US.

It was really neat to see in the main hall some of the booths, constructions, and, I guess, the major players over there, and just interacting with the people. It was a welcome event there. I did see a few of our US industry colleagues walk on the aisles as well. It was good to see them over there and connect. Overall, I enjoyed my time, and I definitely will do it again.

I heard that there were a few of us over there, and yeah, it’s a monster show. What was Goebel doing over there? What booth did you guys set up, or do they call them stands over there, don’t they?

They do. They call them stands. They had a sizable booth and/or stand in Hall One. For them, they’re a big player in the European market. They obviously had all their subsidiaries, all the employees from various branches were working the booth forum, meeting with their customers. Everybody came to the show to talk with them, open projects, new opportunities, and stuff like that.

What’s the footprint of Goebel in Europe? Most of our listeners, of course, are North American. We always think of you and what you’re doing at all the shows. You’re always front and center near the entrance, usually. How’s that different from what you do in Europe?

I guess it’s similarly over there. They also try to be in the main hall and try to be as close to the entrance as best as possible. I cannot really speak on their marketing strategy over there, but I know they’re a major name brand and have been growing as well, like we have in the States. Obviously for them, they have the long-time tenure behind it, opening in 1979 and just being ingrained in that industry. They’re a household name.

You said it was your first time at this show, Fastener Fair Global in Stuttgart, Germany. What was your biggest shock? What was the biggest difference between all the many shows that you attend here in the US?

The most notable difference was, I guess, the lack of networking, or I wouldn’t say the lack of friendliness. It just seems everybody’s siloed over there. In the US, the shows usually have a welcome reception or some type of networking event paired with the show or a golf outing, depending on what event you attend. Even though here in the US you might have competitors, you can still be friendly on a personal level and build those personal relationships.

I think that makes all the difference, and also what’s attributed to our growth here in the US. Whereas over there, it seemed it was the Fasteners show itself, and that was it. There was no golf, there was no networking, no welcome reception, nothing. Literally, people would show up, they’d work their shift at the booth, so to speak, and then they’d go back to the hotel. There wasn’t really any after-show festivities or anything like that. That was the most notable difference that I saw between the US and the global show over there.

That’s a very interesting read. What Craig was saying, and of course, he’s a veteran of the show. Eurolink, he’s been there a lot of times, but he said that his big standout difference is the extent to which business activities are going on in the booths where they have conference rooms built into them, for example. They’re serving pretty extensive food offerings, it sounds like. Doesn’t that foster networking right there on the show floor?

That’s true. That’s a valid perspective as well. You’re right. There are quite a few bigger booths that have full-on staff and, full-on cafe. There are pastries, sandwiches, coffees, and drinks. That was a neat option to see at some of the booths as well. You’re right. The conference rooms had the table setups. I guess they did business on the show floor.

European Reaction To Tariffs: Seemingly Unbothered

You could compare and contrast endlessly. It’s a different show, and it was huge, and it sounds like you had a good and productive time out there. What was the takeaway for you? How are the Europeans reacting, obviously, to the big headline, the tariffs?

Seemingly unbothered, to be frank. My whole purpose of going to the show was obviously to meet our current joint venture suppliers overseas and also seek out new relationships, and everyone I spoke to knew of it. Obviously, they saw the news headlines. They were aware of what the Trump administration was doing, but it didn’t directly affect them, so to speak, because most of them did very little, if anything at all, in the US market. While they knew of them, they didn’t seem really bothered by them. That was something that I noticed, that I would interact with others and mention, this is what we’re trying to overcome right now. They just didn’t seem to be very engaging on the topic.

That’s what I’ve been hearing. I’m surprised by it, but it sounds like that’s the read. We’ve got another Fastener Fair coming up next month. You’re going to be there. This one, you’re driving the ship. What do you have lined up for Fastener Fair USA in Nashville, Christian?

We’ll be there. We’re super excited about it. Come see us at booth 401. We’re right near the front doors, as we usually try to place ourselves. We’re pretty excited about it and the opening welcome night reception. It should be a good time as well, from what I see of what they have planned. Definitely, we’ll have the whole team out there. Come stop by, say hello. We’ll have some free giveaways, and we’re excited to see everybody.

I got to tell you. I’ve still got that Bluetooth speaker you set me up with at one of the shows, and it cranks out at the shag bark barbell gym every day. Hopefully, you’re giving some of those away because I think of you guys every time I blast it.

That’s a good little radio. We will have some of those available via raffle drawing. Definitely stop by, throw your business card in our little raffle box, and then we draw a winner every day of the show.

Christian Reich with Goebel. This is the news segment. We’ve got Mike McNulty coming up. He’ll have Adam Derry with Field Fastener with them this time. They’ll be going over the FDI. Of course, Goebel has been with us for a long time and not just on the podcast and FCH, but also out there on the mud racing course. You’re a proud, tough nutter or rugged maniac. What are we calling ourselves these days? How’s your training going for this year’s mud race?

