Written by R.W. Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 1/9/23

Key Takeaway:

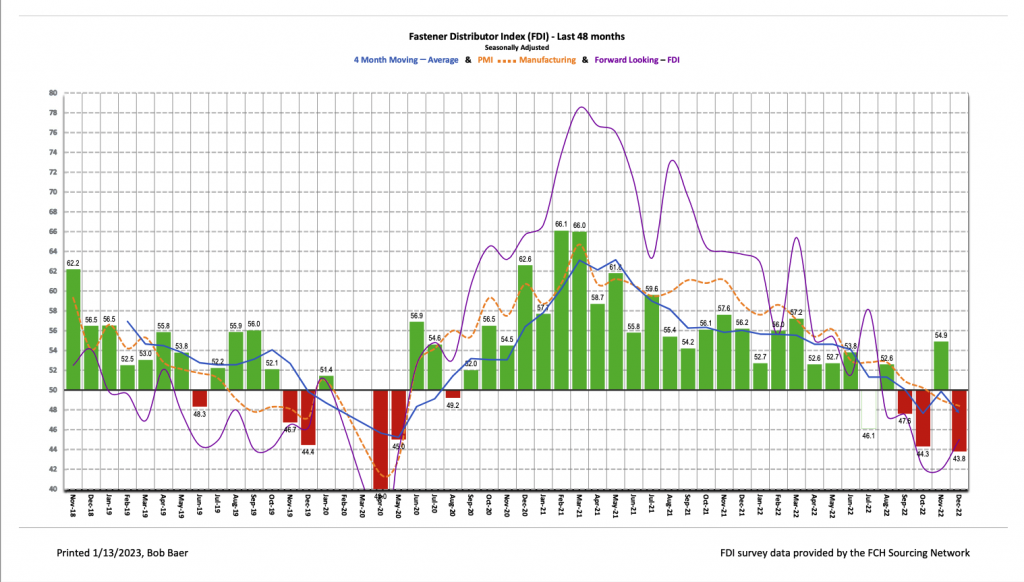

The seasonally adjusted Fastener Distributor Index (FDI) capped off the year with a startling sub-50 reading, coming in at 43.8 in December. This was a significant deceleration from last month’s 54.9 reading and indicates market conditions worsened vs. November. Commentary pointed to slowing around the holidays and domestic trucking issues constraining product supply as the primary culprits. Looking ahead, the Forward-Looking Indicator (FLI) registered another sub-50 index value at 45.0, but improved modestly vs. last month. Overall, the FDI/FLI suggest continued slowing in fastener distribution market conditions.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and R.W. Baird. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward- looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM). Additional background is available at:FastenersClearingHouse.com.

Key Points:

FDI ends the year on a softer note. The seasonally adjusted December FDI (43.8) retreated to below 50 (indicating contraction) and reached the lowest level of the year (prior low was October at 44.3). The sales index was significantly softer compared to November with just 16% of respondents indicating sales were better than expectations vs. 34% in November. All four sub-components of the FDI (sales index, employment, supplier deliveries, and customer inventories) deteriorated m/m.

FLI remains contractionary. The FLI registered a 45.0 reading, which was a slight improvement vs. last month (42.0) but signals additional weakening is expected ahead (still sub-50 reading). The employment index was also softer vs. last month, but improvement in the six-month outlook more than offset, leading to slight overall m/m improvement in the FLI. On the outlook specifically, 26% of respondents anticipate activity levels will be higher six months from now vs. today, albeit off December’s low base (lowest FDI since March 2020). This level of optimism remains modest compared to the 47% average seen over the past two years. Conversely, 29% expect lower activity levels (November was 45%) vs. an average of just ~13% over the past two years. Finally, 45% expect a continuation of December trends over the next six months. The most common theme among participants in their outlook commentary was expectations for flat to lower revenue trends in 2023.

FDI employment index softens. The FDI employment index came in at 50.0 for December vs. 57.9 in November. Employment levels continue to be seen as generally at appropriate levels (74% of responses), while just 13% said employment levels were too high and 13% said they were too low. Turning to the overall economy, the December jobs report came in above expectations. 223,000 jobs were added vs. economist expectations for +200,000. A cooling labor market remains key toward the Federal Reserve eventually slowing/pausing interest rate hikes, but to this point the labor market remains persistently strong.

Outlook improves for second consecutive month but still muted, overall; international logistics constraints improving but domestic remains challenging. Forward-looking commentary remained relatively cautious on the whole. Respondents generally seem to be forecasting flat to lower revenues in 2023: “We have grown over 60% since 2020, but I doubt this will continue in 2023 as I foresee revenue flat or lower through 4Q23.” Another respondent said, “Really have no idea but recent trends and industry experts forecast a softer year. With demand softening and inventories in good position, it seems like activity has to be slower in the first half at least.” Commentary on shipping constraints was mixed, with significant improvement registered overseas (“Shipments from Asia to USA are improving on cost and timing”) but domestic challenges continue (“Domestic trucking issues are still a problem”).

Trends facing the industry in 2023. This month’s supplemental question focused on major trends expected to impact the fastener industry in 2023. A few highlighted examples include: heavy consolidation in the structural fastener market, difficulty hiring/retaining quality employees, US/China/Taiwan tension escalation, recession fears, ongoing logistic challenges, and uncertainty regarding inventory positioning (de-stocking, fast moving material cost changes, etc.).

Fastenal will report December daily sales in conjunction with 4Q22 earnings on January 19. We are modeling overall daily sales +8.5% y/y, which is slightly better than normal seasonality. In 2023, we model weaker-than-seasonally-normal sales given recent contractionary readings in the FDI, a sub-50 ISM PMI, and our over-arching 2023 recession assumption. Recall, in November FAST’s fastener sales grew by 8.7% y/y – moderating vs. 12.2% in October. Additionally for FAST, safety was +9.6% and other non-fasteners were +12.0%.

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for December 2022, with graphs and disclosures, Click-here.