Written by R.W. Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 2/4/21

Key Takeaway:

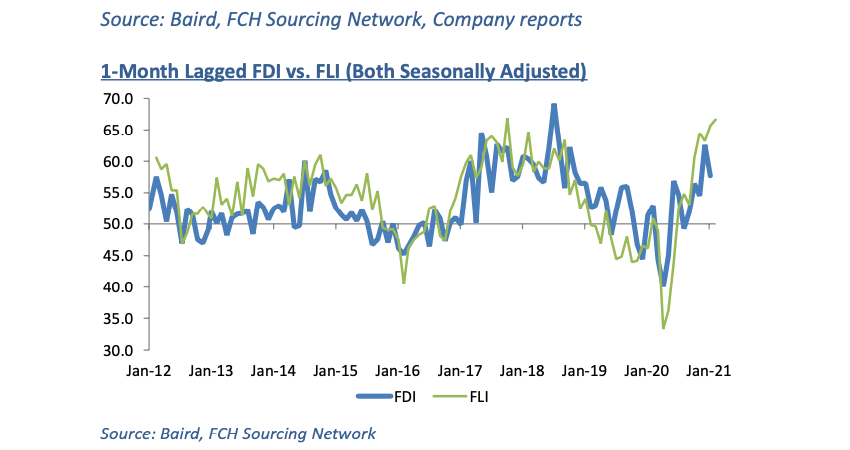

The seasonally adjusted Fastener Distributor Index (FDI) for January came in at 57.7, moderating slightly from last month’s very strong December reading but still showing nice growth (well above a neutral 50 reading). The sales index saw sustained strength with about two-thirds of respondents seeing better than seasonally expected sales. Looking forward, the Forward-Looking Indicator (FLI) continues to tick upward at 66.7, seemingly boding well for future demand conditions. Taking the FDI and FLI together, we believe January was a strong month for most fastener distributors relative to expectations.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, produced by the FCH Sourcing Network and Baird with support from the National Fastener Distributors Association, now in its 10th year. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward-looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM).

Key Points:

FDI starts off the new year on a solid note. The seasonally adjusted January FDI (57.7) slightly moderated vs. December (62.6) but this was entirely due to the seasonal adjustment factor which slightly adjusted the FDI downward, as January is typically a very strong month relative to seasonal expectations. Seventy percent of respondents saw better than seasonally expected sales in January, which was essentially unchanged m/m. Pricing continued to move higher and multiple respondents commented on the various inflationary pressures in the market, including freight rates for imported materials/the ongoing shipping container shortages, significant steel inflation, material shortages, and FX rates.

FLI also moves slightly higher. The seasonally adjusted FLI was 66.7, remaining well above the neutral reading of 50 and improving moderately from 65.7 last month. Nearly all components of the FLI (employment, respondent inventories, customer inventories) improved vs. December, with the six-month outlook the lone component to decrease slightly m/m. With the FLI well above 50, customer inventories getting increasingly low, and respondents continuing to forecast favorable six-month outlooks, we believe the FDI should see additional expansionary readings ahead, implying continued improvement particularly as y/y comparisons ease significantly beginning in March/April.

Employment levels reflect an uptick in optimism. The FDI employment index registered a 64.3 reading this month vs. 58.8 last month. Thirty-four percent of respondents saw employment levels as above seasonal expectations in January compared to 24% in December. Looking at the broader economy, despite a continued gradual recovery in the labor market, the unemployment rate remains elevated (6.7% as of December). The December jobs report showed a net reduction in jobs (-140,000) for the first time since the mass layoffs seen in the early days of the pandemic last Spring. The January jobs report is expected to be released on 2/5/21. Economists are projecting a slight m/m addition in jobs but expect the unemployment rate to remain at 6.7%.

Transportation issues and inflation the overwhelming themes of respondents’ commentary. Nearly every comment touched on current logistics and transportation issues. Freight appears to be one factor driving pricing higher for many respondents, in addition to raw material shortages and steel price increases. Per one respondent, “Logistics and transportation [are] a mess. Steel prices are out of control, and supply is limited. Automotive customers’ schedules are erratic due to supply chain pressures and inability to get everything needed. And Lunar New Year starts soon!” Another commented, “The steel crisis and crisis on the west coast are very concerning.” Many seem to be forecasting logistics headwinds to persist through at least the first half of this year: “We expect upward pressure to continue in terms of cost and pricing, supply to be tight, and continued challenges in the logistics markets for at least the first half of this year.” Said another respondent, “The issues with container capacity and issues at the ports will slow the supply chain in Q1 maybe into Q2. The exchange rate could be a lingering factor to the price increases happening.” Perhaps the significant supply chain issues were a factor in driving a slightly less optimistic view on the next six months, as 69% of respondents now forecast higher activity levels six months from now vs. today compared to 79% last month.

FCH Sourcing Network activity reflects supply chain instability. Fastenal CIO and former FDI analyst, Holden Lewis, classified industry sourcing platform FCH as a type of “counter-cyclical indicator”, and the volume of inventory inquiry and RFQ traffic proved that to be the case again. “We expected an uptick in activity after we upgraded our search framework to improve performance on mobile platforms this month, but what we saw surpasses the positive impact we expected just from the software enhancement,” commented FCH managing partner Eric Dudas.

Fastenal’s 6.5% overall January daily sales growth compared very favorably to our +1.3% estimate, primarily driven by significant demand for safety/PPE (+26.1% y/y). Excluding safety products, underlying sales were still solidly positive at +2.1% y/y, marking the third consecutive month of underlying growth. Turning to fasteners specifically, FAST’s fastener sales were a touch weaker m/m at -0.2% (December +0.5%). Looking forward, we model 4.5% daily sales growth in February, reflecting further moderation in safety demand (which we assume gradually moderates throughout 2021) but slight underlying improvement (+2.6% y/y).

For the full FDI report for January 2021, with graphs and disclosures, Click-here.