It could be better, but I’m doing my best. I try to get that cardio in to be ready for the race in August.

You didn’t suck down too many of those pastries over in Stuttgart, did you?

No, I tried my best not to.

Give us an idea. What are you doing? How do you focus on your training, or do you really not do training, or do you just keep up what you usually do?

I just keep being active. I try to do cardio every day and then some strength training as well with some weights, and just overall, just trying to be more flexible. Didn’t want to have any injuries on the course.

Tariffs are wreaking havoc on the supply chain and the global economy. Share on XThat’s probably a very good policy, you know? From the sound of it, we’ve got an expanding team, and I’m hoping for some young blood, and maybe they’ll help us keep the pace. What do you think?

I agree with that. I’m looking forward to it.

We should put out one more call before we switch over to the news. Anybody who’s even slightly interested in getting involved with this year’s Tough Mudder. Of course, you could see the race is happening in August. Go to ToughMudder.com. It’s actually not Chicago. It’s Rockford that would be the location that’s happening in connection with the MWFA fastener week. We’ll be there. A whole bunch of stuff is happening, and we’ll continue talking about it on the podcast. Christian, appreciate you jumping in with us for a moment. I’m looking forward to seeing you at Fastener Fair. You got one more duty before I let you run on this one.

Sounds good. Now, with news about screws you can use, here’s Mike McNulty.

Fastener News Report: FDI Results And Tariffs

Thanks, Christian. This is Mike McNulty from Fastener Technology International Magazine, bringing you the Fastener News Report, which is sponsored by Volt Industrial Plastics, makers of the world’s finest plastic fasteners. The Cleveland Browns now have five quarterbacks vying for what has been called the gnarliest job in the National Football League.

The so-called April 2nd Liberation Day in the USA may actually be remembered as another April Fool’s Day, and many base and hubristic establishments continue to deteriorate and embarrass rank-and-file Americans, but I am still focused on Fasteners and ready to deliver today’s Fastener News Report. In this episode, Field Fastener President Adam Derry joins us to reveal the latest results of the Fastener Distributor Index, also known as the FDI.

Also in our broadcast, we have our top story from the National Association of Wholesaler-Distributors, also known as the NAW, and newsmaker headlines from Fastenal, the NFDA, Fabory, Huyett, Buckeye Fasteners, Linfast Solution Groups, Bay Fastening, Chicago Rivet, and more. On the back page, we’re going to talk about Poland, and we also have Marco Rodriguez of Cresa with his quarterly industrial warehouse space leasing report. We’ll get to all of that in the latest FDI results right after this.

This is Tough Mudder Jake “Valdez” Davis here, and when I’m not training for the upcoming Tough Mudder race. I’m grabbing some Yuban Blend coffee and heading out to the next Fastener Association meeting. BTM Manufacturing is going to have a busy 2025, and I’m looking forward to seeing everyone. Train hard or not. See you.

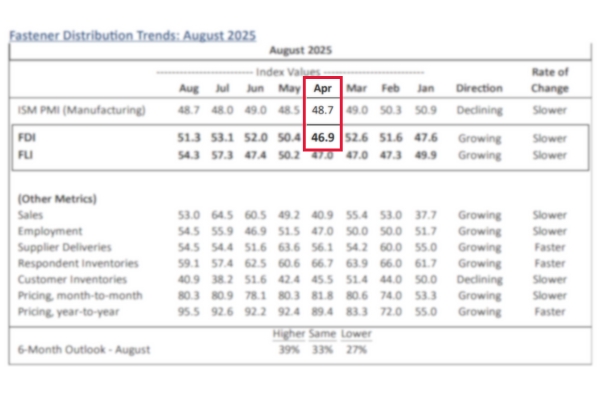

The Seasonally Adjusted Fastener Distributor Index for April 2025 dropped significantly to 46.9 after posting a solid 52.6 reading in March, seasonally adjusted. This ended two months of readings above 50, the first ones recorded since October of 2024. The forward-looking indicator, also known as the FLI, was unchanged at 47.0, the fourth straight month of being below 50.

Fastener distributor index data is collected and analyzed by the FCH sourcing network and Baird. The FDI seeks to identify demand pricing and outlook trends within the American fastener distribution industry. To get some insight into these results, we’re going to talk to Field Fastener president, Adam Derry. Adam, thanks for joining us on the Fastener News Report.

Mike, it’s great to be here.

It’s good to have you. These aren’t the best results to come on the show with. What do you think about the latest FDI results?

You’re going to change the podcast to just be about tariffs. I know you guys have talked about that for the last several months. Certainly, tariffs are wreaking havoc on the supply chain and the global economy for sure.

This was a drop in a lot of retreating after having a good month last month, and some we’ll get into the comments later. Some of the comments indicated that people were buying ahead of the anticipation of the tariffs. Maybe that’s what caused the big drop this time around. If we dive into the numbers, we had the sales, employment, and customer inventories all drop while supplier deliveries, respondent inventories, and pricing all increased. Any insights or comments there? Are there things you guys are seeing? Sales were a big drop.

