Written by R.W. Baird analyst David J. Manthey, CFA 5/6/20

Key Takeaway:

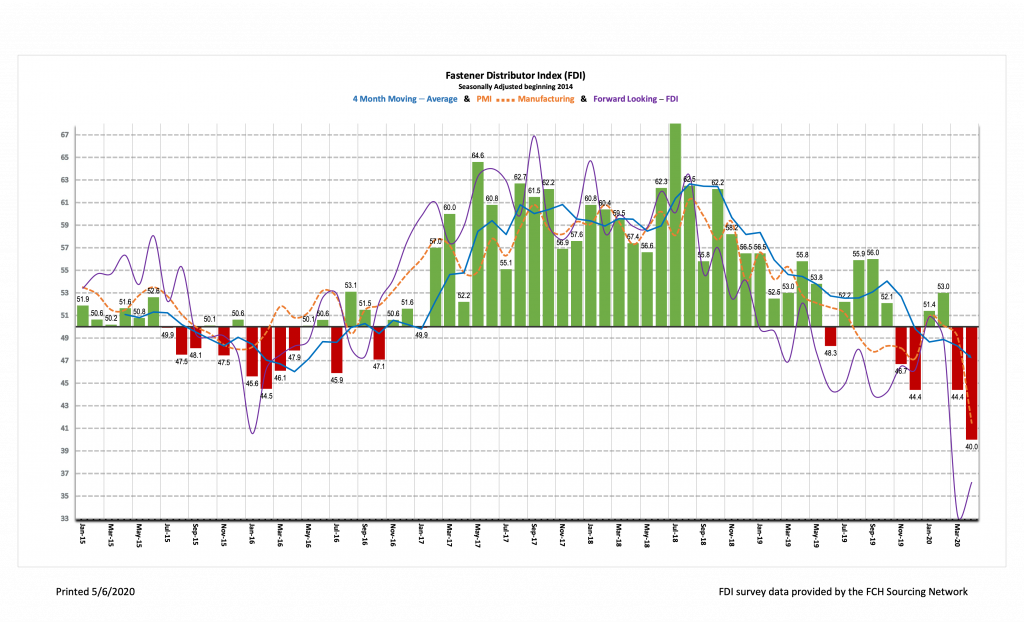

The seasonally adjusted Fastener Distributor Index (FDI) for April was 40.0, deteriorating further as the full brunt of COVID-19 customer shutdowns was felt. Sales trends on a seasonally adjusted basis were again much weaker. The six-month outlook encouragingly showed some signs of stabilization, however, as last month’s extreme negative sentiment improved a bit this month. Net, conditions remain very weak but expectations for a gradual reopening of the economy have some participants leaning slightly more optimistic than previously.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and Baird with support from the National Fastener Distributors Association. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward-looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM).

Key Points:

FDI retreats further in April. The seasonally adjusted April FDI (40.0) unsurprisingly experienced further m/m deterioration (March 44.4) as the full impact of COVID-19 was felt in April compared to only a partial, two- week impact in March. The seasonally adjusted sales index was very weak, coming in at just 14.0 as a full 83% of respondents saw sales below seasonal expectations. Pricing was a slight m/m and y/y tailwind with inflation seen across some respondents, although the majority continue to see more stable pricing.

FLI showing signs of stabilization. The seasonally adjusted FLI improved to 36.2, recovering from an all-time record low of 33.3 last month. While broad uncertainty remains amid the COVID-19 pandemic, respondents are becoming more optimistic that activity may bottom as stay-at-home orders are gradually lifted. This was reflected in an improved six-month outlook, with an additional ~20% of respondents compared to March expecting higher activity levels over the next six months. Additionally, supply chain constraints continued to manifest as further respondents noted slower supplier deliveries.

Hiring sentiment also stabilizes, albeit at a low level. The FDI employment index registered a 26.8 reading, which was similar to last month’s 27.0. No respondent noted higher employment levels than seasonal expectations for the second consecutive month and 46% characterized employment as below expectations, the highest percentage recorded in survey history (since 2012). The broader economy has seen an even more marked and rapid decline in the employment situation with 30 million and counting US workers filing initial claims for unemployment benefits over the past six weeks. Economists believe this implies a real-time unemployment rate in the high teens vs. pre-COVID levels of ~3.5%, with wide swaths of the economy currently shut down.

Respondent commentary downbeat, but some see a light at the end of the tunnel. Commentary on April sales/activity was bleak. One respondent commented, “We lost 80% of our sales. It will not get better if we continue the [shelter in place] since most of our customers are closed. Those that are open have limited work they are allowed to do at this time.” Looking ahead, some respondents anticipate at least a partial recovery in momentum as state-wide shutdowns are lifted. One respondent summarized this by saying, “We are hoping for higher activity once the stay at home orders are lifted,” while another said “April sales were down 14%. I expect May might be up slightly up because businesses seem to be opening up slowly.”

Others expect sluggish demand to be longer lasting, continuing over the next several quarters. As one respondent said, “Even with some states opening up, the climb back to normal levels I expect to be slow. Some manufacturing was already trying to recover from 2 slow quarters prior to the pandemic.” Perhaps reflecting cautious optimism surrounding a reopening of the economy, a lower proportion of respondents this month indicated they expect lower activity over the next six months compared to today (54% vs. 73% in March), and 34% now expect higher activity six months from now vs. just 16% only last month.

Fastenal reported a very impressive +6.7% overall April daily sales growth vs. our -18.0% estimate, boosted by 120% y/y daily sales growth in safety products. Excluding safety products, underlying sales were -16.4% y/y. This also reflected a significant acceleration vs. the mid-month -10.5% FAST was tracking at as FAST received significant surge orders for PPE in the latter half of the month to government and healthcare customers. Fastener sales, however, fared significantly worse than the overall, with sales decreasing -22.5% y/y (March – 10.1%). Looking forward, May safety product sales will likely continue to benefit from surge orders, albeit not to the same degree as April, while we expect fastener products and other non-fastener products to remain weak (we estimate -13.6% y/y). As such, we model overall -6.2% y/y daily sales declines in May.

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for April 2020, with graphs and disclosures, Click-here.