Despite shifting tariff pronouncements, the fastener industry records another strong month as Brighton Best International president Jun Xu joins newsman Mike McNulty explain on the Fastener News Report (28:33). Meanwhile, Rick Perkhaus of Fastener Specialties Manufacturing confronts an issue facing many small to mid-sized family operations (8:37). On the Fastener Training Minute, industry guru Carmen Vertullo discusses the fine points of mixing small lots when sending parts for plating (1:07:19). Brian and Eric note an attractive aspect of European fastener shows. Musical cameo @ 1:04:55 The Meters – “Doodle-Oop” 1971. Run time: 01:16:20

—

Listen to the podcast here

Important Links

- Fastener Specialties Manufacturing

- Brighton Best International

- Fastener Distributor Index Monthly Survey

- Fastener Technology International

- Episode #70 – Kickstart

- Special Report: Stuttgart 2025 With Craig Penland Of Eurolink

- FTR@FullyThreaded.com

- McNulty@FastenerTech.com

The Mike And Jun Show

What’s Inside This Episode

If you buy, sell, manufacture, or import threaded fasteners, this is the show for you. It is good to see you. We’ve had a few special reports out there. You usually don’t jump in on those, so I’m glad to have you.

I know. You could have also added even faintly interested in fasteners.

I toyed with the idea of adding in some play with the tariffs here, but everybody is so sick of this.

I know.

As we’re recording, the headline dropped that tariffs on all countries aside from China will be waived for 90 days or suspended. I don’t know how exciting that is because it’s all subject to change.

The stock markets were very happy to hear the news. They had a very large rise. Mind you, it’s been a large drop, so it’s not as if we’re anywhere rosy.

We’re getting whipsawed all over the place from many angles. That’s the way it is. Some things are solid and dependable, as is this episode of the show. This is episode 213. We’re publishing on April 10th, 2025. We dropped a couple of special reports dealing with tariffs. They’re mostly still relevant even with this latest headline pry. We’ve gotten a lot of commentary on that, so I know people are very interested. I’m expecting that’s going to continue even though conditions are a little bit different at the moment.

On the Fastener News Report, Mike McNulty is joined by Brighton-Best International President Jun Xu. They touch on the tariff issue. I want to remind everyone that it was recorded right before this latest headline, so they have a lot to say. It’s still germane. They touch on lots of other areas as well, so it’s a very worthwhile conversation. It qualifies as the Mike and Jun Show this time. That’s the bulk of the episode. We’re trying to stick to our new, tighter format, but we’ve also got a warmup segment that we’ll throw at you in a minute here.

Rick Perhaus with Fastener Specialties Manufacturing. We’ve been toying with the idea of having this conversation for the show for a while, and Rick finally decided to pull the trigger on it. He’s a small operator down in Florida. He’s been running his family business for many years. He has come to the point where he’s weighing what to do to sell out, create an ESOP, and find a buyer. What should you do? A lot of folks in the audience will be able to relate to this one.

The exit strategy game.

A slice of fastener life for many small business people. Rick’s a great guy.

He has been an FCH member for years, too.

That is true. One of the stalwarts. I was glad to get this one done. We’ve also got a Fastener Training Minute for you. This time, Carmen Vertullo addresses the issue of commingling fasteners for the purpose of electroplating. It could be any kind of plating, but he’s talking about grouping different lots and the pros and cons of doing that. That’s the Fastener Training Minute.

The title sponsors of Fully Threaded Radio are Brighton-Best International, “Tested and tried true, Brighton-Best,” Goebel Fasteners, “Quality the first time, go Goebel,” and Star Stainless, “Right off the shelf, it’s Star.” Fully Threaded is also sponsored by Buckeye Fasteners and the Ohio Nut & Bolt Company, BTM Manufacturing, Eurolink Fastener Supply Service, Fastener Technology International, INxSQL Software, Fastener Fair USA, J.Lanfranco, MW Components, Solution Industries, Volt Industrial Plastics, and Würth Industry USA. Let us know what you think of the show, or if you hear any breaking headlines regarding tariffs, email us at FTR@FullyThreaded.com. Fire away.

I should note about our sponsors. We’ve had them for a long time. We’ve known them for a long time. We’ve been friends for a long time. We encourage you to consider them first when you are looking for fasteners because they have made it possible for us to produce Fully Threaded.

Thanks for that. Good point. They are partners in all of that. That includes the FCH Sourcing Network and the Fastener Distributor Index, which Mike McNulty and Jun Xu will be speaking about shortly. We should also thank all the participants. I don’t know if it’s because of all this tariff upheaval, but participation in the survey this month was huge. We got a lot of feedback. They’ll be covering the numbers and digging right into that.

I’d like to say thanks to everybody who is out there every month. It fluctuates slightly all the time, but you guys poured it on this month. If you’re not participating in the FDI, the way it works is we try to get one representative from each participating company. We’re trying to avoid getting redundant input and get a true representation of what’s happening out in the market. If you’re interested in getting your voice into this survey, it’s very welcome.

You should be interested. It’s your industry.

The website for that is FDISurvey.com. We send out an email every month alerting you that the survey is open, which it is for a couple of days. It only takes two minutes.

It’s very simple, and it’s anonymous. In other words, the people who do the analysis have no idea because all that is stripped off when Eric sends them all the results. They have no idea which companies have completed the survey.

It’s not anonymous to us, but to put it this way, in fifteen years, we’ve never had a complaint. We’re not going to let your information out anywhere.

It’s anonymous as far as the rest of the world is concerned.

That’s FDISurvey.com. Thanks to everybody who’s out there participating. Thanks to our sponsors. Thanks to you for tuning in to the show.

Those of you who did fill it in this month, thank you very much, because last month was a bit of a problem. The browsers decided in their infinite wisdom to suddenly stop sites like ours from working for that particular one. It was caught completely unaware.

That was a little bit of a second-order effect from the ongoing cyber warfare. It was a little bit of a headache, but we got it done. A little more manual work than usual. Let’s shift and talk to Rick Perkaus. He’s used to doing hard work at Fastener Specialties Manufacturing.

‑‑‑

Rick Perkhaus Of Fastener Specialties Manufacturing

Rick, good to talk to you again. How, how did we get onto this whole conversation about selling fastener businesses in the first place?