I anticipated that, honestly, and some of our customers did this too, that they pulled in orders and tried to produce before the tariffs to try to avoid those impacts. It artificially inflated the demand in the last month or so. That didn’t surprise me. A lot of the other metrics that you mentioned are worsening. It’s not going in the direction that we want. It’s really clear in there that pricing month over month, pricing year over year, those things are consistently growing. It just highlights the fear and the reality of costs are going up in the supply chain. Those are starting to get passed through the supply chain. Eventually, it’s going to affect us as consumers or end users of the products that we’re buying.

Pricing, month over month and year over year, is consistently growing. It just highlights the fear and reality of costs going up in the supply chain. Share on XYou mentioned pricing. Both the month to month went up and the year-to-year went up, and the year-to-year got my attention because the raw number there is 89.4, which is almost double what it was back in August.

Huge jump.

I’m not sure what will happen, but I don’t see them coming down if all this tariff stuff continues to go on and changes every day.

I was hoping it would be a negotiation tactic initially to try to level the playing fields and try to lessen country tariffs on us and reduce the trade deficits. The more time that goes on, it seems the reality is setting in that these tariffs may not go away. We want to push manufacturing back to the US. I think the concept of what we’re trying to do with the administration makes a lot of sense. The very broad nature of it is that it’s not just China. It’s really anything outside of the US that comes in and gets a tariff.

I’m sure we’ll spend more time talking about that because there is some misinformation or some educational things that need to happen just to understand the nature of it, because so much is changing. There’s certainly some manufacturing in the US that we don’t want back. We’re not going to make apparel, t-shirts, or clothing, or even the iPhone. There’s going to be some product types just based on our labor rates in the US that you cannot justify moving back here. Certainly, get more manufacturing here in the US. I think we all would want that to do.

That takes a long time, though. That was the thing we were talking about last month was bringing jobs back here, putting in factories, hiring people, that all takes time. We have these headlines of tariffs changing every other day or every couple of days because they’re being implemented in a different way than they were intended, I think, which causes a lot of havoc. I don’t think it does. It does cause a lot of havoc.

We had a new story that this is not related to the FDI, but the old way was that if you had a claim, you would submit it to the US International Trade Commission, and they would investigate. If they found that there was dumping or unfair trade practices going on, then the punishments would be dealt out and the tariffs would be gone. One just came down last month on nails, which is a type of fastener, and that’s the old way that it used to be done. You negotiated trade agreements and you’re back and forth, and lived up to those, and now it’s out of control.

As you said, though, to start from scratch and to open a facility and to produce in the United States if a company’s not doing that today, that’s going to take a long time, five years or more. Some larger companies can shift production and move things around if they have an existing footprint or capacity. They can do that faster, but smaller mid-sized companies that need to really change their manufacturing presence are going to take time to do that.

With all the uncertainty in the market, consumers, businesses, investors, owners, and entrepreneurs everybody’s just a little bit gun-shy. I think people tend to be more cautious when things are unpredictable and scale back investments, or frankly put things on hold of things maybe they were considering just because they don’t like volatility in the market.

Distributor Inventory And Supply Chain Slowdown

It’s been a common theme on this show and in the FDI for years about the difficulty of getting good employment and getting people and wrap things up quickly, especially since the pandemic. A lot of moving pieces there to get things back. I think the gradual way is the better way to go. Anyways, let’s go back. We mentioned pricing, sales. Employment went down, but it just went down slightly. It’s hovered around that same mark for the last year, just in the middle there. We had supplier deliveries tick up a little bit. Respondent inventories ticked up, and customer inventories ticked down. Any insight there?

We’re a distributor. Obviously, we’re importing in a lot of cases from Asia or stuff that’s made domestically. Our customers are the OEMs, and when their business slows down, we feel that right away because we’re filling bins and doing VMI services for them. Traditionally, it takes longer for us to turn off or slow down our supply chain, especially considering the lead times are longer. I would mirror the numbers in that index because the customer’s inventories are going down, the respondents, companies like Field, they’re growing, honestly, because as things slow down. We cannot turn it down fast enough. When things soften, it worsens the distributor’s inventory because we cannot turn it off fast enough.

People tend to be more cautious when things are unpredictable and scale back investments. Share on XAs we mentioned, the forward-looking indicator did not change, and it’s still below 50. It’s been that way since the beginning of the year. All year, a little bit below the 50 number. I don’t see that going up anytime soon.

I don’t either. We’re certain about uncertainty at this point. There’s just a lot of caution, I think, in the market, and we’re certainly seeing that. The biggest unknown is how these prices that eventually are going to go up. How does that affect demand, and does that cause a recession or both in the United States and globally? I think there’s just a big unknown around what’s going to happen based on further softening in demand, based on the reality that inflation is going to take place, and prices are going to go up. Prices are going to continue to go up.

