Written by R.W. Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 4/7/21

Key Takeaway:

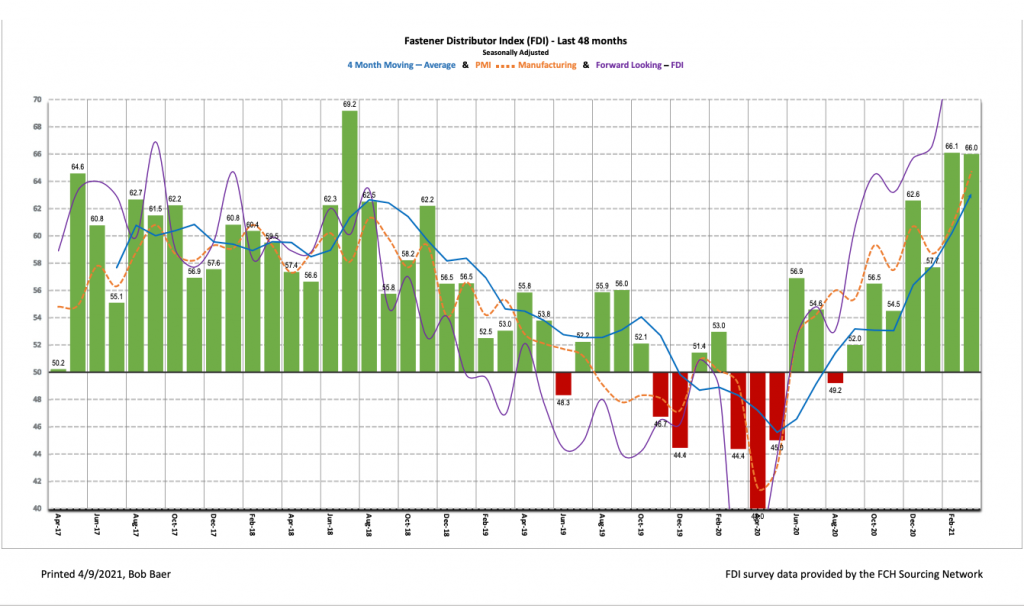

The March seasonally adjusted Fastener Distributor Index (FDI) was essentially stable m/m at 66.0, implying conditions remained at the strong pace seen in February. The sales index remained at very high levels as respondents continue to report more demand than supply. The Forward-Looking Indicator (FLI) also saw further m/m acceleration, reaching a new record high of 78.5, shattering last month’s 73.9 record, and signaling additional expansionary demand conditions in the months ahead. Net, we believe March was another strong month for most fastener distributors relative to expectations, although supply seems to be more of an issue than demand currently.

About the Fastener Distributor Index (FDI).

The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and Baird with support from the National Fastener Distributors Association. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward-looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM).

Key Points:

FDI sees stability in March. The seasonally adjusted March FDI (66.0) remained at very strong levels and was essentially unchanged vs. February. A robust 91% of respondents saw better than seasonally expected sales in March, breaking out even further vs. the ~70% seen consistently over the last three months. Price increases from suppliers continue to flow through at an elevated rate/frequency, while delays in importing materials continue to cause headaches for many respondents. Feedback suggests lead times continue to extend, leaving many distributors unable to fully meet the very strong demand.

FLI sets another record high. The seasonally adjusted FLI was 78.5, setting another new all-time high after last month’s record 73.9 reading. Increasingly thin respondent and customer inventory levels amid imported materials constraints and extended lead times, along with a more bullish six-month outlook continue to power upward momentum in the FLI. Only the employment index saw some m/m moderation. With the FLI well above 50, customer and respondent inventories at very low levels, and respondents continuing to forecast favorable six-month outlooks, we believe the FDI should see additional expansionary readings ahead, implying continued improvement in the months ahead.

Employment levels were slightly softer m/m. The FDI employment index registered a still very strong 65.6 reading this month, although this did moderate vs. 67.1 in February. Forty-one percent of respondents saw employment levels as above seasonal expectations in March compared to 43% in February. Looking at the broader economy, the March jobs report showed an impressive gain of 916,000 jobs, easily ahead of economist expectations for +675,000, as the leisure and hospitality sectors react to normalizing travel demand with COVID-19 infections moderating. The construction market also added an impressive +110,000 jobs m/m. The unemployment rate now stands at 6%, although this still reflects nearly 7.9 million fewer jobs vs. pre-pandemic levels.

Supply chain constraints and pricing the key areas of focus. Nearly every comment again touched on supply chain constraints as importing material into the ports remains highly challenging amid congestion and container shortages. Per one respondent, “The marketplace is in chaos. Supplies are low, demand is high. Lead times are extending due to material cost pressure and demand pull.” Echoing this, another participant said, “Import delays continue to be extended and domestic manufacturer lead times going out as well. Price increases are out of control and coming in with every repeat order.” This has translated into significant supplier price increases: “Increased costs continue to pressure margins. Customers fighting the increases even though they are aware of the market conditions. Delays in shipments from overseas causing lots of busy work.” Lastly, a respondent commented, “We have seen an average [price] increase of 7% which lowers our profitability on the contract customers. Once the anniversary date of the contract arrives we will adjust customer costs to offset these increases.”

Fastenal’s 1.5% overall February daily sales growth trailed our +4.5% estimate, including a significant drag from unfavorable weather conditions (-2.6-3%) and soft non-residential construction demand (- 14.4%). Safety growth remained very strong at +17.6%, although growth has clearly moderated as FAST begins comping 2020 pandemic safety sales. Excluding safety products, underlying sales decelerated to – 2.2% y/y. Turning to fasteners specifically, FAST’s fastener sales were slightly weaker m/m at -2.1% (January -0.2%). For March (to be reported with 1Q21 earnings on March 13), we model +7.0% non- safety growth (against a -6.1% comparison from March 2020) and -5.8% safety sales as demand continues to moderate.

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for March 2021, with graphs and disclosures, Click-here.