I was reading your episode, ideally. You spoke to Steve. He didn’t speak to Cheryl, but Steve and Cheryl sold their company, SASCO. I don’t know their size, but I know they’re smaller than many of these companies that I deal with. It made me start thinking about an exit plan. I need to put a lot of thought into that and put some pen to paper.

A lot of guys are out there in that situation. The market is a nonstop acquisition. It seems like it’s the bigger guys that are always involved. That’s one of the reasons you and I see eye to eye on so many things. Over all these years you’ve been with FCH, we’re both still on the small side.

I’m very envious of you and Brian. You’re hanging out with the bigwigs, and I’m still down here at my little wooden desk.

Do you get out to the associations at all? Are you doing CFA?

I would like to do CFA. That’s coming up fast. I don’t know that I’ll have time to plan a visit there, but I would like to.

They’re right down there in your neck of the woods. For folks who aren’t familiar with Fastener Specialties Manufacturing, you’re right there in North Miami, right?

Correct. West Palm Beach is a little bit North of Miami and Fort Lauderdale. We’ve been here for 45 years.

You’ve been running it for 34, right?

That’s correct. I got into it in the early ‘90s when my parents weren’t as healthy at the time. I took leadership roles.

Classic fastener story. You’ve been driving this thing. What markets are you serving? I know you do a lot of stainless.

We do a lot of stainless steel, a lot of duplexes, and all the unusual metals, like titanium and 17-4s. We do any metal. There are a few metals that give us trouble that we have to say, “No, thank you,” to, but most metals, we sell every single month.

You’re operating on the manufacturing side and the distribution side, aren’t you?

Yeah. We’d like to do more distribution, but it is the manufacturing that makes the phones ring or, in this case, the emails come in.

You’ve been with FCH for many years. I looked up your account. I don’t know if it’s cool to share this, but it was 2013 when you first got on.

We were happy to get on there. We were with Nationwide Directory before that. They’re a great company, but they were only permitted 500 items. We wanted all 8,000 of our items on a list. That’s why we came over to you. It has worked out quite well. It easily pays for itself every year.

Thanks for saying that. In the old days, I would’ve edited that out, but everything’s cool there. That’s the way the world goes. We’re going to delve into this whole idea of fastener companies acquiring one another and things changing in general. It’s what happens. I was bringing it up because you’re using FCH on the distribution side.

We were talking about getting an exit plan together. However, we stumbled into that, and you have misgivings about it. It’s not that you’re ready to do this immediately. We’re not making a sales pitch here, but on the other hand, you never know. Maybe somebody is reading who might be interested in a company like yours. You’re doing a lot of different things. You’ve struggled with this whole idea. Can you talk a little bit more about that?

The whole idea of selling it makes me nervous, anyway, because this has been my entire business life. I graduated from college, and I’ve been here all this time. It’s probably going to be an emotional period when I do sell it, so I’m hoping someone wants to buy it from me and keep me and most of my crew on. I know it restricts a lot of buyers, but that’s what I’m hoping for.

I’m a fastener guy. I’m good at talking to people and solving problems. I’m not the best guy to be behind the minutiae of running a business. It’s one of those things that I’m not as good at. Clearly, I’ve been here a long time, so I’ve been successful, but it’s not my thing. I’d much rather be the fastener guy than the business owner guy.

Are you running this pretty much solo, or do you have a partner that you work with?

I have no owner-partner, but we have some great crew here that has been with me for a long time. I would love to share a portion of what I get with them, hopefully, when it sells. We have to see how it falls out. This is truly my retirement. I don’t have a great retirement in another way, so I have to take care of my wife and me in the future as I think about these things. We have to move forward with this sooner rather than later.

I’ve been doing this for so long. It’s so strange to even talk about this. When you work at something your entire adult life, it’s hard to imagine even growing the business faster than I have. It hasn’t grown tremendously during my ownership, which is a regret of some sort. When I did have it bigger, I had about nineteen employees at one time. I didn’t do as well, so I shrank it back down to about thirteen employees. About eight of them are production employees.

When you work at something your entire adult life, it is still hard to imagine the growth you are experiencing. Share on XWe have a good crew. It’s easily manageable. I sleep well at night. I can come in a little bit later than some people do to the East Coast. I’ve grown into this great role. I’ll stay until 7:00 or 8:00at night sometimes. It’s a great little business. I’m good at the part that I do best, so hopefully, I’ll continue that long into the future.

This is what some people call a lifestyle business in a way.

I agree with you. That’s why most of us get stuck here. It’s interesting how even some people who have been out of the business for many years very often end up coming back. That knowledge is so valuable.

Do you talk to a lot of people who are in that position?

I do, quite often. One of my hires, a guy named Bill, is the son of the owners of a company called Precision Socket that’s long gone. When he was looking for a job a couple of years ago, I said, “I can’t afford you, but let me know.” We ended up talking. He works for me. He does lots of other things as well. He’s a welcome addition to our crew. Hopefully, he’ll stick around a long time, too.

Is he like an auxiliary guy for you now?

I was falling way behind on quotes when I was doing more of it myself. Since he has all that fastener knowledge, he was able to step into the role. He has machining knowledge also, which I did not have. I have book smarts when it comes to machining, but I don’t have actual machining time in my life. It was good to get someone who had the machining time. He was able to add a good perspective to the business. He gets the quotes done more quickly than I can.

Do you ever see Robbie down there?

Sure. He has been sitting in this chair that I’m staring at. He has been in my chair.

I’m not surprised.

He’s a great guy. I appreciated it when he first stopped by many years ago. I see him every now and then.

He’ll be at CFA, I bet you. I don’t know that for sure, but he’s one of those guys.

I’m guessing he would be. It’s closer to his home base, too, so if he has left his Florida home, I’m guessing he’ll be up there.

Speaking of running into people in your neck of the woods, I know it’s a little distance because he’s on the other side, but have you ever run into Leo Coar?

I have not run into Leo Coar. The last fastener show I went to was one in Orlando, one year before they permanently went to Vegas. That’s probably the last time I ran into Leo.

That’s before my time. When was the Orlando fastener show? Was that in lieu of Vegas, or was that before they even started Vegas?