When you see things about people getting creative to try to get around things. Any stories you hear out there you want to share about how people are reacting to these, and I know a lot of people are complaining they’re spending too much time discussing the tariffs and what to do as opposed to doing regular business.

As you can imagine, a company like Field is selling tens of thousands of components. This has every item have a clearly defined HTS code and country of origin. Even now, the raw material is melted and manufactured. There’s a lot of administrative time that goes into truly understanding and being accurate in defining tariff impacts so that we can have meaningful conversations with customers about what our impacts are and how they can share in that.

You hear stories about people who maybe you could use a different tariff code or import it first through Mexico or do some other things like that, or Vietnam, or something. We’re not doing any of that. We want to obviously hold our integrity and do things right. We’re just trying to be very transparent and work with our supply partners and with our customers, and just controlling what we can and managing it and working through it collaboratively.

As a partnership up and down the supply chain. That’s really been our approach, and our orientation is to be transparent and open and understand the true cost impacts and work together to try to mitigate them. It’s frankly been a real struggle. If this were isolated to China or a narrowed product set, we could work through that. With the broad nature and casting of a wide net with these impacts, we had nowhere to turn. Margins are tight through the supply chain. Again, you hear in the news about companies that will absorb it and not pass it on. I’m not seeing that in anyone I talk to in our industry, or outside of it isn’t seeing that either. We’re like putting a corner, and we’ve got to just deal with it.

Those are very nowhere to turn that could be a headline. Got nowhere to turn, but we’ll see what happens. The last set of numbers we have is the six-month outlook. Interestingly, people moved off the center mark of things staying the same. They moved into the better and the worst categories. The numbers this month were 48% expect things will be better in six months.

They’re expecting things to get resolved and improved. Fifteen percent say things are going to be the same. Thirty-six percent say it’s going to be the worst. That’s one of the worst numbers we’ve seen. That’s a little bit, like I said, a lot of people moved off the middle because last month it was 44, 24, and 32. We’ve got some people moving to the six-month optimistic and some moving into the pessimistic, abandoning the center. How about you?

I’m honestly surprised by 48% being higher than I would think. I share that. Some of it may be, there certainly still are markets or industry verticals that are strong companies that, for example, support the data center market. That market’s exploding and is really economy-proof. It’s grown regardless, and companies like Google and Microsoft, and others are continuing to invest in that regardless of what happens with tariffs or other things. If you play in a market like that, you could see that, but I’m not surprised, honestly, with the increasing percentage or the growth of percent in a lower or more pessimistic view for sure.

In some industries, they don’t even care. They’re like, “It doesn’t matter.” When you’re in the nuts and bolts business, metals and things are going into every assembled product. You’ve got nowhere to turn. You’ve got to face the music. Let’s move on to the comments, as expected and said earlier. Most of these are tariff-dominated, with a couple of bright spots at the end. I’ll go through and read the comments unless you want to jump in on any of those and share any insights. You can do that. The first one is “Tariff-enhanced products starting to reach our inventory, and we are preparing costing for pricing adjustments.”

Second one is, I would say, an exciting one here, “The tariffs resulted in a brief surge and then wham, it all just stopped. None of our customers knows what to do. Some companies are taking advantage of their customers by raising prices far in excess of their tariff costs. I’m looking at you blank and blank.” Those are the blanks that are the companies that they name. “Tariffs remain a horrible idea and only those who have never taken an economics class think they’re a good idea or those who haven’t bothered to study history.”

There’s a lot there.

They didn’t hold back.

To maybe add context or comments to that last one, I agree with those comments. To me, the US should make products and services that we’re best at and allow the world or other countries to do the same. Again, this approach of one size fits all or everybody that has a trade deficit against the United States should be penalized for that.

It’s an arbitrary thing.

We're certain about uncertainty at this point. Share on XI don’t share that because the US has 26% of the world’s GDP, or by far the wealthiest and strongest economy. We’re going to have a trade deficit with countries like Vietnam or Cambodia, or even larger countries. There’s going to be a trade deficit just because we’re consumers and the biggest out there.

There are too many variables.

A lot of variables out there. Again, like the people I talked to, other CEOs, and we’re very involved in several industry associations. That last comment that you made, I think it’s shared pretty pervasively.

Next comment is, “Tariffs are wreaking havoc on the supply chain, our customer base, and there is fear that higher prices will drive demand down and cause a recession. We are certain about uncertainty at this point. There’s another headline.” Next one is “Tariffs will initially boost top lines, but that revenue will essentially be empty calories as our default approach is to pass them through rather than try to margin them. Longer term, we believe that the second order of inflationary effects on the tariffs is going to curb demand, especially for OEM customers for whom exports are part of the revenue mix. We’re already seeing clear early evidence of this.” That’s maybe in an area where you guys feel the same.

I agree with those comments. I think we talked about some of that already. That’s real. It’s going on.

