Written by R.W. Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 6/6/25

Key Takeaway:

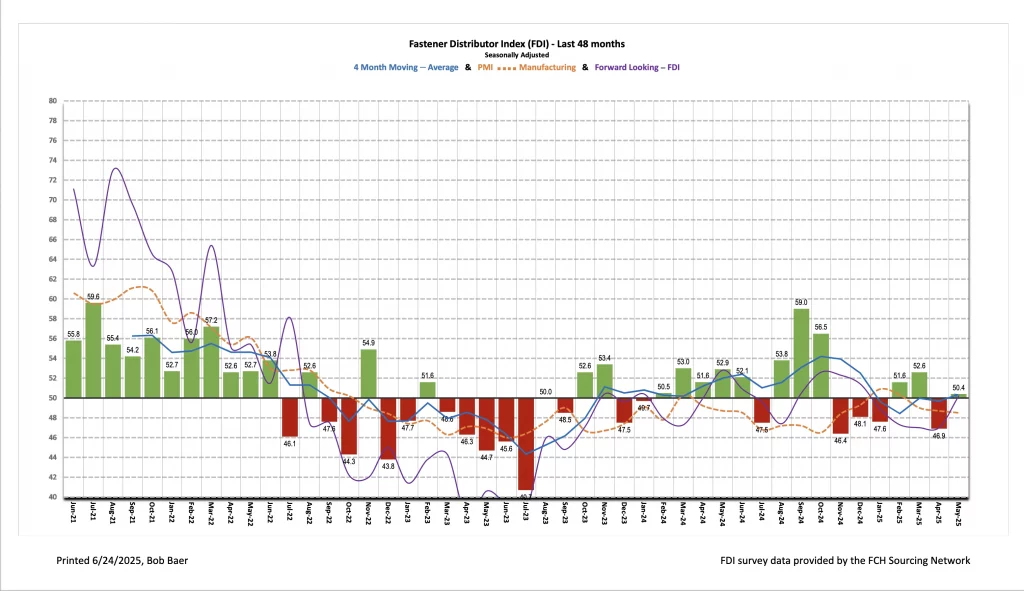

The seasonally adjusted Fastener Distributor Index (FDI) saw month-over-month improvement, reaching 50.4 (April 46.9). This reflected improvement in three of the four underlying components (sales, employment and supplier deliveries). The Forward-Looking Indicator (FLI) also improved at 50.2, the first reading above 50 for the first time since December. Overall, May saw some bounce back after a fairly dismal April, though commentary suggests trends/outlook remain largely uncertain amid ongoing trade disruption.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and R. W. Baird. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward- looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM). Additional background information is available at:FastenersClearingHouse.com.

Key Points:

FDI back very modestly above 50. The May seasonally adjusted FDI improved to 50.4 from April’s weak 46.9 reading. This primarily reflected normalization off a very weak April, which we believe had been impacted by some pre-buy in March ahead of tariffs. 39% of respondents said sales came in above seasonal expectations this month, which was up from just 30% in April, while 39% indicated sales were below expectations (down vs. 45% last month) and another 21% said in line. Employment was also a contributor to the expansion as the share of participants saying employment was lower than seasonal norms decreased m/m (from 18% to 9%), though the overwhelming majority (79%) continue to say employment is in line. Pricing, meanwhile, again moved higher as steel/China/global import tariffs take hold. A majority (64%) of respondents this month said pricing was higher vs. April, which matches last month and follows 61% in March, 48% in February and just 17% in January.

FLI also a bit more positive. The FLI also saw m/m improvement, reaching 50.2 vs. 47.0 in April. Factors driving this improvement included higher employment levels, leaner customer inventories, and slower supplier deliveries. Quantitatively, the six-month outlook was slightly weaker, however, as 33% of participants forecast better activity levels over the next six months vs. today – further eroding vs. 48% last month and compared to December when participants were significantly more optimistic (61% expected improvement at that time). Another 42% forecast trends to muddle through at a similar rate (higher than the 15% in April and 22% in March), while 24% expect sales to deteriorate further (vs. 36% last month).

One subject remains on everyone’s mind. Again this month, nearly all commentary focused on tariffs impact on pricing, demand and the outlook. Most are beginning to see some level of demand destruction: “Tariffs are starting to cause demand to soften with customers. Prices are going up and its been a challenge with many customers passing it along… challenging and chaotic times.” Similarly, “Tariff uncertainty continues to depress demand – wait and see attitude while burning off existing inventory – manufacturing seems to continue to slow/delay product launches.” Several comments expressed dismay at the lack of certainty on pricing and/or an inability to plan/forecast: “Tariffs continue to be a distraction, and business strategies remain fluid. It’s hard to plan ahead when you can’t see what’s coming. Meanwhile, business is steady, maybe a slight falling off but expect the same level over the next 3 months.” Another comment said, “May was a challenging month for sales and new business with many customers trying to understand their real costs due to tariff confusion.” Quoting seems to be up as customers look for alternative sources of supply, but feedback on conversion of quotes was mixed: “We’re seeing a significant uptick in RFQ activity, suggesting elevated interest across the market. However, this hasn’t translated into firm orders—indicating much of the activity may be exploratory or price-testing in nature. Notably, there’s been a marked increase in requests specifically for domestically manufactured products, but these often stall once pricing is provided—likely due to sticker shock compared to offshore alternatives.” In contrast, a different commenter said, “Way fewer RFQ’s this month but we converted a higher percentage of them to make up for part of that loss. Still, not a great month.” FX is also having an impact on pricing: “[We are] anticipating slower demand if the tariffs remain in effect at the current levels. As a result, [we’ve] seen a sudden price increase, and the exchange rate of the dollar is now down 11%, which impacts price also.” A few are still seeing healthy activity levels, however: “Currently, demand has been outpacing capacity, making it difficult satisfy future customer needs”; “YOY sales up by 10% – Good action.”

Fastenal reported May daily sales growth of +9.3% y/y, just below our +10.9% estimate. However, consistent with the >50 FDI, fastener sales accelerated to 8.9% growth (from +1.5% in April). Elsewhere, safety sales were +10.4% and other non-fasteners grew +9.2% y/y. For June, we are modeling a further improvement in trend to +9.9% y/y daily sales growth, which mostly reflects better-than-normal seasonality but also further pricing from tariffs.

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.Grainger: Risks include ability to maintain margins, internet-only industrial supply sources, ability to sustain secular growth, cyclicality, and international operations.

MSC Industrial: Risks include cyclicality, maintaining and managing growth, success of Mission Critical initiative, and poor investor sentiment.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for May 2025, with graphs and disclosures, Click-here.