I believe it was before they went to Vegas permanently. They may have visited Vegas once up to that point, but I believe it was probably the very last one before they moved to Vegas.

For some of the folks in the audience who this predates them, for a while, Banister McGuire tried to run the fastener show East and West. They had Columbus and Vegas. Eventually, Columbus fizzled out, so now it’s just the Vegas show. For a while, they tried traveling, and they went down to Orlando. You saw Leo down there. The last time I saw Leo in Florida was at the NFDA, right before the world shut down, when he and Tracy rented this beautiful yacht. He took a whole bunch of NFDA people out of Naples. That was amazing. It was a great way to have our last months of freedom before the world changed.

I remember that trip. I wanted to go on that trip so badly, but I had too many things going on here, so I wasn’t able to leave this business.

It seems like a theme with you.

Unfortunately, a lifelong theme of not going to things I would like to have gone to.

You’re busy because you’re a one-man show.

It was once a family business, so I had family help. Now, I’m the only family member, but I still have a great crew that I admire and perhaps love just as much. It’s still a family-style business, but I’m the only Perkaus that’s still working here.

Achieving Contentment In Your Business Life

I can understand the emotional attachment you have to Fastener Specialties Manufacturing, and getting back to this whole idea of struggling with an exit plan or coming up with a potential buyer. You mentioned that you were thinking a lot about the growth that you’d had over the years, or maybe the lack of it. I know exactly what you mean. There’s something to be said about lifestyle businesses and contentment. I’ve been thinking a lot about that since we decided we were going to record about this.

That contentment is where I’ve been living for the last couple of years. I want to be at least happy with it. I want my wife to appreciate me coming home, perhaps before midnight. There are some things to be said about having some sort of life outside the business,

Always maintain a life outside of your business. Share on XAlso, in terms of how driven you feel yourself. Let’s face it. For a company like Field Fastener, for example, those guys do not take over the fastener world in their own space at breakneck speed without a premeditated, very driven attitude. We’re all in different circumstances in that, but on the other hand, some of us are content to hang at the level we’re at.

At Field Fastener, there’s someone we used to sell to quite often back in the day. They’ve outgrown us, but they’re in a different sector of the business. Those guys have grown like crazy. It has happened to so many of our customers over the years. They have multiple locations and multiple everything. I’m used to just one place.

What are you going to do? What’s your next step? Are you talking to people? Are you thinking about this? What’s your main idea here?

There are lots of decisions to be made, but do I list it? Do I give it to the employees or sell it to the employees? Closing it down certainly is not an option. I hope to never have to do that. Selling it makes the most sense for my future and my wife’s future. I’ll keep on hoping that the buyer is willing to keep most of us on if possible.

I hope we can keep on rolling down the road we’re on already, hopefully with even more success and perhaps even with more financial backing, because that’s always been the thing. I’d like to have newer equipment. We don’t need it, but that kind of thing would be nice. It might make for more profitability. There are lots of things we can do around here that would perhaps run more smoothly if it weren’t just me.

I hear you loud and clear on that one. That’s a very interesting perspective. We hear the other side of that idea all the time. I’m glad you’re out here talking about this with us because it’s something that we haven’t talked a lot about on the show. Who knows? Maybe one of your strategies inadvertently has come on the show and told the world where you’re at. Maybe your phone will ring.

As horrifying as it may be, maybe I’ll get 100 calls.

We’ll see what happens. I’m sure you’ll let me know. When I caught you earlier, you were out with the fastener dogs. I remember seeing those guys out on LinkedIn.

That’s true. I was walking the fastener dogs when you called. I had to be a few minutes late, so I appreciate you being patient with me.

No worries. Are you kidding? You know about the show. Brian and his menagerie over there have continuous fun with the wildlife.

I’m so thankful that we don’t have any more parents. We used to have fastener parrots here when my parents were around. I’ve outgrown parrots. No more parrots. I sure appreciate you having me on. I know that this business has grown a lot since I’ve been in episode 70. That was a long time ago, and so much has changed since then.

Thanks for reminding me of that. It’s been a while. We’ve been talking for a long time. You’ve always been a guy who has been a helpful FCH member through our ups and downs. I appreciate that, too.

It has been great talking to you.

‐‐‐

Looking Forward To The Annual Fastener Week

It’s the new segment. Mike McNulty and Jun Xu will be up in a moment.

Good.

The new Link Magazine hit the street. I looked at the digital version. I haven’t gotten my hard copy yet.

I did, too. I was very surprised to see a picture of Harpo the parrot there.

Harpo the parrot made it into Link Magazine. Check out page 32 for that. You have noticed his cameo appearances from time to time on the show.

Unplanned.

Mostly. The cover of Link Magazine this time is LindFast Solutions. They’ve got a feature story. They cover all the member companies. It’s very good to see. The thing is cover-to-cover of friends and partners. As many of you know, Eurolink Fastener Supply Service is celebrating its 25th anniversary. They’ve got a feature story in this issue, too. Link Magazine. Don’t miss it.

Mike McNulty For The Fastener News Report

The Fastener News Report is brought to us by Volt Industrial Plastics. The title sponsors of Fully Threaded Radio are Star Stainless, Goebel Fasteners, and Brighton-Best. One other thing to drop before we get to McNulty is I want to remind everybody that Fastener Week is coming up, the annual August fastener gala put on by the Midwest Fastener Association.

Regular audiences already know full well that the Tough Mudder race is happening on August 23rd, 2025. We’re shaping up to have a pretty good-sized team this year. We’re going to break all the records. There’s still time to get on board. You’ve got plenty of time to train for this thing. It’s a 5K. There’s a very low chance of extreme electrocution or drowning, so don’t be afraid.

Why would you let that worry you?

I got a message here from Bob “GQ” Bear. He is the spiritual leader of the team. Tough Nutters is our moniker. He said that every week, he’s going to be dropping on LinkedIn a thumbnail of one of the obstacles. If you follow Bob on LinkedIn, keep your eyes peeled for that. If you’re a team veteran, make sure you drop your comments in there and get some energy going behind this thing.

Hopefully, Bob will run out of obstacles before the actual time of the race. Otherwise, there are a lot of obstacles.