The last two are a little bit more positive. One person writes in and said sales are solid and up from last year. The last one said, “We have a pretty robust backlog and all signs are pointing to increased activity in Q3 and Q4. The wild card is how resilient the economy will be, given the uncertainty we’re currently experiencing. Hard to know what it will look like in six months from now when everyday volatility is so sharp.” Things are going good for those guys, but they’re not sure.

Love the optimism there. Again, some of that I think goes back to the industries they’re serving, subsets of that that still could be very positive.

Lots of uncertainty and lots of issues, and that’s pretty much the theme. Anything else you want to add on the FDI or the FLI before we jump over and let you give the audience a hearing about what’s going on at Field?

Tariff-wise, for the industry, you hear a lot about these reciprocal tariffs. I know those are paused currently. That is really core to what you hear on the news. The biggest impacts in our industry are more geared towards the 232 raw material tariff and the 301 tariff specific to China. As I mentioned earlier, there’s a lot of misunderstanding and frankly, a lot of education that we need to talk to customers about what’s going on with tariffs, just because I think sometimes people misunderstand it. The 232 tariff has an enormous impact on us. It’s any material that is not from the United States of America, and it has a minimum 25% tariff on it. Obviously, in China, it could go up to 140% or 145%.

Those are big numbers.

Huge numbers. It’s virtually impossible not to pass those around. Without any advance notice, it’s hard for us or the industry to do much about that. We certainly tried to diversify the supply chain and be less reliant on China, and move things around, and have done that. Again, with the broad reach of these tariffs and how pervasive it is of anything not produced in the United States, it’s hard to avoid.

The thing that I think is really interesting, too, and I’ve heard that from many of our domestic supply partners, is that they’re seeing raw material increases, too. The feedback is both a blend of, because the suppliers feel that they can raise prices because the imports are now more expensive, but then also the demand for domestically produced raw material is higher. It’s shifting the supply and demand curve. Even the stuff in the United States and made in the US is likely to go up because of these factors.

I guess the rule of thumb for me is whenever you try to manipulate markets, bad things happen.

Whenever you try to manipulate markets, bad things happen. Share on XWithout question.

We’ll end on that. We’ll end the numbers and the tariffs on that, and we’ll give you a chance to give the listeners an update on what’s going on in the field.

Field Fastener’s Growth And Culture Amidst Challenges

I’m sorry I came on. It’s a lot of doom and gloom. Trying to bring a positive spin to what’s going on. I would say in the field, there’s a lot of really good stuff going on. We had a record March and a record first quarter. That’s really been gaining market share. We continue to grow. We’ve got many customers that are soft or slowing down, but with the new customers that we’re bringing on, we’re continuing to grow.

We’re anticipating some further softening. We’ve talked internally about just using the capacity that we have within the organization to get stronger and better, really strengthening our foundation to be ready for growth in 26, whether that’s organic and things turn around, or new business coming in, or potential acquisition.

We talk a lot internally about using the bandwidth of the capacity we have to get stronger and better, and finding ways to innovate and automate. Just get stronger as an organization. There’s a big rally cry and mantra at the field to continue to improve this year, even if there could be a storm brewing or some pessimism going on. We want to make sure that we’re using every opportunity that we have to improve as an organization.

You guys have a long history of growth. I’m looking at your page on your website, the by-the-numbers page, and all the good data here on growth and headcount growth and sales growth, and all these things. What do you attribute to that? Your culture, I think, right?

Yeah, the culture is a huge part of it. If we treat our team right, they’re going to treat our customers right. We try to keep it simple that way and really have an environment that people want to come to work each day. They’re part of a vision and a purpose that’s bigger than themselves. They align with a mission and a vision that they can be a part of and are passionate about doing that.

If we treat our team right, they're going to treat our customers right. Share on XWhether it’s optimism and a lot of growth or some economic uncertainties, it all comes down to us taking care of the customer because if we’re passing on price increases and dealing with tariffs, like customers don’t like that, but I think they can understand it. Those are more fruitful conversations when we’re doing a great job of support. The core of all this is taking care of the customers because, again, OEMs don’t want to change fastener suppliers.

They do it only if they have to and if there are performance issues. We try to just do a great job of taking care of customers and making sure that they’re happy. Again, working through these pricing pressures or the tariffs, or supply chain disruptions, all those things we can work through if we stay focused on just doing a great job.

Don’t panic when problems come up, just work through them.

You think about the last several years with COVID and the freight search. There have been so many things that have happened over the last several years, and it’s like we just do the right thing and focus on the stuff that matters, like we’ll get through it. The industry is so strong and resilient with that, too. There are so many smart people in the industry, people who, again, just want to do a great job and support each other. I love connecting with others in the industry. I’ve talked to several other owners in the industry over the last several months is to say, “How are you guys handling this? What are you seeing?” The ability to best practice share and talk through challenging situations like this is so helpful, and they’re such a strong industry and backing to help each other.

