Written by R.W.Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 12/5/21

Key Takeaway:

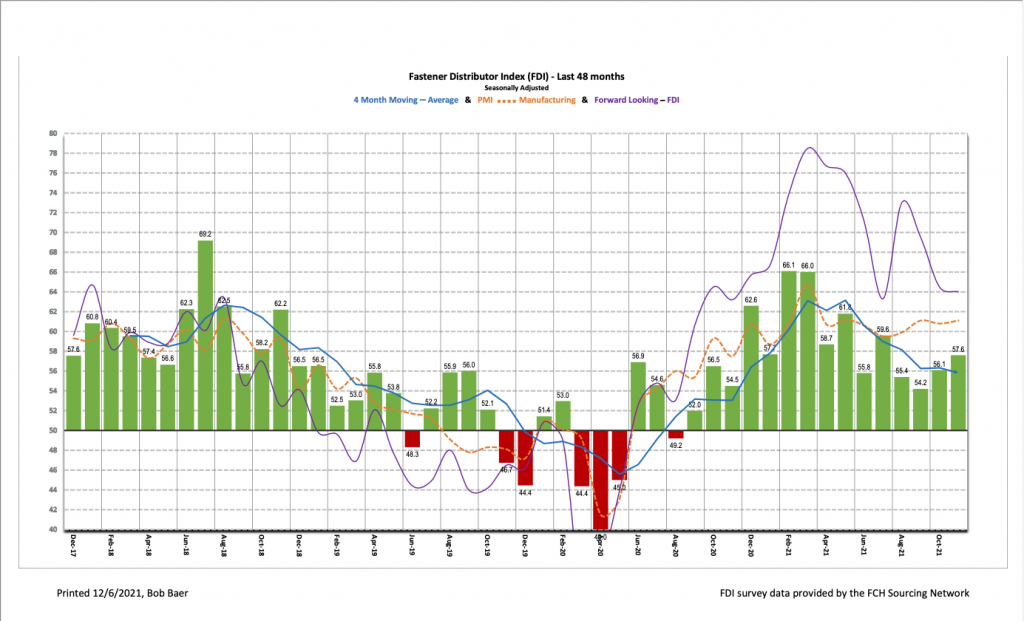

The November seasonally adjusted Fastener Distributor Index (FDI) of 57.6 saw slight improvement, driven primarily by better seasonally adjusted selling momentum. The Forward-Looking Indicator (FLI) continued down the path of gradual moderation that the index has been on for the past ~six months, but the FLI nonetheless remains healthy in absolute terms at 64.0 (compared to 2018/2019 average of 52.9). Prior respondent commentary had been focused on container/material shortages and port backups but the focus notably shifted toward labor constraints this month. Net, November largely saw a continuation of recent themes, including stronger demand than can be served, extended lead times, and raw material and labor shortages.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and Baird. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward- looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM). Additional background is available at: The FCH Sourcing Network

Key Points:

FDI ticks up moderately in November. The seasonally adjusted November FDI (57.6) saw a modest improvement vs. December (56.1) as better seasonally adjusted sales trends offset slightly weaker employment levels. Pricing remained stable sequentially with the m/m and y/y FDI Pricing Indexes mostly unchanged. While past commentary focused on freight delays, container shortages, and shortages of imported material, labor seemed to be the biggest irritant this month, cited by nearly all respondents.

FLI continued to moderate. The seasonally adjusted FLI came in at 64.0, contracting slightly m/m for the third consecutive month. The FLI has been on a gradual downward descent since June as supply chain issues and labor challenges led to less rosy forecasts of future activity. Relative to October, the FLI was pressured this month by lower employment levels and a slightly less positive six-month outlook for participants. On the latter point, the six-month outlook now reflects just 36% of respondents anticipating higher activity levels over the next six months compared to today – down significantly vs. a clear majority of 80%+ in February/March 2021. That said, product shortages in the face of continued strong demand could simply lengthen out the cycle, resulting in the FDI remaining nicely in growth territory for some time to come.

Employment dipped in November. The FDI employment index came in at 63.6 compared to 65.2 last month. Multiple respondents indicated hiring remains challenging despite significant efforts. As one participant summarized, “Hiring is tougher than ever, with very little replies on Help Wanted ads.” The broader economy saw a similarly sluggish job market in November, albeit off a solid October report. The economy added just 210,000 jobs compared to economist expectations for +500,000. Hard-hit customer-facing roles in areas such as stores, restaurants, bars and hotels were especially soft (retail saw a net loss of jobs in November), although manufacturing and transportation & warehousing were positive at +31,000 and +50,000, respectively. Unemployment fell to 4.2% from 4.6%, which was a new pandemic low but is still slightly elevated relative to the pre-pandemic level of 3.5%. The labor force participation rate increased but remains soft at just 61.8%.

Familiar themes of supply chain disruption, with more acute labor headwinds. A material improvement in the state of the supply chain did not occur in November. Said one respondent, “Still having delayed deliveries with both overseas and domestic product. Customers still not too encouraged in increasing our sales due to uncertainty in the market and inability to get other product to continue production on a daily basis!” Frustration with these lingering issues continues to build: “This supply chain problem is getting old.” Labor challenges were seemingly more prevalent and more impactful this month than in prior months. As one participant said, “A disappointing month due to limited human labor …. We’ll be back up to full speed in December.” Another respondent commented, “Slight slowdown, believe many orders have already been placed ahead of time based on the current situation with material shortages, lead time, overseas port backlogs, etc. Hiring is tougher than ever, with very little replies on Help Wanted ads.” Lastly, one participant noted supplier price increases continue “due to material shortage, labor shortage and delayed shipments from raw material suppliers.”

Fastenal’s +14.1% overall October daily sales growth beat our +10.8% estimate. Safety sales were +2.9% y/y but further normalized as a percentage of sales towards pre-pandemic levels. Excluding safety products, underlying sales were +17.2% y/y, also nicely above our +14.3% estimate and normal seasonality. Turning to fasteners specifically, FAST’s fastener sales were +23.2% y/y, consistent with generally strong FDI/FLI readings. Looking at November specifically, we model November overall daily sales +5.3% y/y, reflecting safety -3.6% and non-safety (including fasteners) +7.8%. November sales will be reported on December 6.

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for November 2021, with graphs and disclosures, Click-here.