I don’t know how they do it, but they jam 20-some in that 5K. The good news for that, though, is that it’s not as much running. There are a lot of us on the team who are not into the running aspect of it. Fastener Mud Racing is all for fun.

It is that. It’s a fun day.

I’m looking forward to it, and I’m looking forward to the news. Why don’t you do your thing?

I will. For news about screws that you can use, here’s Mike McNulty.

Thanks, Brian and Eric. This is Mike McNulty from Fastener Technology International Magazine, bringing you the Fastener News Report. This is sponsored by Volt Industrial Plastics, makers of the world’s finest plastic fasteners. Cinderella did not show up at the 2025 NCAA basketball tournament, and trade tariffs have reached a whole new level of reckless and destructive madness, but I’m still focused on fasteners and ready to deliver the fastener news report.

In this episode, Brighton-Best International President, Jun Xu, joins us to reveal the latest results of the Fastener Distributor Index, also known as the FDI. Also, in this broadcast, we have our top story on the EV fastener market and newsmaker headlines from Würth Industry, Martin Supply, Simpson Strong-Tie, EZ-LOK, the Las Vegas Fastener Show, the Industrial Fasteners Institute, Dokka Fasteners, and more. On the back page, we’re going to talk about executive orders. We’ll get to all of that in the latest FDI results right after this.

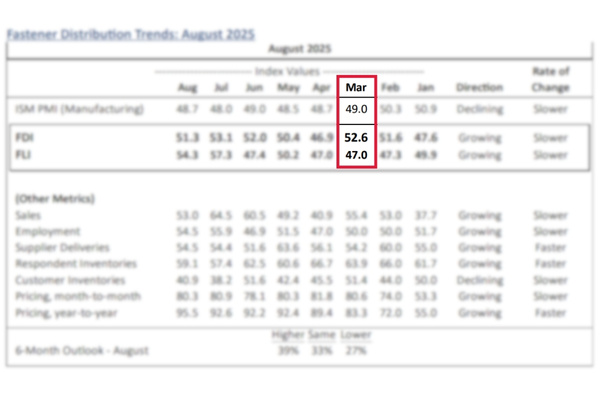

The seasonally adjusted Fastener Distributor Index for March 2025 increased to 52.6 after posting a 51.6 reading in February, seasonally adjusted. This was the second straight above 50 reading and the first one since October of 2024. The Forward-Looking Indicator, also known as the FLI, continued its slide, impacted by the ongoing tariff chaos, dropping modestly to 47.0 versus 47.3.

Fastener Distributor Index data is collected and analyzed by the FCH Sourcing Network in Baird. The FDI seeks to identify demand pricing and outlook trends within the American fastener distribution industry. To get some insight into these results, we’re going to talk to Brighton-Best International President Jun Xu. Jun, thanks for joining us on the Fastener News Report.

I’m glad to be back, and I’m happy to be here.

It is good to have you. The last time you were here was in February 2024, and the numbers were 49 and 50, respectively. We’re different, maybe a little bit flipped about that. What do you think about the latest FDA results?

Certainly, a few years ago, the world was very different. It’s accurate. We certainly saw an increase in February and March, but we do wonder if that was because of distributors trying to get ahead of the tariffs and the cost curves associated with that. The weaker forward-looking makes sense, too. There are a lot of questions about demand going forward and what that’s going to do to fastener consumption. It’s in line, but what a difference a year could make in terms of where we are.

Who would’ve predicted that? We’d be talking about tariffs nonstop. I don’t want to get ahead of anything, but a lot has changed. You’re right. If we look at the numbers in the report, the sales, customer inventories, and pricing all went up. Supplier deliveries and responded inventories went down, and unemployment was unchanged. Any insights there?

That’s accurate. After the new administration was voted in, people expected some of the tariffs to come down. Certainly, if you had the ability to, you would bring in more inventory. The part that I don’t think people expected was how much of a window in time there was. There was very little. People expected much more of a review and discussion process, but it was enacted unilaterally and overnight, so there was little time to react.

It doesn’t surprise me that people’s inventories are up. Unemployment being flat is a little surprising, given what’s been going on in the government. The federal government is a big employer. My understanding is they’ve reduced maybe about 10% so far, and then what that does to the commercial side of it, too. They’re looking at contracts with consulting companies and whatnot. There are a lot of businesses that are in the commercial space that are tied to government spending. It’ll be interesting to see how that number fluctuates. I don’t think it’ll be flat for very long. That’s my gut feeling.

The federal government is a big employer, but they have reduced 10% employment so far. Share on XWhat got my attention was the pricing hit the 80-point level on the reading. I expect that with the consequence of these tariffs, it’s going to keep going up.

With tariffs, I figured that’d be our favorite word for this episode.

It’s not the profit going up. It’s that the whole level’s going up.

It’s cost. A tariff is a tax on the cost of goods. The reason why the president likes to use tariffs is that he has the unilateral authority to make changes as he sees fit. Tariffs are a revenue for the government. Income taxes are also a revenue to the government, but you need congressional approval to change income taxes. The reason why it’s his favorite word and his favorite tool is because he has unilateral control.

The keyword there is control, right?

Absolutely. He’s showing us how much control he has. It is an increase in cost and an increase in taxes for the product. How much of it is absorbed or passed through depends also on the type of product and the supply chain. My general feeling is that everyone pays for it. It’s not only that the consumers pay for it, or only the factories pay for it.

The factories have to stay globally competitive. The importers have to stay competitive. The distributors have to stay competitive. All in the chain, people are probably taking some parts of that. Ultimately, the importer pays the tariff. That’s by law, so that’s not going to change, but with how that’s spread out, it depends on the type of product you’re selling and the supply chain that is coming through.

Also, with everything going up. There are a couple of comments I say. Does anyone think that the government needs more money? That’s my first comment.

Yes.

People in government do. Whether they’re a good place to spend it, I don’t think so.

The government needs more money. This might veer off topic a little bit, but Elon, when he was doing his DOGE work, said something about finding computers at the Federal Reserve that make money. It does not literally print, but it creates serial numbers for money. When we look at balanced budgets for a company, you have to make more than you spend. That’s the nature of the business.

For families, you have to balance your budget. For the government, you can print money. That’s exactly what they’re doing. The only question is, are people willing to buy this money? For example, the government issues treasuries. Let’s say they issue $1 billion of treasuries at 4% over 10 years. After 10 years, when that money is due, they don’t pay that money back. All they do is print more money. They go and print $1.5 billion.