You mentioned it’s a strong industry, and some people were telling me, “You still have to take a long-term look at everything, and these industries will survive, and then people need the fasteners and that’ll all survive this volatility.”

We’re not looking at stock prices or any of those things. We’re a multi-generational family business. We want to just do what’s right in the long term. Again, that’s taking care of our team and taking care of our customers and weathering any storms together. I agree with your comments. We’re certainly focusing on weathering the storm and looking at things.

Looking at the long term. You mentioned the generations of people, and there was also a thing, something that caught my eye recently. It says that you have a big involvement with the NFDA, the National Fasteners Distributors Association. You have three past presidents and one current board of directors member. What can you tell us about that?

The NFDAs we’ve been a part of for a long time. We love that association. Melissa Patel is on the board now and has done great things. I had the privilege of serving as president in 21 through COVID, and my dad and uncle both did that, Bill and Jim Derry. We’ve been very active, get a lot out of the association, and really believe in it strongly. It’s shaped us as a company, it’s helped us get better, it’s opened doors for new supply partners, and talking to other distributors in the industry and common challenges. Those are all very helpful and productive, too. It’s been a great thing for Field.

Good relationship with Field Fastener and the NFDA. You mentioned that Melissa Patel is on the board now, and she’s looking here on your website. She’s the vice president of supply chain. She’s in the crosshairs right now.

Yes, she is.

Sleepless nights. That’s good. Anyways, you guys seem like you’re doing a good job for a long time, multi-generation, your teams are growing, and everything like that. I say keep up the good work.

Thanks, Mike.

Thanks for coming on. Adam, I appreciate you spending the time and sharing your insight with the listeners. It’s good to talk to you again and have you back on the program.

I really enjoyed the time, enjoyed the conversation. I appreciate you having me on.

That was Field Fastener President Adam Derry, and the FDI number for April 2025 was 46.9 versus 52.6 in March. Visit FDIsurvey.com to participate in the process and get a detailed PDF copy of Barrett’s monthly analysis. Our top story. The National Association of Wholesaler Distributors, also known as the NAW, in collaboration with Modern Distribution Management Research, also known as MDM Research, released new survey results on the impact of tariffs on the supply chain.

Based on responses from an industry-wide survey, the findings reveal that tariffs are driving cost increases and creating operational challenges across the wholesale distribution industry. Eric Hoplin, CEO of NAW, says, “The survey indicates that one-third of distributors are already facing price hikes of 25% or more. Though these increases haven’t hit store shelves yet, it’s an indication of where prices are headed.

We urge President Trump to secure trade agreements quickly to restore certainty, help businesses plan, and ease supply chain pressures.” Survey results highlight that 62% of distributors expect the cost of goods to rise by 10% or more in 2025. Financial strain is already widespread, with 67% of respondents reporting a negative impact on their businesses and only 2.5% indicating any positive financial impact.

Operational shifts are also underway. Forty-eight percent of distributors are slowing inventory replenishment. Forty-four percent are delaying new hiring. Thirty-seven percent are cutting capital investments. At 60% are reducing discretionary spending. The top concern for survey respondents is tariffs on China, with 37% reporting that 20% of their inventory originates from China. Only seventeen percent say they can meaningful shift in sourcing to domestic or non-impacted suppliers.

Beyond tariffs, the survey revealed growing concern among distributors about potential tax increases. Preserving key provisions from the 2017 tax reforms signed into law during President Trump’s first term remains a top priority for the industry. Distributors overwhelmingly credit those tax cuts with driving growth. Sixty-two percent reinvested it in their businesses, and 40% increased wages and benefits from those tax cuts last time.

You can learn more about this report from www.NAW.org. Next up, Fastener Newsmaker Headlines. In corporate news, Fastenal Company announced a two-for-one stock split. Fabory agreed to acquire Stokvis. Huyett launched a new threaded fastener line with over 60,000 products in five categories, and it expanded its clevis end manufacturing capabilities in Arizona. The Ficodis Group acquired Bay Fastening Systems.

TechnoForm Fastener started the operation of its sixth Ness Shroff parts forming machine. Portland Bolt & Manufacturing acquired Applied Bolting Technology. Rolled Threads Unlimited celebrated 40 years of operation. Delta Secondary launched a newly redesigned website. Fastener Industries, the parent of Buckeye Fasteners, won an ESOP award. Applied Industrial Technologies acquired Iris Factory Automation.

LinFast Solutions Group, also known as LSG, enhanced its PPAP capabilities. BuFab AB announced a 5-for-1 stock split. In personnel news, Angela Norman of Empire Bolton Screw won the Wi-Fi Margaret Davis Scholarship. Chicago Rivet and Machine appointed James T. Tanner, Senior Vice President of Sales and Marketing, and the National Fastener Distributors Association, also known as the NFDA, named Mark Shannon, retired former president of Tower Fasteners, as its 2025 recipient of the Professional of the Year Award.

