Written by R.W. Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 4/6/23

Key Takeaway:

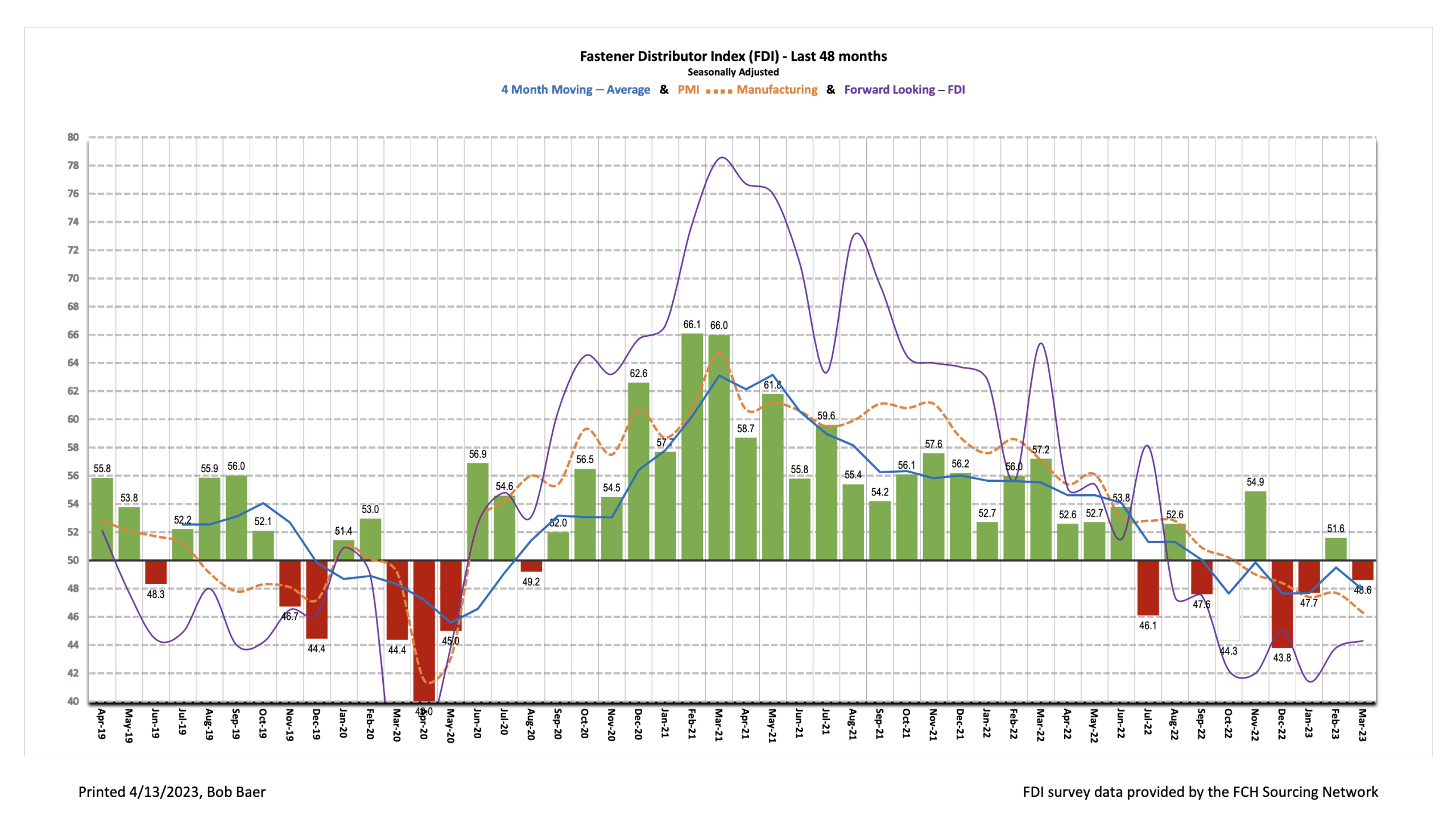

The seasonally adjusted Fastener Distributor Index (FDI) retreated slightly, coming in at 48.6 vs. 51.6 last month. Participant commentary suggested slowing demand and recession concerns weighed on sentiment. The Forward-Looking Indicator (FLI) improved very modestly, albeit remaining in contractionary territory at 44.3. Overall, the FDI/FLI results suggest March was a touch softer than February market conditions for the fastener market.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and R.W. Baird. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward- looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM). Additional background is available at:FastenersClearingHouse.com.

Key Points:

FDI reverts to sub-50 levels. The seasonally adjusted March FDI (48.6) weakened vs. last month’s 51.6, which had been the first expansionary reading since November. Faster supplier deliveries and weaker employment indicators primarily drove the m/m reduction. That said, the supplier deliveries index improving could be more so driven by a normalizing supply chain than weakening demand. The sales index did come in slightly lower m/m, however, at 49.5 (February 51.4). Participants’ demand commentary was mixed, with some citing reshoring trends and automotive strength as driving solid demand, while others noted softening “general industry” conditions and stagnate demand.

FLI mostly unchanged. The FLI registered a 44.3 reading, which was a very modest improvement vs. February’s 43.8 but remained at <50 and thus signaled weakening is still expected ahead. A modestly better six-month outlook drove the very slight improvement, with 25% of respondents anticipating higher activity levels six months from now vs. today compared to 27% in February, 44% expecting similar activity vs. 37% in February, and 31% anticipating lower activity vs. 37% last month. Respondents cited a possible recession occurring in the third quarter and expectations for stagnate or lower demand in the second quarter.

FDI employment slightly lower m/m. The FDI employment index came in at 54.2 for March vs. 55.0 last month. Employment remains at generally appropriate levels for the vast majority of respondents (86% of responses). Just 11% see employment as too high, while only 3% believe they are understaffed. Turning to the overall economy, the February jobs report came in above expectations, with 311,000 jobs added vs. economist expectations for +225,000. The March jobs report is expected to be released on April 7; economists are penciling in a consensus of 239,000 jobs added.

Outlook moves slightly higher. While commentary suggested continued concerns over a potential weakening in the economy ahead, the outlook was slightly more positive on balance this quarter. The six- month outlook registered a 47.2 reading vs. 45.0 in February. Forward-looking commentary included concerns over a recession in the back half of 2023: “We continue to plan around the expected 3rd quarter recession.” Second-quarter expectations also appear to be low: “Expecting Biz to be stagnate or down for Q2. Inventories are a problem across the board. Still hard to hire, getting easier but good candidates disappear quickly.” Others see reshoring as a major positive catalyst for near-term growth: “As a manufacturer, we are seeing an increase in interest of reshoring product back to the US. This alone has caused an increased outlook for the short-term future.”

Fastenal reported February daily sales growth of +9.6%, just above our +9.3% estimate and in line with normal seasonality. This included +8.0% y/y growth in fasteners, +3.2% growth in safety, and +13.8% other non-fastener growth. March sales will be reported with 1Q23 earnings on April 13. However, we model overall March daily sales growth to be stable m/m at +9.6% y/y. This would be just slightly below normal seasonality which we view as appropriate given the still sub-50 FDI/FLI and a softening ISM PMI. Looking at 2023 overall, we generally model slightly weaker-than-seasonally-normal sales given the string of sub-50 FDI/FLI readings, a sub-50 ISM PMI, and an over-arching assumption that recession hits in 2H23.

For the full FDI report for March 2023, with graphs and disclosures, Click-here.