The value of it goes down.

People are willing to buy it. As long as people are willing to buy the treasury notes, the system can keep going. That’s what they’re tackling. This deficit is getting so big. We keep printing so much money that at some point, people are going to say, “We don’t need to buy more dollars.” That’s when you’re forced to balance your budget. You have to go and cut a lot of spending entitlements and all that.

They’re trying to avoid that.

Everyone sees the problem. There’s a massive deficit. Everyone realizes it needs to be resolved. People realize there should be some pain, but maybe don’t want to go through some pain. I don’t know. It’s a tricky situation for the government to go through. Everyone can agree that the path that we were on was also unsustainable, too.

Do you mean the spending path?

Yeah.

That is still going to continue.

To some extent.

It’s DOGE stuff, but a couple of percentage points. It’s nothing.

It’s a drop in the bucket.

They’re continuing the spending spree, and they’re going to try to get more revenue with the tariffs. How much can the average person tolerate the price increases?

I was looking at some numbers. The US economy imports may be $3 trillion worth of product, and our budget deficit is about $2 trillion to $3 trillion or something like that. In order to offset our deficit, you would have to impose almost 100% tariffs. That’s the question. How much are people willing to pay? Our general feeling for strategic industries, like semiconductors and steel, is we’re okay with it because it’s a subset of the economy. It doesn’t affect the demand entirely. When you’re taxing, it is everything that comes into the country. We sell gloves. Glove factories are not going to set up in the United States.

They take a long time to do any of that stuff, too. It’s not going to happen in four years.

There are a lot of reasons why it’s not going to come back. Number one, the workforce doesn’t even want to do glove manufacturing. What I’ve seen in the factories is lines of people. What’s interesting about making gloves again is that if you look at your hand, the natural position of your hand is curved. If you try to flatten it, it is uncomfortable.

Machines are good at sewing on flat surfaces, but gloves have to have a three-dimensional shape in their natural state. The sewing is in 3D. That’s why you need people to do it, because machines can’t do it very well. To do that in the United States, the cost would be ten times more. At some point, you have to ask the question of what we want to make as a country versus what we want to buy cheaply because we just have to use it and buy it cheaply. There are some products that are not going to come back.

The other point that you brought up is that these factories take time. It’s not just a factory. It’s a factory to make that product, whether it be a fastener or a glove. It’s also the supply chain behind it. It’s the materials. It’s the mills. It’s the logistics. It’s an entire supply chain that needs to move. These things don’t build overnight. It takes years. The way this environment has been changing overnight, the businesses don’t have the confidence to make these long-term investments.

If we know that it’s going to be like this for a decade or maybe two decades, then I can see some people thinking, “To serve the US market, we need to be there and do this and that.” If it can change by next week, all the factors that make sense for you to be there, and all of a sudden, it doesn’t make sense to be there. I see it being a very tough decision for businesses to say, “We’re going to make these types of products in the United States.” With tariffs, some product categories make sense, but for the stuff that we don’t want to make as a country, and we want to buy cheaply, I don’t think that makes sense.

You made a reference to how a family has to do certain things, too. We all run trade deficits with certain businesses. You go to the grocery store to get your groceries. They don’t come to your house to buy anything from you. It’s common sense. There’s a place for targeted things and when people are abusing the system or companies, or countries are abusing the system. With trading partners, when the existing trade deals are in place, that is crazy.

These tariffs are calculated. I don’t think people understood the calculation. People think, “They tax me 30% on cars. We’re going to tax them 30% on cars.” That’s not how the reciprocal rates are being calculated. People looked into it. It’s the trade deficit that we have with any one country divided by the total trade we have with that one country. That’s how they’re calculating the rates. It’s how much the deficit is divided by the total volume of business we do with that country, and then divided by two. The reciprocal rates are not tit for tat the way that people think it is. It’s more about total trade volume.

How Trumpism Affects The Purchasing Managers’ Index

Let’s move on back into the numbers a little bit here. I wanted to bring up the PMI, the Purchasing Managers Index. It had a streak of 2 months above 50, but that streak is over. It dropped below 49. That little momentum is either gone or a little blip. What do you think?

I don’t track that one as much. I don’t know that index well.

We talked about it in the last couple of shows that it was below 50 for a long time, like a couple of years, and then it got above 50. There are some people, maybe myself included, who think that going into 2025, we had a chance here for some good growth. That’s getting stymied by this tariff stuff, especially with a lot of money, time, and effort we put into nearshoring. I was in Mexico. There was a lot of stuff going on, and then we stopped.

It goes down to the environment in which companies operate. If there’s a clear direction, either way, whether we’re going full-blown globalization or whether we’re going full-blown protectionism, people can adapt to it and make investments in that direction. For the challenges, we’re in between that. We’re not in full-blown either. We’re in Trumpism. He can change his mind at the flip of a hat. Due to that environment and that uncertainty, I do think people are holding back their investments. Even if you import a container from overseas, depending on the week that it lands, it could be 0% tariffs or 35% tariffs. How do you run a business like that? You can’t time it.

You can’t plan it.

You have to do what you have to do. It is what it is. If you’re going to think about buying capital equipment or building a factory and spending money to build up production, if today, it makes sense and tomorrow, it doesn’t, are you going to do it today to make it?

Interesting times. The last numbers we have here are the six-month outlook for March, which was unchanged from February. It is still somewhat gloomy. 44% of the respondents think things will be better in 6 months. 22% think it’s going to be the same. 33% think it’ll be worse. That was pretty much the same as it was in February.

That’s a good balance. I generally do think people are more optimistic than pessimistic, especially in business. Yeah.

Still, 2/3 say the same or better.

That’s not bad. Business people tend to be a little bit more optimistic than pessimistic in general. That is about even in my mind.

Reading Comments From Our Listeners

We have all the comments. Maybe we’ve already covered some of these, but I’m going to go through and read them. If you want to jump in on any of these, then we can get a little bit of extra commentary. The first one says, “After the initial rush to stuff inventory, before Trump’s tariffs, most customers are now backing off. They all seem to hate the tariffs, rightly so, and are going to run out of inventories before reordering.”