You can get details on all of these stories and more in Fastener Technology International Magazine and the Fasteners News Report. The monthly newsletter, available both online at FastenerTech.com. Next up, and before we turn to the back page report, here is Marco Rodriguez from Cresa with his quarterly industrial warehouse spacing leasing report.

Industrial Real Estate Update: Trends And Free Trade Zones

This is Marco Rodriguez with Cresa, delivering your quarterly industrial real estate update. I know, numbers can be dry, but trust me, there’s some juicy stuff in here that affects your bottom line. As always, we’re analyzing key trends across major markets, and the data underscores that industrial real estate is highly regional. Rental rates vary significantly, impacting strategic decisions for warehousing, distribution, and even production.

It’s not a one-size-fits-all world out there. In the South, Atlanta rates continue to rise 5.7% year over year to an average of $8.70 per square foot. Dallas follows with continued strong growth of 4.3% and rates of $8.69. Miami remains a premium market with high lease rates of $19.78 per square foot. Though growth is more moderate at only 2.4%. Overall, the South indicates potential for rising operational costs, especially in Atlanta and Dallas. If you’re thinking of expanding down there, maybe factor in a little extra cushion in the budget.

The Midwest presents a different scenario. Chicago is showing stability with 4.1% rent growth and an average rent of $9.09 per square foot. For businesses prioritizing predictability and cost effectiveness, Chicago is a viable option. It’s like the steady eddy of the bunch. Looking at the Northeast, New York is a high-cost market, much like Miami, with lease rates at $19.20 per square foot. The rent growth is nearly flat at 1.1%. This suggests cost stability, but at a very high base cost. On the West Coast, we’re seeing a huge shift.

Los Angeles is experiencing a decrease in lease rates, down 6.3% to an average of $17.57 per square foot. Now the Inland Empire is also seeing rates decrease by 15.6% down to $12.58. This is creating opportunities for businesses to negotiate favorable lease terms or expand in these markets. Maybe a chance to stage a deal finally. The industrial real estate sector is experiencing increased demand for warehousing and free trade zones as businesses adapt to uncertainty in global trade. A free trade zone or FTZ is a designated area in the United States where goods are treated as if they were outside of the country’s territory.

This means that companies can store, process, assemble, or even re-export products within the FTZ without paying import duties. Duties are only paid when the goods leave the FTZ and enter the domestic markets. Many companies are strategically utilizing free trade zones to defer and hopefully reduce tariffs. By storing goods in an FTZ, companies can delay paying these duties. This allows them to wait out periods of uncertainty and make informed decisions on when and how to move their products, potentially minimizing the impact of tariffs.

It’s like a strategic pause in the tariff game. In February, Endries announced they opened the 65,000 square foot distribution hub in a free trade zone in Fort Worth, Texas, recognizing the strategic importance of such locations for an efficient distribution network. Not sure how long ago this was planned, but it would seem like the team at Endries has a crystal ball. Unfortunately, obtaining free trade zone status can be a lengthy process, even more so now.

At Cresa, we have many 3PL clients in free trade zones offering services whose phones are ringing off the hook. Basically, FTZ spaces are the hot commodity right now. For inquiries about markets not covered in this segment or further discussions on industrial real estate and free trade zones, feel free to reach out to me on LinkedIn. I’m Marco Rodriguez with Cresa. Remember, I make industrial real estate almost as interesting as fasteners.

Poland’s Economic Success And Fastener Poland Trade Fair

That was Marco Rodriguez of Cresa. Now let’s turn to the back page to talk about Poland. In the latest issue of National Review magazine, Dominic Pina reports on the quiet, decades-long, and ongoing economic success story taking place in Poland. Since breaking free from Soviet control in 1989, Poland has been averaging annual growth of about 4% per year. Next year, it is expected to have a higher per-person economic output than Japan.

Based on data from the World Bank and the International Monetary Fund, Poland’s per capita GDP in 1990 was $12,810, about the same as Brazil and $4,000 behind Mexico. By 2023, Poland’s GDP had grown to a level three and a half times higher than it was 33 years earlier. Based on 2024 and 2025 growth rates, it will move ahead of Japan in 2026. Pino emphasizes this wasn’t the result of top-down industrial policy or government planning.

He says, “Poland went all in on free markets during its transition to democracy. Never underestimate the power of markets.” Speaking of Poland on October 15th and 16th, 2025, the eighth edition of Fastener Poland will take place in Krakow. This trade fair is a unique event on a Polish and European scale. In 2024, 153 exhibitors from 18 countries took part in it, 75%, whom were foreign companies.

In addition to Polish exhibitors, manufacturers and distributors from Belgium, the Czech Republic, Denmark, France, Spain, India, Malta, Germany, Switzerland, Turkey, Taiwan, Great Britain, Italy, China, and the USA presented their offerings at the show. For the first time, manufacturers from Pakistan and the United Arab Emirates exhibited at the fair. Details on the show are available at www.FastenerPoland.pl.

