Written by R.W. Baird analyst David J. Manthey, CFA with Quinn Fredrickson, CFA 11/5/22

Key Takeaway:

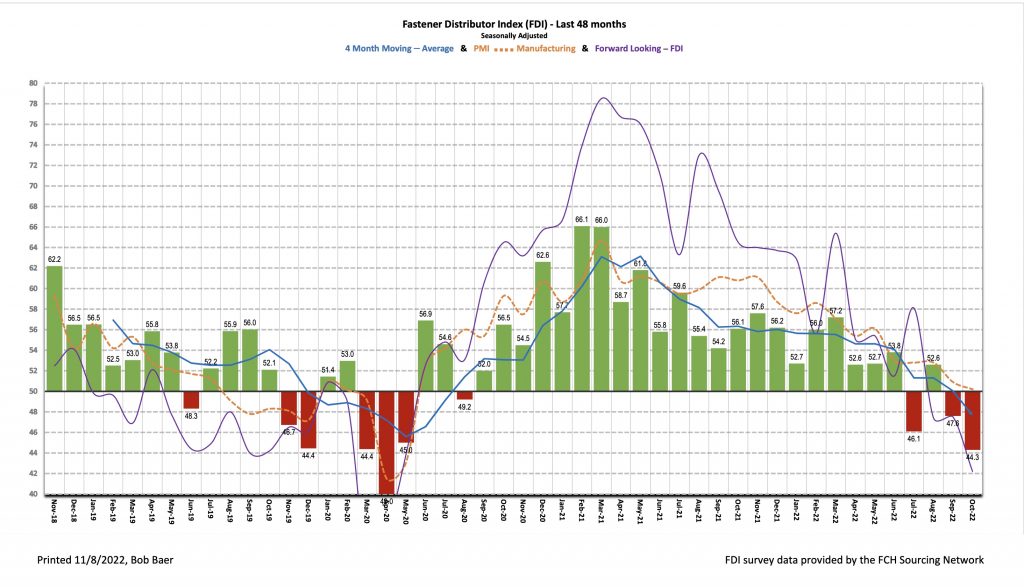

The October seasonally adjusted Fastener Distributor Index (FDI) improved m/m, rising to 56.1, despite continued supply chain disruption, reflecting slightly better selling momentum and employment levels. Commentary remains focused on very elevated freight costs, shipping congestion, and raw material/semi- conductor chip shortages, although demand commentary was again generally favorable. The Forward-Looking Indicator (FLI) moderated for the second consecutive month, reading 64.5, on slightly higher respondent/customer inventory levels, which the FLI reads as a negative for future demand (less restocking needed) but could actually prove to be a positive in terms of ability to meet demand. Net, October market conditions strengthened but respondents cast a cautiously optimistic forward view in light of continued supply chain/labor constraints.

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network and R.W. Baird. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward- looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM). Additional background is available at:FastenersClearingHouse.com.

Key Points:

FDI sees m/m improvement. The seasonally adjusted October FDI (56.1) improved from last month’s 54.2 amid better selling momentum (the non-seasonally adjusted sales index improved despite a slight downtick in the seasonally adjusted index) and higher employment levels. Pricing picked up modestly as the proportion of respondents reporting higher pricing m/m was 73% compared to 71% last month. Key issues respondent commentary focused on included raw material shortages (especially stainless steel), freight costs (which one respondent said was 4x the normal cost), and potential additional shipping congestion heading into the holiday season.

FLI decreases slightly again. The seasonally adjusted FLI came in at 64.5, contracting m/m for the second consecutive month. This was attributable to a slight uptick in both customer and respondent inventory levels (bearish for potential future restocking/demand), although inventory levels remain very low in absolute terms, particularly at the customer level. The six-month outlook was essentially unchanged, with 42% of respondents expecting activity levels to be higher six months from now (unchanged m/m). That said, product shortages in the face of continued strong demand could simply lengthen out the cycle, implying the FDI could remain in growth mode for much longer.

Employment slightly improved in October. The FDI employment index came in at 65.4 vs. 54.8 last month, suggesting some loosening m/m in the very tight labor market. Fewer respondents indicated employment levels were below seasonal expectations (September 26% vs. October just 6%). Reflecting this, one participant said, “On the employee side we are finding more people coming in to apply for open positions vs September and before.” The broader economy saw a similarly improved job market in October. The economy added 531,000 jobs compared to economist expectations for +450,000. Leisure and hospitality led the growth, adding 164,000 jobs, as COVID cases declined. Unemployment fell to 4.6%, beating expectations (4.7%), but still slightly elevated relative to the pre-pandemic level of 3.5%.

Supply chain remains challenging for all participants. Respondents largely did not see a material improvement in the state of the supply chain in October. Said one respondent, “Deliveries not improving. Distributors all searching for the same parts, vanishing inventory levels. No end in sight!” Echoing this, another participant said, “Raw material deliveries still problematic. Wire vendors continue to push deliveries out into 2nd quarter 2022, especially on stainless steel.” Another respondent commented, “Slow supply chain is a real challenge in purchases & receiving goods import & domestic made.” One respondent did indicate some easing in inventory held in transit but was wary of potential upcoming transportation issues around the holidays: “Inventory that has been lost in transit purgatory has finally begun to show up. Attention must be paid to demand trends and managing inventories moving forward, with the challenges mainly pertaining to continued shipping congestion through the holiday and CNY season.” Demand commentary, however, remains positive: “Sales are incredible. Up almost 40% YTD over last year and almost 30% from 2019.”

FCH SourceFinder shines. Survey respondents who participate in the FCH Sourcing Network broadcast RFQ system known as SourceFinder added bonus sales during the month, reporting a noticeable increase in the average value of inquiries, along with an uptick in volume.

Fastenal’s +14.1% overall October daily sales growth beat our +10.8% estimate. Safety sales were +2.9% y/y but further normalized as a percentage of sales towards pre-pandemic levels. Excluding safety products, underlying sales were +17.2% y/y, also nicely above our +14.3% estimate and normal seasonality. Turning to fasteners specifically, FAST’s fastener sales were +23.2% y/y, consistent with generally strong FDI/FLI readings. Looking forward, we model November overall daily sales +5.3% y/y, reflecting safety -3.6% and non-safety (including fasteners) +7.8%.

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

For the full FDI report for October 2022, with graphs and disclosures, Click-here.