That goes in line with the March numbers being a little high, because I do think people were frontloading a little bit.

The next comment says, “Many customers are holding on to orders due to tariffs. They have communicated. They’re waiting in hopes that countries will negotiate, and the tariffs will be lower or eliminated in the coming weeks.” That would be good.

I don’t think people know how to reduce those rates. The only way to reduce those rates is for countries to buy as much as the US buys from them.

That is an arbitrary thing.

For some small countries, all they do is specialize in making a certain thing.

They’re good at it.

They don’t need to buy a bunch of stuff because their economy can’t sustain it. It’ll be interesting. It’ll play out. Some of these reciprocal rates will probably go down, but I’m not sure people know how it’s going to go down. I don’t think there’s a formula out there that’s very clear.

The next one got my attention. It’s something I’ve been thinking about. It says, “Tariff wars are killing all our time. More meetings in a month in the past five years. We would all be happy working with customers on fastener requirements rather than spending time addressing tariffs.”

That’s true. I always feel like the best business environment is for the government not to be involved. Let the market take shape. We’re not the only country that’s going through it. If you look at Europe, they have a lot of regulations going through, like the CBAM regulations and the Russia sanctions. They have a bunch of stuff going on, too, on their side. It’s not unique to the United States, where regulation is taking a lot of time to process.

The business environment may work best without government involvement. Share on XMany times, we’re less regulated than others, so that keeps us still. Head above the water, and people are still buying our treasury notes. The whole thing with regulation is that it’s time spent on things that aren’t productive. For the next two comments, together, they’re both about pricing. “North American pricing increases are primarily due to tariffs, not higher costs of goods.” The other one is, “Pricing would be trending about the same absence of the tariffs.”

That’s true.

That’s why the pricing went up on the FDI this time. One more comment. It says, “If not for the tariff turmoil, I would’ve interpreted March activity and results as proof that the industrial market cycle had bottomed out and was building momentum for the remainder of the year. Instead, I selected Same for my answer on future activity. Selecting lower felt wrong, even though it could very well be right.” There’s a semi-optimistic business person.

If you are 60% optimistic and 30% not, that’s pretty much 50/50 in reality.

Those are the comments. Anything else you want to add on the FDI or the FLI before we let you tell the readers what’s going on at Brighton-Best?

It’s very time-consuming. With tariffs, as the comments have noted, there’s a lot of confusion. That’s what’s driving that hold-back in investment. Companies and businesses need clarity and certainty in terms of the market dynamics. It is one way or the other. It changes back and forth all the time. That’s the struggle that we all face.

Things that are time-consuming and confusing aren’t very productive or fun. They’re not enjoyable either. Let’s move on. I know you got a lot going on at Brighton-Best. What can you tell the readers about what you guys are doing?

2025 is our 100th year. That’s pretty special. We’ve already done some things on the marketing end to highlight it, but we’re going to do maybe a little nicer party. We are fastener people, so we’re very pragmatic, but we are going to try to do a little bit better than usual for the fastener cocktail party in Vegas. Some ideas are the 1920s. We might do an anti-prohibition thing going on.

Speakeasy?

Yeah. That speaks to the country, too. In the 1920s, that’s when prohibition was. It’s amazing how much the country can change in 100 years. We’re very proud of it. More than anything, it is quite humbling to know that there have been so many people who have worked at the company and built this legacy. We feel like we’re stewards of the brand. Our goal is to continue to build on it and in the next 100 years have that team look back and say, “We’re proud to be part of this and to continue to build on the dignity and character of the business.” It’s incredibly humbling, knowing the people who have been part of the business.

It’s a great milestone. I appreciate and enjoy the logos that you guys have created using the black and gold. It’s eye-catching and something to be proud of.

Hosting The Fastener Training Week In Ohio And Other Upcoming Events

Thank you. We have a fastener training center in Cleveland. It’s a great facility for us. It’s the largest warehouse we have, but it’s such a critical part of the fastener industry. The entire Midwest area is a big part of where our customers are. Training is something that’s very important in our industry. We do notice a trend. Everyone sees it. Experience is aging out or retiring. We’re still relatively young in our years. If we look at the next 15 or 20 years, we think about who’s aging out and who we have. In every company, if you look at it and think about it that way, we have to invest in people. We have to invest in training.

We’re very much in support of any type of training. We do our fastener one-on-ones, but any type of training we can do to bring the next generation of fastener experience. What we don’t want to see, and it’s certainly a negative for the industry, is when people turn into part number buyers, and you lose that experience. It is a unique industry in that way. When it becomes a part number, then you lose the character, the relationships, and a lot of the value that you add as a company to a process.

The other concern we have is that if it becomes a part number, who has the biggest marketing budget at that point? There are some big players out there. Even Amazon is a huge player. It comes down to who has the bigger marketing budget to get those Google ad clicks. That’s not a game that any of us wants to play. We do believe in fastener training and training the industry. Anything we can do to support the industry in that way, we’re fully on board.

Getting an advantage with knowledge and understanding.

It’s such a critical part. It’s a two-cent part that can create so many headaches.

There are a lot of details.

It’s important.

At the conferences and shows, I know you guys were in Stuttgart, and then you’ve got some stuff coming up with PacWest and CFA, as well as Nashville.

A lot of trade shows. We were talking about the value of attending so many trade shows. The Stuttgart show happens every other year. We have a facility in the UK that exhibits there. If you’ve been to the Vegas show, Stuttgart is going to look like a whole different world. The booths are massive. They have chairs and tables. You get served food, like beer and wine. It makes you think, “How do we upgrade the US trade show experience?” I tend to like to go to the Spanish ones because they serve you the ham. You have your little around-the-world tour in terms of food. It’s a good show.

The European market, you do realize, too, is a very different market from the US. There certainly is the European trading bloc. At the same time, there are a lot of differences between countries. It’s not as integrated and cohesive as the United States is in terms of a single market. You certainly see and feel those differences when you’re there. They treat you nicely.

I’ve been to some European shows. Some governments help them with their promotion. I think that’s the difference. They get some country pavilions and some money to help them with marketing and stand-building. You’ve got guys painting and drywalling. There are stands as opposed to the Erector sets we have here.

