Written by R.W. Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 7/7/22

Key Takeaway:

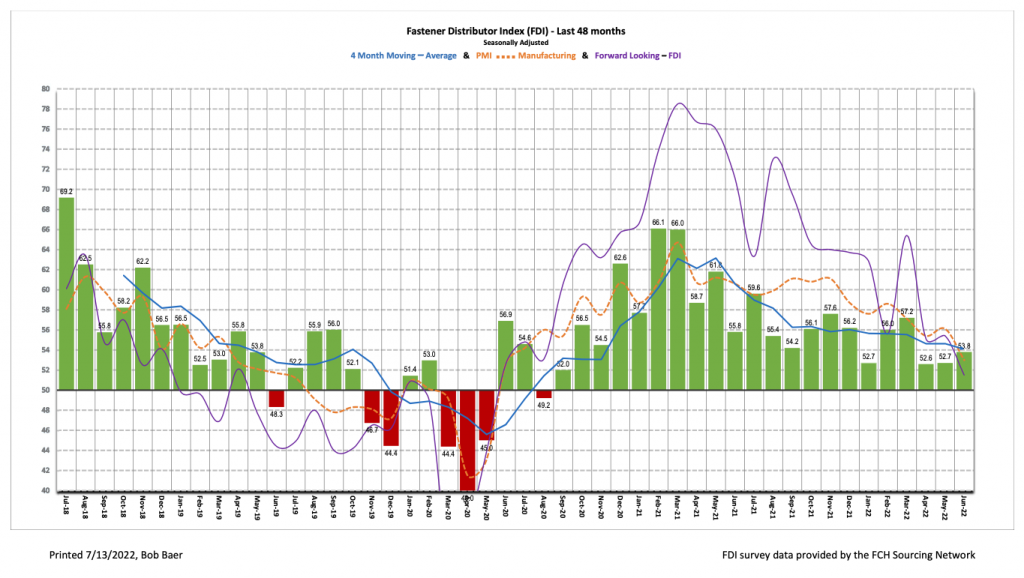

The June seasonally adjusted Fastener Distributor Index (FDI) reading is 53.8, improved vs. last month, indicating slightly faster growth than May. The pricing indices moderated some (albeit remaining at elevated levels) as respondents noted softening commodity prices and some improvement in material shortages/lead times. Customer demand seemingly remains solid/strong, although a few participants noted some softening ahead was expected. Accordingly, the Forward-Looking Indicator (FLI) fell to just mildly above expansionary levels at 51.5 as respondents offered mixed outlooks (some see no signs of slowdown, others predict softening customer demand in coming months). Net, we believe growth and overall market conditions in June remained solid but see potential signs of decelerating growth in the second half of the year.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and Baird. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward-looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM).

Key Points:

FDI increased in June. The seasonally adjusted June FDI (53.8) climbed m/m (May 52.7), consistent with continued growth but at a slightly more measured pace relative to earlier this year (1Q22 average FDI 55.3). The sales index did see nice m/m improvement from May, however, which was seemingly due to improved material availability and deliveries. Pricing moderated slightly vs. last month, which respondents attributed to softening commodity prices (steel) and freight costs. Overall, we believe the FDI showed continued growth in June but at more measured rate relative to earlier this year and 2H21.

FLI signals slowing growth. The seasonally adjusted FLI came in at 51.5—down from last month’s 55.4— signaling the expectation of slower growth ahead. A weaker six-month outlook was the principal m/m drag in the FLI, along with a slight drag from the employment index. Regarding the outlook, more respondents are expecting lower (39%) than higher (27%) activity levels over the next six months compared to today; this is the first time the outlook skewed negatively since the COVID-19 driven recession (April 2020). Multiple participants indicated they are bracing for slowing growth and/or declining demand, although whether the economy enters outright recession or merely slows is unknown.

FDI employment index softens moderately. The FDI employment index came in at 59.1 for June after bouncing up to 62.9 in May. Most participants indicated they were at levels of employment that is seasonally normal/appropriate (76%), with just 3% saying employment levels were low (compared to a post-COVID high of 26% in September 2021). Turning to the broader economy, economists’ consensus estimates call for 270,000 jobs to be added in June. May saw +390,000 job additions (which beat economists’ initial estimate of +328,000). It is worth noting that average hourly earnings rose +5.2% y/y in May as competition for workers remains intense.

Demand remains strong for now but softening ahead seems to be the consensus. Overall, while forward-looking commentary this month was mixed, commentary on June was near universally positive. Multiple participants noted record sales despite brewing macroeconomic headwinds: “June 2022 was our largest sales month in history.” Looking forward, however, many are beginning to forecast weakening customer demand. As one participant said, “Customer demand is OK for now, but is trending softer.” Another commented, “The growth rate acceleration is expected to be slower in Q3 and beyond.” Respondents had mixed feedback on whether outright recession is imminent, but most nonetheless are expecting some slowing in growth ahead. Pricing could also be starting to moderate given the recent decline in steel/other commodities: “Commodities’ pricing softened this month (scrap at $760/ton for June and $600/ton for July). Freight costs are coming down, but still much higher than pre-pandemic levels. Continued inflationary pressure in cost due to inputs other than material.” Lastly, persistent material shortages and extended delivery times could be showing signs of improvement. As one participant noted, “Material shortages are starting to stabilize however tooling availability has become a major issue. Lead times continue to increase but that is not affecting incoming sales at all.” Another respondent said, “Inventory starting to arrive earlier than previously expected while customers are starting to ask for pushed out deliveries.”

Fastenal’s +17.6% overall May daily sales growth came in above our +16.6% estimate and normal seasonality. Consistent with the FDI, fastener sales were again very strong (but moderating) at +20.0% y/y (compared to April’s +25.5% growth), while safety was +15.6% and other non-fasteners were +16.1%. Looking ahead to June daily sales, we model overall daily sales +18.8% y/y. This would again be slightly better than normal seasonality given the strong June FDI reading. FAST will report June daily sales in conjunction with 2Q22 earnings on July 13.

For the full FDI report for June 2022, with graphs and disclosures, Click-here.