Written by R.W. Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 5/5/21

Key Takeaway:

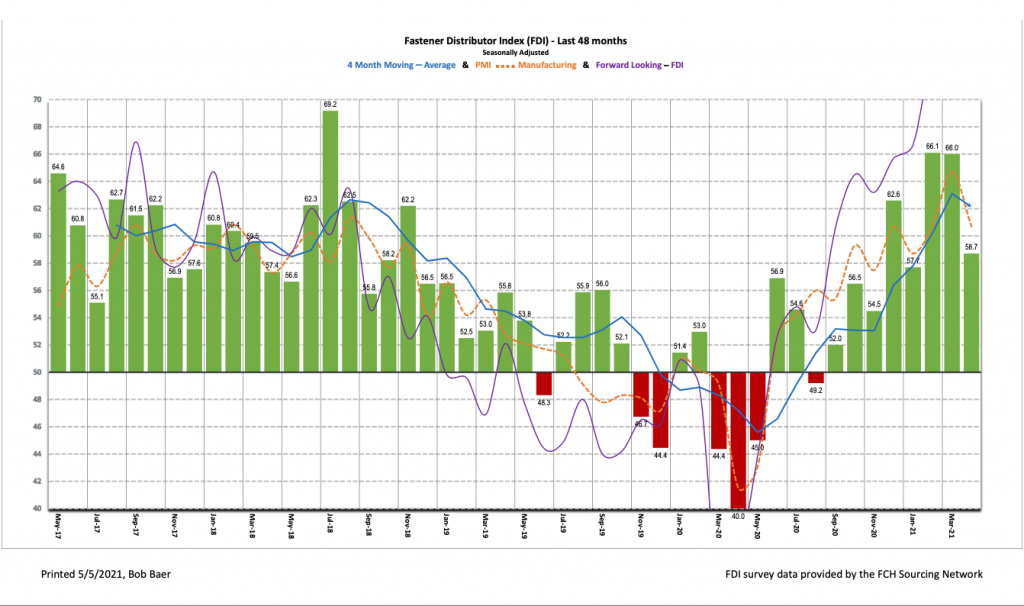

The April seasonally adjusted Fastener Distributor Index (FDI) 58.7 showed market conditions cooled off from the frenetic pace seen in February and March as supply chain constraints inhibited growth. Respondent commentary indicates underlying demand remains strong but servicing all demand is becoming increasingly challenging given intense supply chain/freight difficulties. The sales index dipped sharply from recent robust levels, but nonetheless still implies a healthy sales environment. The Forward-Looking Indicator (FLI) 76.7 also moderated slightly m/m but continues to signal expansionary demand conditions in the months ahead. Net, supply and freight remain bigger issues than demand in the fastener industry currently.

About the Fastener Distributor Index (FDI).

The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and Baird with support from the National Fastener Distributors Association. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward-looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM).

Key Points:

FDI decelerates but demand conditions remain favorable overall. The seasonally adjusted April FDI 58.7 moderated from last month’s robust 66.0 but indicates continued growth in fastener markets (well above neutral 50 reading). About half of respondents saw better than seasonally expected sales, which was significantly lower than the 91% in March and the ~70% December through February. We attribute this to continued shipping delays/container shortages and an inability to source products, which has resulted in many respondents being unable to fulfill all customer orders. These dynamics have also translated into continued price increases; 94% of respondents saw higher point-of-sale pricing y/y and 72% higher m/m.

FLI moderates. The seasonally adjusted FLI was 76.7, decreasing vs. March’s 78.5, although the FLI had set new record highs the previous two months hence some moderation was likely overdue. The main driver of the m/m contraction was the six-month outlook, which was slightly less optimistic than prior months. We believe sentiment is being more directly impacted by supply chain constraints than in prior months when respondents were still navigating these challenges reasonably well. That said, we see a positive outlook for the FDI ahead as customer inventories remain at very low levels, and note an FLI well into the 70’s is consistent with expectations for continued improvement in fastener markets ahead. Even if respondents are not able to meet all demand, distributors seem to be able to meet enough demand to generate good levels of sales growth.

Employment levels unchanged. The FDI employment index came in at 66.7, the third consecutive month in the 66-67 range. Forty-two percent of respondents saw employment levels as above seasonal expectations in April – essentially equal to March’s 41%/February’s 43%. Looking at the broader economy, the March jobs report showed an impressive gain of 916,000 jobs, easily ahead of economist expectations for +675,000, as the leisure and hospitality sectors react to normalizing travel demand. The construction market also added an impressive +110,000 jobs m/m. Unemployment now stands at 6%, although this still reflects nearly 7.9 million fewer jobs vs. pre-pandemic levels. The April jobs report is slated to be released Friday May 7, and economists are expecting another month of very strong additions (consensus expectations are for nearly one million adds).

Supply chain issues starting to have a more direct impact. While port backup, container shortages, and increasing freight rates have been consistent topics of discussion in the FDI the last several months, respondents seemed to be feeling the impacts more directly on their businesses this month. Said one respondent, “We are finally noticing the container shortage and backup at the ports. We assume it is only going to get worse until 2022.” Another commented, “Inventories at all of the Major Master Importers (IE. BBI, Stelfast, XL Screw, Star Stainless, Vertex etc. ) are very low….we are getting parts that we need from all of their branches from all over the country. Margins are going down because of the additional ‘freight in’ charges. We are feeling the pain of all of those ships that are backed in the ports of LA, SanDiego, Seattle etc. ” Several respondents indicated they feel the supply chain is holding back their ability to meet otherwise robust demand: “Stressed supply chain is depressing sales. If our customers could obtain all components they need, they would be building more. Transit markets and material shortage will continue to apply upward pressure on pricing.” Echoing this, another comment said, “There is unprecedented demand combined with supply challenges that our entire industry is trying to navigate.”

Fastenal’s 7.5% overall March daily sales growth nicely exceeded our +4.1% estimate. Safety growth was still positive y/y at +3.2% but clearly moderating as FAST begins comping 2020 pandemic safety sales. Excluding safety products, underlying sales accelerated nicely to +8.7% y/y (February was -2.2%). Turning to fasteners specifically, FAST’s fastener sales were +14.0% y/y, albeit against a March 2020 comparison of -10.1%. For April (to be reported on May 6), we model +25.1% non-safety growth (against a -16.5% comparison from April 2020) and -42.5% safety sales as demand moderates and FAST comps 2020 safety sales.

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for April 2021, with graphs and disclosures, Click-here.