Written by R.W. Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 2/7/23

Key Takeaway:

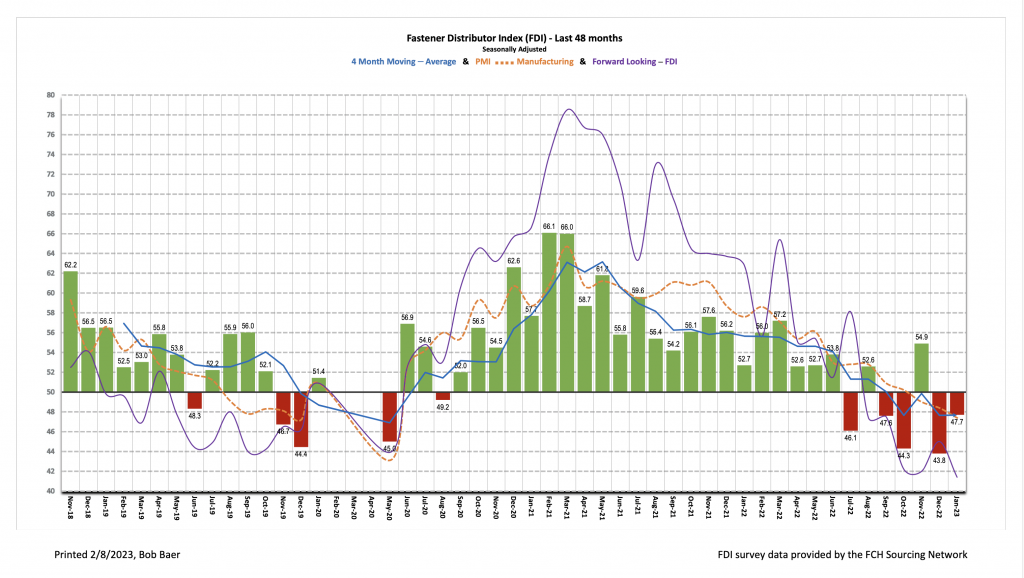

The seasonally adjusted Fastener Distributor Index (FDI) began 2023 with another sub-50 reading, albeit modestly improved over the previous month with a reading of 47.7. Commentary was mixed as some respondents pointed to still-strong customer backlogs and solid demand, while others saw significant slowing and cancellation of large blanket orders. Looking ahead, the Forward-Looking Indicator (FLI) continued to retreat further with a downbeat 41.4 reading, suggesting participants largely expect further softening. Overall, the FDI/FLI continue to suggest a slowing demand backdrop for fasteners.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and R.W. Baird. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward- looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM). Additional background is available at:FastenersClearingHouse.com.

Key Points:

FDI slightly improves vs. last month but remains well into contractionary levels. The seasonally adjusted January FDI (47.7) slightly improved off last month’s 43.8 reading – which was the lowest reading since April 2020. However, the index remains <50, indicating conditions continued to worsen vs. last month – just at a slower rate than in December. The sales index told a similar story, coming in at 44.7 vs. 37.9 last month. 37% of respondents this month saw sales above seasonal expectations vs. just 16% last month. The sales index and customer inventory index drove the slight m/m overall improvement in the FDI, with employment slightly worse vs. last month.

FLI continues to decelerate. The FLI registered a 41.4 reading, retreating further from last month’s 45.0 reading and signaling additional slowing is likely ahead (still sub-50). In addition to weaker employment, higher respondent and customer inventory levels drove the continued drop in the FLI. The six-month outlook was modestly improved, however, with 37% of respondents anticipating higher activity levels six months from now vs. today compared to 26% in December. This level of optimism nonetheless remains below the 44% average seen over the past two years. Conversely, 33% expect lower activity levels (December was 29%) vs. an average of just ~19% over the past two years. Finally, 30% expect a continuation of December trends over the next six months. Expectations for a mild recession and slowing demand in certain markets were commonly expressed outlook themes.

FDI employment reading also slightly softer m/m. The FDI employment index came in at 48.1 for January vs. 50.0 last month. Employment levels continue to be seen as generally at appropriate levels (81% of responses), while just 7% said employment levels were too high and 11% said they were too low. Turning to the overall economy, the January jobs report came in well above expectations. 517,000 jobs were added vs. economist expectations for +187,000. A cooling labor market remains key toward the Federal Reserve eventually pausing rate hikes, but to this point the labor market has remained persistently strong.

Outlook improves for third consecutive month but still muted, overall. Forward-looking commentary suggested general expectations for softening throughout 2023, with degrees of variance +/-. One respondent anticipates a mild recession with some geographic differences: “I believe there will be a mild recession this summer, but I do not expect it to affect all areas of the country equally. I think Southern Florida (for example) will be largely spared. I think parts of California and New York will be hammered. ” Others see a relatively balanced outlook, with some markets seeing growth and others contracting: “Large blanket orders that were placed due to manufacturer/wire extended lead times in 22Q4 we have received requests to cancel from our customers. Working to balance the cancellations has led to good discussions with customers. Good customers are more open to working together this year compared to past years. We see market sectors that will be slow until 23Q4 while other markets continue to grow. Box of chocolates.” Still others remain optimistic based on customer backlogs: “I’m hearing all this doom and gloom from the press, but I’m not seeing it with the orders from my customers. Many of my customers have 6-9 month backlogs.”

Fastenal reported January daily sales growth of +11.2%, nicely exceeding our +6.2% estimate and in line with normal seasonality. This included +11.6% y/y growth in fasteners, +6.2% safety growth, and +14.1% other non-fastener growth. Looking forward, we model overall February daily sales growth of +9.3% y/y – moderating vs. January which is consistent with deceleration in the FLI. Looking at 2023 overall, we generally model slightly weaker-than-seasonally-normal sales given the string of sub-50 FDI/FLI readings, a sub-50 ISM PMI, and an over-arching assumption that recession hits in 2H23.

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for January 2023, with graphs and disclosures, Click-here.