Written by R.W.Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 3/7/22

Key Takeaway:

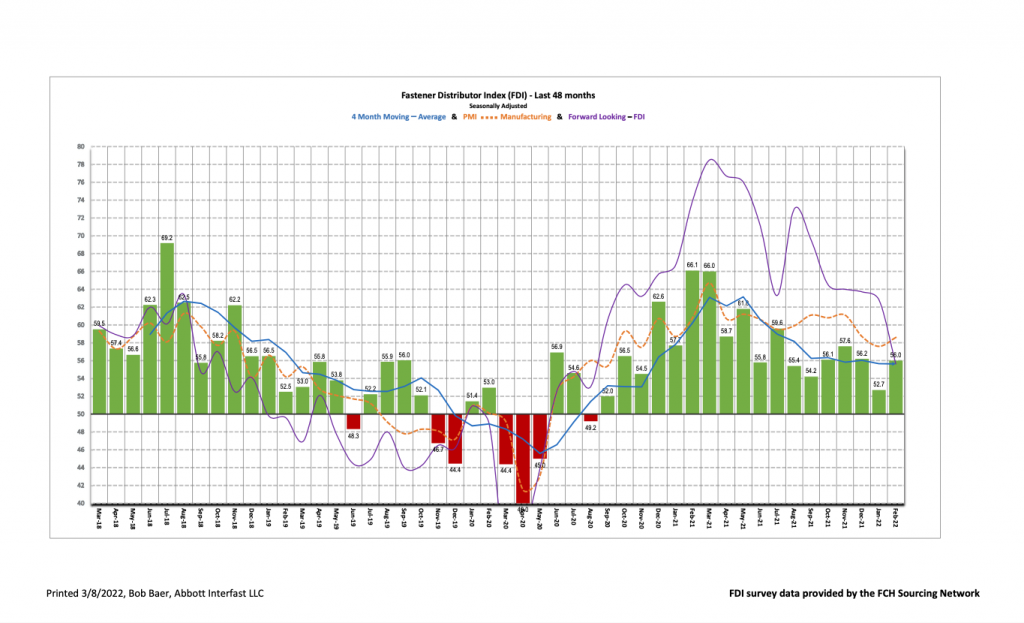

The February Fastener Distributor Index (FDI) recovered nicely m/m, rebounding to 56.0, following January’s seasonal-adjustment driven down-tick. The recovery was broadly consistent with recovery seen in the ISM PMI and other macroeconomic data points as pandemic-related disruption eased. Respondent commentary suggests a continued supply and labor constrained market. The Forward- Looking Indicator (FLI) retreated m/m to 55.6 as incoming order growth slowed for some respondents. Overall, we believe fastener market conditions were strong in February as demand remains robust, although fulfilling demand remains challenging.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and Baird. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward- looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM). Additional background is available at: The FCH Sourcing Network

Key Points:

FDI sees nice sequential uptick.

The seasonally adjusted February FDI (56.0) saw a solid m/m improvement (January 52.7). This was primarily driven by improvement in the sales index, as some respondents saw a release of previously backfilled orders caused by product availability/shipping constraints. Pricing continues to increase as measured by the month-to-month and year-to-year indexes. Demand feedback was again very positive (booming incoming sales), but frustration with product availability and labor shortages continues to build.

FLI moderates.

The seasonally adjusted FLI came in at 55.6, decelerating fairly sharply vs. last month’s 62.8 although continuing to signal growth ahead, but at a slower pace. The FLI has been on a mostly downward descent since June 2021 as supply chain issues, inflationary concerns and labor challenges have led to less rosy forecasts of future activity. Relative to January, a lower employment reading, higher respondent inventories and higher customer inventories were drags, partially offset by a modestly improved six-month outlook. Regarding the outlook, a majority of respondents (62%) again indicated this month that they see similar or weaker activity levels over the next six months compared to today vs. ~72% on average expecting higher activity levels back in 1H21. However, with continued strong demand/backlog and lengthy lead times, we believe this means the FDI could remain in solid growth mode for quite some time.

FDI employment a touch softer despite significantly better macro employment.

The FDI employment index came in at 48.3 compared to 55.0 last month. Competition for labor remains fierce, leading to very elevated hourly rates, while the “Great Resignation” trend also continues to pressure employment. The broader economy, however, saw a significant improvement in hiring levels in February. 687,000 jobs were added vs. +423,000 expected by economists. Areas hit hard by the pandemic, such as leisure and hospitality, continued to see the most significant gains, although manufacturing, construction and non- durable goods employment also saw upticks. January was also upwardly revised to +481,000 (vs. initial +467,000 reported).

Remain in a supply constrained market.

We continue to hear from respondents that demand far outstrips supply. Inbound order levels continue to see strong growth. As one respondent said, “ Incoming sales are booming. Now if we could just get material from our vendors it would allow us to bring delivery estimates down to better meet the needs of our distributor partners!” Another participant commented, “Demand still seems strong for now. Slower growth was expected by many economists [in 2H22}.” In addition to material shortages, labor supply unsurprisingly remains a constraint: “Orders incoming are leveling off, but shipments are still strong as last year’s orders begin to ship. Product availability is still an issue. Hiring situation worsens with payrolls increasing and competition for hires heating up. Even Target is now paying $24/hour in some areas. “

FCH Sourcing Network Activity reflects market activity.

February SourceFinder RFQ inquiries rose in volume and average dollar value. An indicator of commodity shortages within the fastener market, network activity also points to supply weakness in certain specific product categories.

Fastenal’s +21.3% overall February daily sales growth easily beat our +14.4% estimate.

Amid lingering Omicron cases, safety sales were +18.8% y/y. Excluding safety products, fastener sales were +28.0% y/y (accelerating nicely vs. +20.9% last month, consistent with FDI improvement) and other non-fasteners were +17.3%. Looking ahead to March daily sales, we model overall daily sales +18.9% y/y.

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for January 2022, with graphs and disclosures, Click-here.