Expected attendees of Fastener Poll in 2025 this fall will no doubt see the fruits of more than three decades of market-driven wisdom, which will likely be a stark contrast to imposing unilateral blanket tariffs, also known as taxes and regulations, that ignore existing ratified trade agreements and long-term planning, not to mention the US Constitution, and are based on a fabricated national emergency.

Fastener Training Minute: Electroplating Alloy Steel Socket Set Screws

This is Carmen Vertulo with the Fastener Training Minute coming to you from the Fastener Training Institute and Carver Labs in beautiful El Cajon, California. Our topic came out of the blue. It’s an old topic, one that I’ve addressed many times and possibly have even talked about on the Faster Training Minute before. It has to do with electroplating alloy steel socket set screws, whether they are inch or metric.

Now, we typically would not be electroplating alloy steel socket screws. If we were to electroplate them, the standard tells us, plating and some of the product standards, that we do not need to bake or test for hydrogen embrittlement, even though these are very high-hardness, highly susceptible to hydrogen embrittlement fasteners. The reason we don’t need to worry about hydrogen embrittlement in them is that they are compression fasteners.

In other words, they don’t have any tension on them when they’re installed. Occasionally, someone who is unaware of the principles of how a set screw works will decide to use these set screws in tension. They might try to use them as a stud or, in some cases, and this is what we ran into in this case and have seen previously, they will install the set screw into whatever the application is and then they will put a jam nut on it or some a nut in order to secure it to keep it from coming loose.

That immediately puts the part in tension. Not only does it put it in tension, it puts like one small part of it, just one pitch of the thread in severe tension, even with just a small amount of torque on that nut. We should never do that, not only with a plated socket screw, but with even a non-plated socket screw, because they are not designed for it.

Chances are, if you’re doing that in the application, the socket set screw will have a rather deep drive in it because the longer screws have deeper drives for no good reason that I can think of, except that they might save some material that way. These are cold-formed. When we tighten that socket set screw down, we want to have it fully buried in a hole.

Otherwise, because these are relatively thin sections through which the socket drive is in the screw, we could break that out easily. If we put the nut on it, we could conceivably be putting that tensile load on the screw through the drive section, where there’s very little material. It’s almost certain to break. The bottom line is, don’t electroplate socket set screws.

If you do, make sure that they are not used under tension and certainly do not put any jam nut on it, because you are just asking for trouble there. This is a relatively common thing that happens when people unawarely electroplate alloy steel socket set screws. That’s enough of that. This has been Carmen Vertullo with the Faster Training Minute. Thanks for listening.

I’m going to wind this one down fairly quickly. We’ll have another episode of the podcast in the near future. I got some interviews. The lovely and talented Lynn Dempsey was able to squeeze in at this year’s NCFA distributor social, among other things. It’s off to Nashville, and we’ll do our usual special report following that. More content on the way, folks. I would like to thank Adam Derry for joining Mike McNulty. Great job, gentlemen.

Much is changing, and so fast. Don’t worry, in the next episode, we’ll have a new version of all that to talk about. Also, John “Cool Hand” Butler. He’s with Martin Supply. Great job on the Sleep in Heavenly Peace. Actually, congratulations to the whole industry for getting more serious about that. Helping out a lot of kids doing this, and Christian Reich with Goebel Fasteners. Appreciate it. See you out in Nashville, Christian.

Of course, Carmen Vertullo had the fastener training minute, and Marco Rodriguez cannot forget him. He’s with Cresa. He’ll have more during the upcoming episodes. We’re working on something together. As always, thanks so much to our partners. Brian and I are also out on LinkedIn, so catch us that way as well.

Hard to believe I set out to get this one published several days ago, and fastener life happens. Some of you heard that we did a brisket fest this year, which I guess is the second annual now. It turned out really well. We’ll have some details coming up, I think a few of our guests posted on LinkedIn. We gave away our new edition, fully threaded radio coffee mugs, this year. Several of our partners supplied company swag and various raffle prizes, and stuff.

Buckeye Fasteners, of course, did not disappoint, and they had some of their chapstick that we put in each cup, but Brian added his little sample packs of Vegemite that some of you probably remember from trade shows, and got a text message here following Brisket Fest from Tony Martinez. He’s running big parts of Buckeye Fasteners these days. He also happens to be a really good pit master in his own right.

He brought some absolutely exquisite pulled pork to the event this year was up all night making that. He said in his text, “I’m feeling a little sluggish. I think I might try the second-best thing to come out of Australia. Vegemite.” Number one, being, of course, Hugh Jackman. That’s open to interpretation, but the barbecue is fantastic. Tony appreciates all that.

There’s been so much else happening to Brian. Still catching up in the data lab, but he’ll be back for an upcoming episode. Fear not. Thanks so much for listening to the podcast. Everybody. We really appreciate it. For now, I’ll say for Brian Musker, this is Eric Dudas. Get out there, sell some screws, practice up on your own briskets for next year, will you? We’ll talk to you next time.