It’s structural stands. They have second floors, meeting rooms, and stairs. I’m like, “For three days, they’re going to build this?” It’s mind-boggling. More power to them. I always go back to we’re fastener guys. We’re nuts and bolts guys. Practicality is screwed on pretty tight with us. I can’t envision us ever doing that, but if someone else were to do that, why not enjoy it?

You’re going to be speaking at the PacWest event on May 1st, 2025. You’re on a panel. For readers out in the West, maybe you want to check it out.

Thank you. I do that once or twice a year.

It’s in your backyard.

It’s hard to say no. I do enjoy them because everyone’s stuck in their day-to-day work. When you have to do some of those presentations, sometimes, you have to step out, look around, and get a feel for what’s going on. It helps you solidify a big picture and understand better what’s going on, rather than everyone’s on their own road.

Rather than you staring at yourself. We always appreciate having you on and giving your insights into things that are going on. I don’t know what’ll happen a year from now. You’ve said before that it’s hard to predict three months in advance.

These last few months have been doozy. We’ll see.

We’ll look forward to seeing you out at conferences or trade shows in Vegas, Nashville, PacWest, CFA, etc. Keep up the good work. We look forward to having you back on again.

Thank you.

EV Fastener Market Growth Rate And Other Headlines

That was Brighton-Best International President, Jun Xu. The FDI number for March 2025 was 52.6 versus 51.6 in February. Visit FDISurvey.com to participate in the process and get a detailed PDF copy of Baird’s monthly analysis. Let’s go to the top story. According to market research firm Stratview, the Global Electric Vehicle Fasteners Market, also known as the EV Fasteners Market, is projected to witness a growth rate of 13.5% per year from 2024 to 2030 with a resulting market side of $20 billion by the year 2030.

Stratview launched a report on the global EV Fastener Market, which provides a comprehensive outlook on the global and regional industry forecast, current and emerging trends, segment analysis, and competitive landscape. The global EV Fasteners Market is segmented based on vehicle type, application-type material, threading type, fastener type, and region.

Rivets represent the largest fastener type, and nuts hold the second dominant position. In terms of region, the Asia Pacific, led by China, is the strongest, followed by North America. Other strong countries include the USA, Germany, France, and the UK. The EV Fastener Market is highly fragmented, with over 50 players involved.

Leading companies in the manufacture of fasteners are not only for EVs, but also serve a wide range of other industries, including aerospace, electronics, medical, and construction. Stratview Research has identified the following companies as the top market players for EV Fasteners. ITW, Stanley Black & Decker, Shanghai Prime Machinery, LISI Automotive, and Bolton. You can see an article on this report in the April-May issue of Fastener Technology International Magazine on pages 146 and 147, available at FastenerTech.com.

Next up is Fastener Newsmaker Headlines. In corporate news, Würth Industry expanded with a new distribution center in Columbus, Ohio. Martin Supply opened a new distribution center in Elizabethtown, Kentucky. Nedschroef Plettenberg of Germany secured a €1 million deal to supply cap nuts with plastic ceiling washers for battery packs.

Simpson Strong-Tie opened a new distribution center in Las Vegas, Nevada. Rocket Industrial expanded its line of Zenith fasteners. CJK Industrial in China enhanced its operations to meet increased demand. Chicago Rivet & Machine celebrated its 105th anniversary. In Personnel News, EZ-LOK introduced Grant Govel as its Business Development Representative.

The International Fastener Expo, also known as IFE or the Las Vegas Fastener Show, named Kerry Tyler as its new show director. The Industrial Fastener Institute, also known as IFI, elected Sebastian Janas, President of Sems and Specials, as the incoming Chairman of its Industrial Products Division. Jose Janeiro, Managing Director of JM Tor Par, was elected Vice Chair for the same division. Mads Kastrup Olsen joined Dokka Fastener of Norway as its new sales and marketing director. You can get details on all of these stories and more in Fastener Technology International Magazine and the Fastener News Report Monthly Newsletter, both available online at FastenerTech.com.

Executive Orders: The Most Abused Tool By Modern-Day Presidents

Let’s turn to the back page to talk about executive orders. Since executive orders have become the most favored and probably most abused tool of the modern-day presidents in the United States of America, I thought it would be wise to revisit their definition, historical use, and evolution. In the United States, an executive order is a directive by the president that manages the operations of the federal government.

The US Constitution does not have a provision that explicitly permits the use of executive orders, but Article II, Section 1, Clause 1 of the Constitution simply states, “The executive power shall be vested in the President of the United States of America.” Sections 2 and 3 describe the various powers and duties of the president, including taking care that its laws be faithfully executed and enforced unless there are laws that the president doesn’t like. I made up that last part, but some of the presidents seem to think that’s true.

Furthermore, the US Supreme Court has held that all executive orders must be supported by the Constitution, whether from a clause-granting specific power or by Congress delegating such to the executive branch. Attempts to block executive orders are successful at times when such orders either exceed the authority of the president or could be better handled through legislation, also known as laws, which are not part of the duties of the executive branch.

Historically, every president, except for William Henry Harrison, who died in office, has issued executive orders. John Adams, James Madison, and James Monroe each issued one. George Washington recorded eight. Thomas Jefferson had four. The first fifteen presidents issued a combined total of 143. Abraham Lincoln had 48, the most recorded at the time.

On the high end, Teddy Roosevelt was the 1st to top 1,000. Woodrow Wilson escalated his above 1,800. FDR broke the bank with 3,721 orders that might have inspired the presidential term limit amendment to the US Constitution. Since then, no president has passed 1,000 orders, but Harry Truman came close at 907.

In terms of speed, President Joe Biden’s 42 executive orders in his first 100 days of his presidency were more than any other president at that time period since Truman, who was managing the country at the end of World War II. In early 2025, President Donald Trump easily outpaced Biden by issuing 104 executive orders in his first 65 days of office, breaking FDR’s old record of 99 in his first 100 days.

Executive orders would be expected to rise during times of war and other emergencies, but these orders are abused. Actual emergencies are extended or expanded in scope, or when non-existent ones are declared emergencies by the champions of the corresponding executive orders. This is where problems start, and the damage of unintended consequences takes root.

