Written by R.W. Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 6/6/24

Key Takeaway:

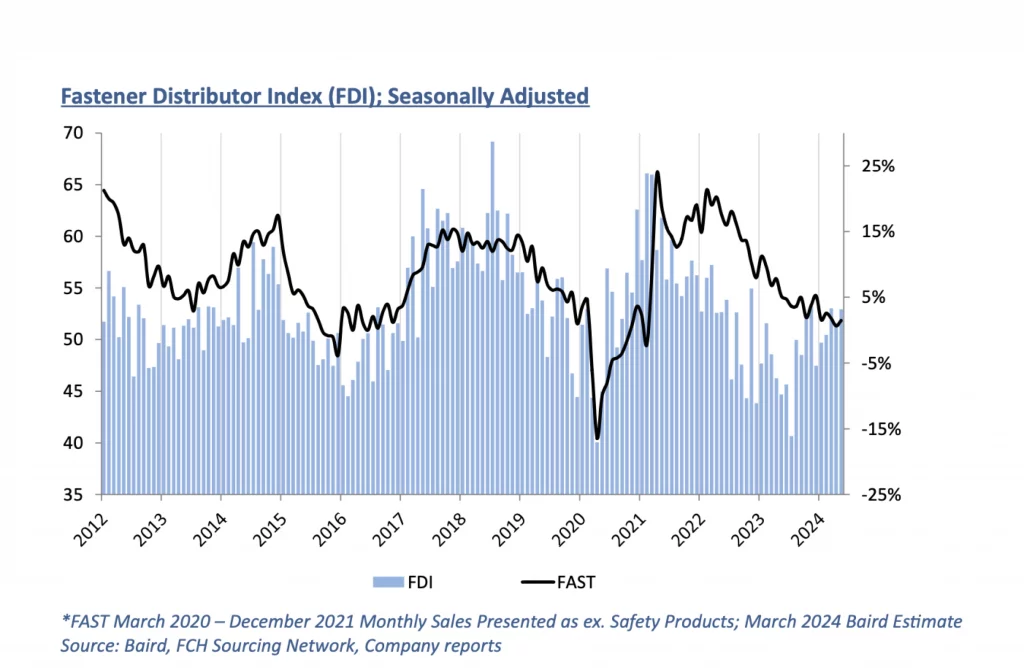

The seasonally adjusted Fastener Distributor Index (FDI) saw modest m/m improvement, reading 52.9 in May vs. 51.6 in April, and continued to expand (above neutral reading of 50), albeit driven by just one component, supplier deliveries. Commentary was again mixed, but our overall read was that demand conditions in May were generally seen as acceptable, not great but not terrible either. Overall performance seems to be divergent among participants based on end market exposure. This month’s Forward-Looking Indicator (FLI) also improved vs. last month and climbed back into expansionary levels, reading 52.8. When taken together with other indicators (FAST, May ISM PMI), we believe market conditions in May remained fairly muted.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and R. W. Baird. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward- looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM). Additional background information is available at:FastenersClearingHouse.com.

Key Points:

FDI improves m/m. The seasonally adjusted FDI moved modestly higher in May to 52.9 (April 51.6). That said, three of the four underlying components (sales, employment, and customer inventories) decelerated vs. April; only the supplier deliveries index improved by a sizable enough amount to offset the weakening in the other three components. As such, while the headline FDI technically improved, our interpretation is that underlying activity was relatively unchanged. Looking at the sales index specifically, 36% of respondents indicated sales came in above seasonal expectations – slightly lower vs. 47% last month but generally in line with the 33% average over the past year. 27% indicated sales were below expectations compared to 33% last month, while the remaining 36% said sales matched expectations (vs. 20% in April).

FLI points to slightly better conditions expected ahead. After registering an exactly neutral 50.0 in April, the FLI improved to 52.8 this month. Slightly leaner customer inventory levels, slower supplier deliveries, and a more optimistic six-month outlook all combined to drive the m/m acceleration. On the outlook specifically, views again leaned net more positive than negative (39% expecting higher activity levels six months from now vs. today compared to 18% lower), but the plurality of respondents continue to see activity sustaining at current levels (42% of responses). In April, 33% expected higher activity, 43% similar, and 23% lower. This drove the six-month outlook index to improve to 60.6 from 55.0.

Divergent views of current industrial economy; election seen as a near-term headwind. Feedback on demand across the industrial landscape remains mixed, with one respondent speculating that diverging end market exposure is the driver: “I have read that many sectors are robust such as electronic components, and many industrial sectors are going through a recession. As an election year, we are performing with single-digit growth. If this is a recessionary time for fasteners, I’ll take it.” Feedback continues to be positive, however, from some participants: “[I] continue to be surprised by the demand coming in from various industries. Our customers are willing to wait longer for deliveries, while our costs are inching higher.” Another respondent said, “February and March were slower than expected but we have seen an untick in sales and overall activity since early April.” Conversely, others who had previously seen strong trends saw a deceleration this month: “After a year of consistent growth, we had poor sales in May. I won’t call it a trend yet. If it happens again in June then I will know there is something bad in the brew.” Many participants are watching the upcoming election with unease, anticipating some slowing ahead: “As the election grows closer, the sales and buying will slow down. We’ve seen it every election year and it starts right about May/June so we’re due. Once the election takes place, some sense of normalcy will return barring any other factors.” Lastly, a recent rise in raw material, ocean freight and labor costs are also seen as a key risk: “While April numbers barely hung in there, May slowed down compared to the 1st quarter. We expect the May levels to continue through the summer months and then [it’s] anyone’s guess. Stainless steel material [is] starting to rise again at the same time. Ocean freight has ticked up. The labor market [is] heating up again with costs increasing, while the number of candidates is shrinking. Overall, [it’s] still better than the good years pre-covid but backward trends never make stakeholders happy.”

Fastenal reported May day sales growth of +1.5% y/y vs. our +2.5% estimate. This was also 1% below what normal seasonality would have implied for the month. Fastener sales, specifically, were -4.1% y/y, softening from April’s -2.2% decline and marking the 14th consecutive month of either flat or declining y/y sales for this product line. Elsewhere, safety sales were +7.5% and other non-fasteners grew +3.0% y/y. For June, we are modeling +3.7% y/y daily sales growth which is in line with normal days-adjusted seasonality. For 2024 overall, we assume FAST’s growth will be mostly in line with normal seasonality as we assume the macroeconomic/industrial cycle remains unfriendly through much of this year. Looking ahead to 2025, we have FAST growing double-digits by March in an industrial market recovery, however.

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Grainger: Risks include ability to maintain margins, internet-only industrial supply sources, ability to sustain secular growth, cyclicality, and international operations.

MSC Industrial: Risks include cyclicality, maintaining and managing growth, success of Mission Critical initiative, and poor investor sentiment.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for May 2024, with graphs and disclosures, Click-here.