Written by R.W. Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 7/7/21

Key Takeaway:

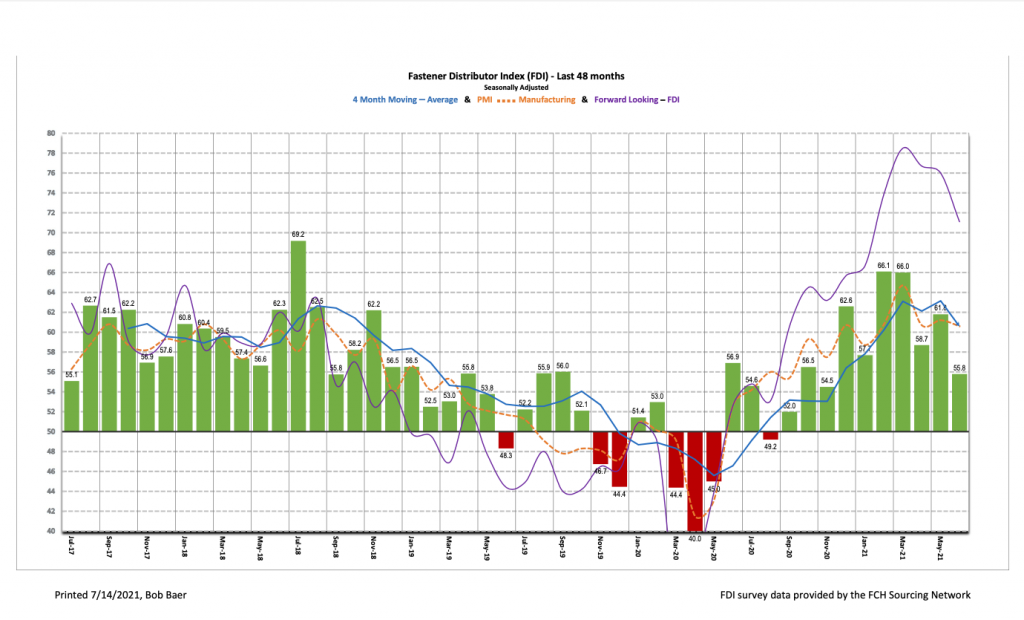

The June seasonally adjusted Fastener Distributor Index (FDI) moderated slightly at 55.8, but remains solidly in expansionary territory. Driving the slight m/m contraction was a decline in both the sales and employment indexes. Respondent commentary focused on broad-based inflationary pressures and product shortages. The Forward-Looking Indicator (FLI) similarly moderated at 71.1, but remains at a robust level, signaling expected expansionary demand conditions in the months ahead. Net, demand and pricing remain strong but widespread shortages continue to constrain growth.

About the Fastener Distributor Index (FDI).

The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and Baird with support from the National Fastener Distributors Association. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward-looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM).

Key Points:

FDI retrenches some amid continued supply chain challenges. The seasonally adjusted June FDI (55.8) moderated from last month’s 61.8 as widespread product shortages constrained sales growth for some respondents. The sales index declined to 71.4 compared to 72.2 in May. Higher pricing continues to be a significant contributor to growth, as 87% of respondents saw higher point-of-sale pricing y/y (vs. 86% in May) and 84% m/m (vs. 76% in May). That said, given the magnitude of supplier price increases, other inflationary pressures and difficulty passing these on to customers fully, some respondents are seeing margin erosion.

FLI also moderates. The seasonally adjusted FLI came in at 71.1, retreating vs. last month’s 76.0, although still elevated relative to historical levels (average FLI reading over survey history is 55.3). Compared to last month, the FLI employment index, respondent inventory levels and six-month outlook all weakened, while lower customer inventory levels were a partial offset. That said, a 70+ FLI continues to point to strong market conditions ahead despite this month’s softening.

Employment levels slightly weaker. The FDI employment index came in at 62.9 vs. 70.3 last month. Thirty-five percent of respondents saw employment levels as above seasonal expectations vs. May’s 49%. We believe this reflects continued challenges in finding/retaining qualified labor amid a strong job market and enhanced federal/state unemployment benefits. Looking at the broader economy, the June jobs report showed a better-than-expected gain of 850,000 jobs coming off two straight soft reports. This solidly exceeded economist expectations for +706,000, and economists are encouraged this could perhaps mark a turning point in easing widespread labor constraints. Unemployment is still elevated, however, at 5.9% compared to the pre-pandemic level of 3.5%.

Inflationary pressures and supply chain constraints key topics of focus. Supply chain disruptions again showed no signs of abating in June, and shortages appear to be extending towards many commonly stocked items. Said one respondent, “Importers are not only out of common items, but are quoting December ETA’s. I have never seen shortages as widespread.” Given the strong demand, widespread shortages, and inflationary commodity markets, respondents continue to see significant inbound price increases: “Ocean Freight continues to run way behind schedule. Transportation Costs are skyrocketing. We are passing through as much of this cost as possible.” Echoing this, one respondent commented, “The price of everything is increasing every day.” While inflation is clearly helping revenue growth, some respondents are seeing margin pressure due to transportation cost increases that are eating away at the incremental profit opportunity: “While we are raising our pricing 5% (higher on some items), we are losing margin because we have to pull inventory (if it is available) from all over the USA. UPS and Fedex Ground are eating up any additional margins we are getting by raising prices.”

Fastenal’s -3.2% overall May daily sales growth exceeded our -5.5% estimate. Safety sales declined 44.1% against a COVID-fueled +136% May 2020 comparison. Excluding safety products, underlying sales were +18.7% y/y (April was +23.8% against an easier comparison), which was above our +16.7% estimate and normal seasonality. Turning to fasteners specifically, FAST’s fastener sales were +28.2% y/y, consistent with the strong readings seen in the FDI/FLI over the last several months. Looking forward, we model June overall daily sales -0.6% y/y, reflecting safety -36% and non-safety (including fasteners) +14.9%. FAST will report June daily sales with 2Q21 earnings on July 13th .

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for June 2021, with graphs and disclosures, Click-here.