Written by R.W.Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 2/7/22

Key Takeaway:

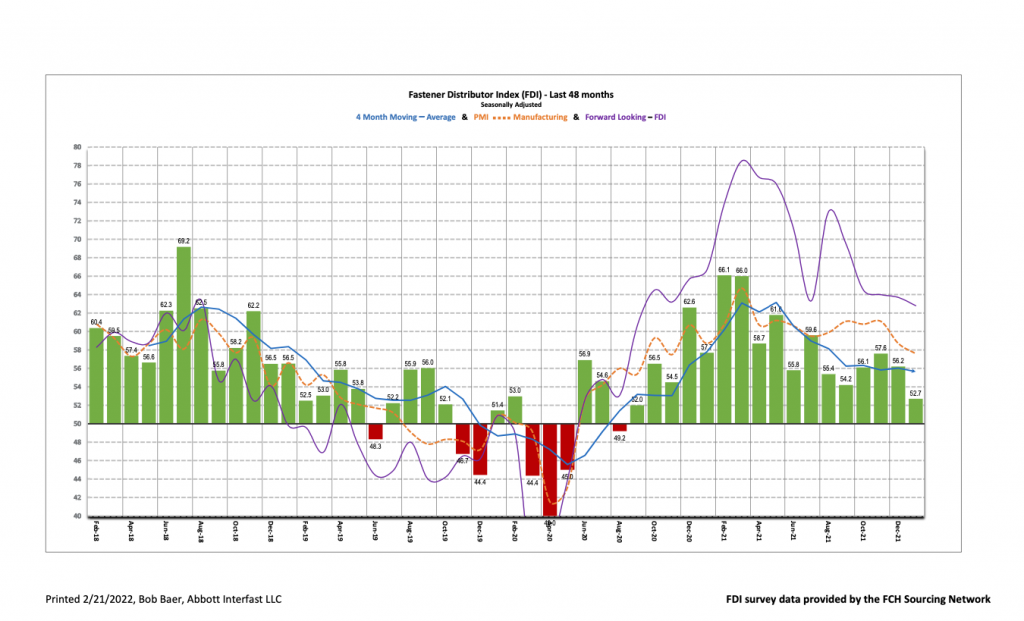

The January seasonally adjusted Fastener Distributor Index (FDI) was slightly softer m/m at 52.7, although modest underlying improvement was seen in most metrics; the seasonal adjustment factor downwardly impacted results as January is normally the strongest month of the year for the index. Respondent commentary pointed to customer fatigue amid erratic supplier deliveries and lead times. The Forward-Looking Indicator (FLI) was modestly softer as well, coming in at 62.8, due to higher inventory levels and a less-optimistic six-month outlook. Net, we believe fastener market conditions were mostly stable with December with continued very strong demand partially weighed down by persistent supply chain challenges.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and Baird. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward- looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM). Additional background is available at: The FCH Sourcing Network

Key Points:

FDI retracts to start the year. The seasonally adjusted January FDI (52.7) saw another m/m deceleration (December 56.2). While most metrics improved, historical seasonality would imply greater improvement would have been expected, which resulted in the overall FDI index cooling further from December’s pace. Pricing was also a touch softer when compared with December, although perhaps this could be viewed positively as it gives respondents more time to pass on past supplier increases to customers. Demand feedback remains positive (customers are busy), but commentary indicates fatigue/frustration could be settling in amid material shortages, lengthy supplier deliveries and extended lead times.

FLI also slightly weaker. The seasonally adjusted FLI came in at 62.8, slightly lower vs. last month’s 63.7. The FLI has been on a gradual downward descent since June 2021 as supply chain issues, inflationary concerns and labor challenges have led to less-rosy forecasts of future activity. Relative to December, the FLI received benefit from a higher employment reading, but this was more than offset by headwinds from higher customer inventories and a lower six-month outlook. Regarding the six-month outlook, a majority of respondents (67%) again indicated this month that they see similar or weaker activity levels over the next six months compared to today vs. ~72% on average expecting higher activity levels back in 1H21. However, with continued strong demand/backlog and lengthy lead times, we believe this means the FDI could remain in solid growth mode for quite some time.

FDI employment mildly better; overall employment significantly improved. The FDI employment index came in at 55.0 compared to 54.7 last month. There were no comments on labor shortages this month – contrasting with a significant number of comments in November’s report. The fairly modest overall index level undoubtedly still indicates labor shortages are a challenge in the fastener market. The broader economy, meanwhile, saw a significant improvement in hiring levels in January. 467,000 jobs were added in January vs. only 150,000 expected by economists. Areas hit hard by the pandemic, such as leisure and hospitality, continued to see the most significant gains. December was also upwardly revised to +510,000 (vs. initial +199,000 reported). This brought the 2021 total jobs added to +6.665 million, which was the largest single- year gain in history.

Impacts on customers from supply chain constraints becoming more evident. Despite consistent supply chain constraints, demand has generally remained robust. Commentary this month suggested for the first time that this could be impacting customer sentiment and/or new project decisions. As one respondent said, “Customers’ schedules remain erratic due to various material shortages. Suppliers’ deliveries and lead times remain an impediment to sales growth and new program start-ups.” Another participant commented, “Customers are busy and fatigued. They are having a hard time keeping up.” Clearly, some element of fatigue/frustration is settling in among customers; it bears watching whether this impacts future demand, although to this point it has not.

Fastenal’s +14.9% overall January daily sales growth easily beat our +11.4% estimate. Amid resurgent COVID- 19 cases, safety sales were +12.9% y/y. Excluding safety products, fastener sales were +20.9% y/y and other non-fasteners were +11.0%. Fastener sales growth, while strong, moderated from December’s +25.5% growth – consistent with the moderation seen in the FDI survey. Looking ahead to February daily sales, we model overall daily sales +14.4% y/y.

Supplemental questions. This month’s special supplemental questions from FCH focused on blockchain technology. 93% of respondents do not feel their understanding of blockchain technology is adequate to evaluate its potential impact on their businesses. Just 14% of respondents are utilizing or planning to utilize blockchain-based systems in support of supply chain operations. Lastly, only 3% of respondents are aware of any customers or suppliers deploying blockchain based systems.

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for January 2022, with graphs and disclosures, Click-here.