Executive Orders are expected to rise during wartime and other times of emergencies. But they are abused when actual emergencies are extended or expanded in scope. Share on XThe 2019 tariff executive orders cite the International Emergency Economic Powers Act from 1977, which authorizes the US President to regulate international commerce after declaring a national emergency in response to any unusual or extraordinary threat to the United States. This seems to be a favorite move of the administration. For the record, there are no national emergencies related to trade deficits, as anyone can learn in an entry-level economics course.

Congress can end this tariff madness in one session by repealing the above-mentioned Economic Power Act of 1977. This has been Mike McNulty at Fastener Technology International Magazine, bringing you the Fastener News Report. Please send your news, pictures, comments, correspondence, or complaints to me at McNulty@FastenerTech.com.

‑‑‑

Fine Points Of Mixing Small Lots When Sending Parts For Plating

This is Carmen Vertullo coming to you with the Faster Training Minute from the Faster Training Institute in Carver Labs in beautiful El Cajon, California. Our topic, as usual, comes from an email question from one of our students in the fastener mentoring group that we do online. It had to do with co-mingling fasteners for the purpose of electroplating. Co-mingling means you take more than one lot and send them out for plating. We do that because lots might be particularly small, and we can save money. When we return, I’ll tell you the ins and outs and ups and downs of co-mingling fasteners for the purpose of electroplating or any plating or coating operation.

We are talking about co-mingling fasteners for purposes of plating, coating, or whatever other kind of miscellaneous processing you might want to do to them. The reason we would do that is that with small lots, we can combine them, and it’s a little bit cheaper. What are the implications? First off, if the fasteners are very similar, let’s say they’re socketed cap screws, except they’re a different size, there is no problem whatsoever. Theoretically, you’re going to sort those out, and you’re going to maintain your lot integrity that way.

Try to make them similar sizes. Don’t send some 4-40 socket screws with some 3/8 bolts or something like that. As long as they’re similar and they’re steel, it doesn’t matter if they’re grade 5s and grade 8s or alloy steel, heat-treated steel, or mild steel. You’ll be fine with that. Be careful. Larger screws might damage smaller screws in the barrel, so consider that.

If the screws are exactly the same and they’re from two different lots, then you might have a little bit of an issue. The Fastener Quality Act allows us to co-mingle two lots. Keep in mind. Any testing that you would do to these fasteners, you would have to, maybe for hydrogen embrittlement testing, double the sample size to ensure you got some from both lots. Hopefully, maybe the lots might be different manufacturers. You could tell by a head mark. They might have some tooling marks that would help you not necessarily sort them out, but sort them out for the purpose of testing for hydrogen embrittlement, if that was one of the cases.

I hope this helps out anyone who’s thinking of co-mingling fasteners for the purpose of plating. You might also consider assigning them a new lot number consisting of both of the existing lot numbers. Most of our ERPs allow us to create new lot numbers to handle that problem. There might be more to that than I’m thinking of, but that answers the question. This has been Carmen Vertullo with the Fastener Training Minute. Thanks for reading.

‑‑‑

This is Brian and Eric back with you to close out another one. If you’re catching this episode in April 2025 and you’re on the West Coast or out in that region, you can catch Jun Xu at the PacWest. He’ll be there on May 1st. He’s doing a panel during their vendor showcase. There’s an obligatory cocktail hour connected to that, too.

That’s a surprise.

I don’t know if you caught this or not. We dropped a special report with Michael Knight from Endries. He was speaking on the tariffs. That got a lot of traction. It was pointed out to me by numerous people that I made a little time-traveling mistake there. I said we were recording in May, even though we were in early April at the time. Thank you, everyone, for pointing that out. I did fix it, but a whole lot of people heard it in the original version. Don’t worry. It’s fixed. Even we here at the show are inclined to make a mistake now and then.

We make use of Dr. Who’s time machine.

We need a TARDIS sometimes. I’m always thinking in terms of what happened two months ago or sometimes what’s going to happen next month with this FDI stuff, the quarterly financials, the shows, and planning it all. You never know where you are.

That’s true.

Speaking of Brighton people, I also got a message here from Rosa Hearn. She and Joe Schumacher, who is with AFC practicing his craft, are doing a marketing workshop at the International Fastener Expo out there in Vegas.

That’s Rosie the River’s specialty, isn’t it?

That’s right. In 2024, she was involved in one of those as well and got rave reviews. That is yet another reason to make it out to Vegas. We’ll be covering some of the developments with that. We’re trying to get Fastener Fair.

Out of the way first.

Under our belts. That show is stacked up. Fastener Fair Stuttgart went down. We didn’t cover it on the show, but I did record a conversation with Craig Penland of Eurolink. I’ll be dropping that very soon. If you’re curious what happened at Fastener Fair Global, Craig and Kim made it out there. It sounds like it was another huge one. That’s every other year they do that.

One day, I’ll get there. I’d like to go and wander around.

I would, too, especially after what Jun was saying. It sounds like you could pretty much take your pick of European cuisine when you’re there.

I remember that Europe is all compressed. You’re only 120 miles from France and about the same distance from Italy. You’re surrounded.

You’re surrounded by good things to eat. If you’re in Stuttgart with fasteners as well, you are surrounded by fine food and fasteners. How could you beat that?

I know. What more could you want?

The title sponsors of Fully Threaded Radio are Brighton-Best International, Goebel Fasteners, and Star Stainless. Fully Threaded is also sponsored by Buckeye Fasteners, BTM Manufacturing, Eurolink Fastener Supply Service, Fastener Technology International, INxSQL Software, Fastener Fair USA, J.Lanfranco, MW Components, Solution Industries, Volt Industrial Plastics, and Würth Industry USA. Thanks so much for tuning in to the show. Thanks for all your comments on the reports that we’ve been dropping. More to come. Standby. Thanks to you, too, Brian, for shoveling all that data over there at the FCH Data Lab. There’s no end.

There’s more of it going on, too.

A good thing you got Harper over there to look over your shoulder.

I know.

That will get out of here. Keep your eyes open for this episode with Craig Penland on Fastener Fair Global. That’ll be coming any minute. That’ll put this one in the can. Get out there. Sell some screws. Don’t get too worked up about the tariffs. It’ll probably be all changed pretty quickly. We’ll talk to you next time.

See you next time.