Written by R.W.Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 10/7/21

Key Takeaway:

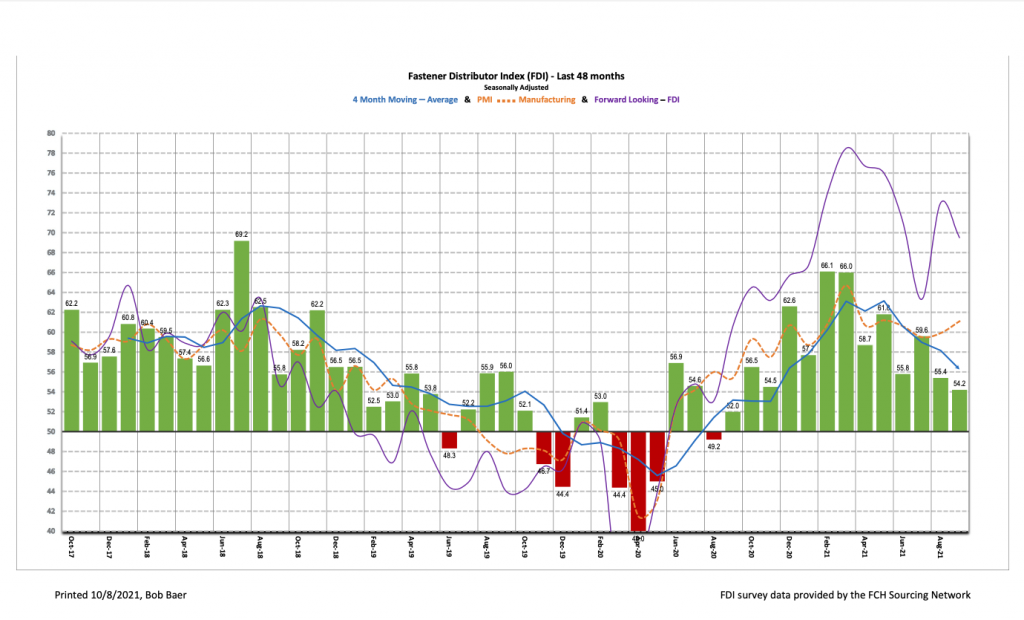

The September seasonally adjusted Fastener Distributor Index (FDI) retreated for a second consecutive month as supply chain constraints continued to wreak havoc, although the index remained in expansionary/growth territory at 54.2. Commentary continues to point to solid demand and results that would otherwise be stronger if not for supply chain constraints, such as stainless-steel raw material shortages, lengthy delivery times, and labor shortages. The Forward-Looking Indicator (FLI) similarly moderated on a softer six-month outlook and a slight uptick in customer inventory levels but continues to signal growth is expected in the months ahead. Net, September market conditions again softened m/m amid intense supply chain challenges.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and Baird with support from the National Fastener Distributors Association. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward-looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM).

Key Points:

FDI again decelerates on supply chain and labor market difficulties. The seasonally adjusted September FDI (54.2) moderated from last month’s 55.4, primarily reflecting lower sales activity (seasonally adjusted sales index -4.4 vs. last month). Pricing settled down ever so slightly, as the proportion of respondents reporting higher pricing m/m decreased (71% vs. 81% last month), which drove a contraction in the FDI Pricing Index (83.9 vs. 90.4 last month). Commentary indicated stainless steel raw material availability is a drag, along with staffing shortages and lengthy deliveries. Uncertainty around the availability and timing of receiving products, particularly imported products, was a common theme among survey participants again this month.

FLI also contracts. The seasonally adjusted FLI came in at 69.5, contracting m/m alongside the FDI. This was attributable to a slight uptick in customer inventory levels (bearish for potential future restocking/demand), as well as a softer six-month outlook. Only 42% of respondents now expect activity levels to be higher six months from now vs. today compared to 58% in August. That said, product shortages in the face of continued strong demand could simply lengthen out the cycle, implying the FDI could remain in growth mode for much longer.

Employment mostly unchanged in September. The FDI employment index came in at 54.8 vs. 53.8 last month. This was driven by an uptick in the percentage of respondents indicating employment is above seasonal expectations (35% vs. just 19% in August). We continue to hear the job market remains extremely tight and filling open frontline positions (warehouse workers, drivers, etc.) is especially challenging, implying the employment index could remain at depressed levels for some time to come. Looking at the broader economy, the August jobs report was much weaker than expected with a disappointing gain of 235,000 jobs coming off July’s better-than-expected report. This widely trailed economist expectations for +725,000 as concerns over the Delta variant impacted hiring in customer-facing areas (restaurants, leisure, hospitality, etc.). Unemployment stands at 5.2% compared to the pre-pandemic level of 3.5%. Economists are projecting ~500,000 additions in the September jobs report (slated to be released on October 8th).

Supply chain continues to negatively impact results but demand remains strong. Once again, respondent commentary focused in on supply chain. Said one respondent, “In my 45 years, I have never seen the supply chain this screwed up and pricing this out of control.” Echoing this sentiment, another participant said, “We could do more if we had products coming in….right now if we are finding parts, we are buying it just to have it. UGH.” Raw material shortages continue to pose a significant challenge, as do labor shortages: “Stainless steel raw material continues to be an issue; shortages and very long deliveries are hampering production. Also staffing shortages continue to slow and hamper production as positions remain unfilled for lack of candidates.” Several survey participants indicate they see the supply chain havoc lingering well into next year: “We are having issues finding good outside sales, inside sales and warehouse help to fill open positions. Even though sales slowed just a bit in September we remain bullish on the near future. China shutdowns are coming and therefore we can assume the shortages will continue through 2022Q3.” That said, demand continues to be very strong: “Demand is strong but supply chain issues could cause actual orders to soften.“

Fastenal’s +9.0% overall August daily sales growth matched our +9.0% estimate. Safety sales declined 3.8% as demand for masks and other COVID-related products further moderated amid easing restrictions. Excluding safety products, underlying sales were +12.7% y/y, essentially in line with our +12.6% estimate and normal seasonality. Turning to fasteners specifically, FAST’s fastener sales were +18.9% y/y, marking the sixth straight month of double-digit fastener sales growth and generally consistent with recent strong FDI/FLI readings. Looking forward, we model September overall daily sales +7.7% y/y, reflecting safety -1.6% and non-safety (including fasteners) +10.2%. Based on softening in the FDI, we could see some downside to this estimate, as this assumes above normal m/m seasonality (+1% above average m/m increases from August to September). FAST will report September daily sales with 3Q21 earnings on October 12.

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for September 2021, with graphs and disclosures, Click-here.