Written by R.W. Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 1/8/24

Key Takeaway:

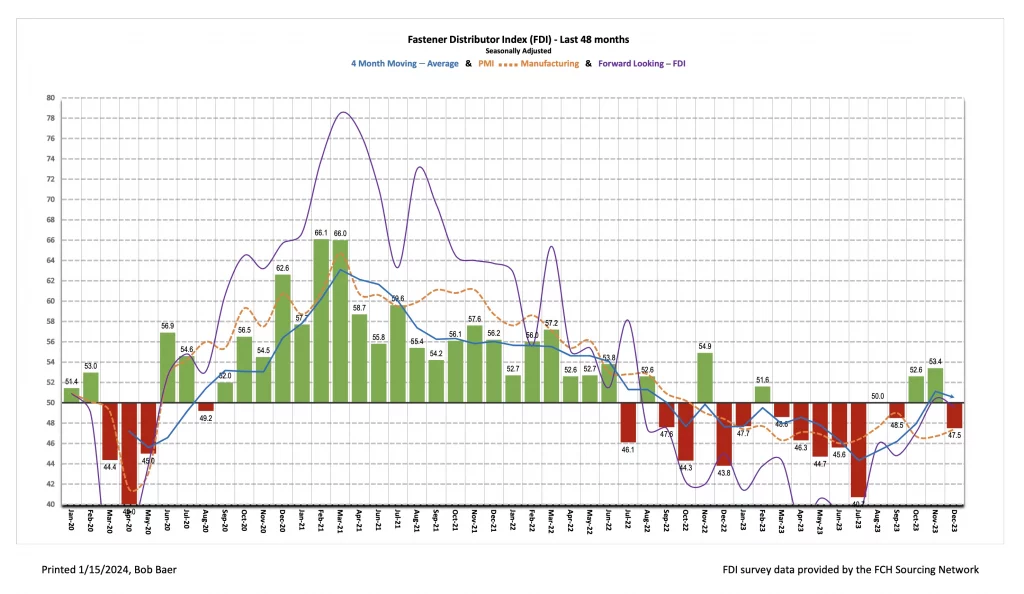

The seasonally adjusted Fastener Distributor Index (FDI) softened m/m with a reading of 47.5 but participants largely attributed this to seasonal softness around the holidays. Comments were varied as some participants see significant uncertainty (economy, election) heading into 2024, while others expressed optimism. The Forward-Looking Indicator (FLI) also moved very modestly lower m/m to 49.6, back below the neutral 50 level. Overall, we believe the FDI/FLI suggests a slightly softer-than-expected December.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and R. W. Baird. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward- looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM). Additional background is available at:FastenersClearingHouse.com.

Key Points:

FDI retrenches below 50. After two consecutive months of expansionary readings that left us incrementally positive on fastener market momentum, the FDI took a somewhat unexpected step back in December to 47.5 (from 53.4 last month). However, this could simply be normal seasonal slowing in December, as many participants suggested: “December is ALWAYS our worst month so the negative answers for month-to-month shouldn’t be taken too seriously. Our customers are mostly closed the last two weeks of the year and many of our vendors are closed the last week of the year. ” M/m deceleration in the FDI was driven by a significantly lower seasonally adjusted sales index (47.4 vs. 63.0 in November), the employment index (moderated to 50.0 from 55.9), and customer inventories (46.6 from 54.4). Just 24% of respondents indicated sales came in above seasonal expectations (November 35% and October 44%). Another 38% said sales were in line (consistent with last month), while 38% saw weaker sales than expected (November 26%).

FLI also slightly lower m/m. The FLI saw similar deceleration, coming in at 49.6 vs. 50.4 last month. Last month’s reading had marked the first growth reading for the index since July 2022. The m/m decline in December reflected softer employment levels and higher customer inventories, although the six-month outlook index did move higher off a soft month. On the outlook specifically, 55% of respondents predicted higher activity six months from now vs. today compared to 47% last month. The percentage anticipating similar activity was 31% compared to 29% in November, while the percentage expecting softer activity was just 14% (last month 24%). This drove the six-month outlook index to register 70.7 vs. 61.8 last month.

Balanced mix of bulls and bears this month. After a notably more positive tone last month, we sensed a more evenly split mix of optimists and pessimists in December. For the optimists, December sales/profit exceeded expectations: “I did not expect December to be a profitable month, with fewer business days and an extra paycheck. I was pleasantly surprised.” Echoing this, one participant said, “Strong demand for the month of December, surprisingly. Our distributors seem to continue to have strong demand for domestic externally threaded fasteners.” Pessimists see uncertainty ahead, including election risk and economic uncertainty: “Dec saw a slowdown in new orders and shipments. Expect Jan – Mar to be the same. Many customers are very cautious about getting too much on order with the uncertainty of the economy and election year.” Another participant said, “Although we responded ‘Higher’ for future 6- month activity, this is more do to [with] new business than current customers. We are more cautious when it comes to current business activity i.e. the economy.” Most seemed to agree that December weakness was more likely reflective of holidays than true underlying softening, however: “Typical December. Not awful but the usual slow down the last two weeks”; “December is ALWAYS our worst month so the negative answers for month-to-month shouldn’t be taken too seriously. Our customers are mostly closed the last two weeks of the year and many of our vendors are closed the last week of the year.”

Fastenal reported November daily sales growth of +3.8% y/y which was above our +2.5% estimate and what normal seasonality would imply (+2.8%). This included fastener sales -3.0% y/y, which was fairly stable vs. last month (-2.6%) but marked the seventh consecutive month of either flat or declining y/y sales. Safety sales were +10.8% and other non-fasteners grew +5.8% y/y. FAST will report December daily sales in conjunction with 4Q23 earnings on January 18th. We model December daily sales +4.0% y/y which would be in line with normal seasonality. Looking out to 2024, we assume FAST’s growth will return to just modestly above normal seasonality in year one of an industrial recovery beginning in 2H24; in contrast, most of 2023 was below seasonally normal sales.

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Grainger: Risks include ability to maintain margins, internet-only industrial supply sources, ability to sustain secular growth, cyclicality, and international operations.

MSC Industrial: Risks include cyclicality, maintaining and managing growth, success of Mission Critical initiative, and dual classes of stock.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for December 2023, with graphs and disclosures, Click-here.